On LINE LOAN APPLICATION Loan Information Collateral

What is the ON LINE LOAN APPLICATION Loan Information Collateral

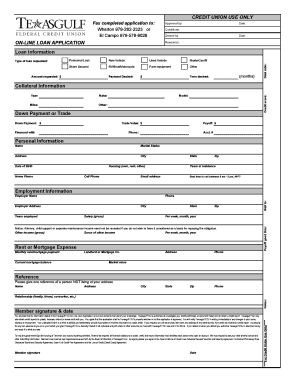

The ON LINE LOAN APPLICATION Loan Information Collateral is a digital form designed to facilitate the process of applying for loans online. This form collects essential information from applicants, including personal details, financial status, and collateral information. Collateral refers to assets that a borrower offers to secure a loan, which can include property, vehicles, or other valuable items. By providing collateral, borrowers may increase their chances of loan approval and potentially secure better interest rates.

How to use the ON LINE LOAN APPLICATION Loan Information Collateral

Using the ON LINE LOAN APPLICATION Loan Information Collateral involves several straightforward steps. First, applicants need to access the online form through a secure platform. Once the form is opened, users should carefully enter their personal information, including name, address, and contact details. Next, applicants must provide financial information, such as income and existing debts. Finally, users need to detail the collateral they are offering, including descriptions and estimated values. It is crucial to review all entered information for accuracy before submitting the application.

Key elements of the ON LINE LOAN APPLICATION Loan Information Collateral

Several key elements are essential for completing the ON LINE LOAN APPLICATION Loan Information Collateral effectively. These include:

- Personal Information: Name, address, and contact details.

- Financial Information: Income sources, monthly expenses, and existing debts.

- Collateral Details: Description of the asset, its value, and ownership status.

- Loan Amount Requested: The specific amount of money the applicant wishes to borrow.

Providing accurate and comprehensive details in these sections can significantly influence the loan approval process.

Eligibility Criteria

Eligibility for the ON LINE LOAN APPLICATION Loan Information Collateral typically depends on several factors. Borrowers must be at least eighteen years old and a legal resident of the United States. Lenders may also consider the applicant's credit history, income level, and the value of the collateral offered. Additionally, some lenders may have specific requirements based on the type of loan being requested, such as personal loans, auto loans, or home equity loans. Understanding these criteria can help applicants prepare a more robust application.

Application Process & Approval Time

The application process for the ON LINE LOAN APPLICATION Loan Information Collateral generally involves submitting the completed form through a lender's online portal. After submission, lenders review the application, which may take anywhere from a few hours to several days, depending on the lender's policies and the complexity of the application. During this time, lenders may reach out for additional information or clarification on the collateral provided. Once the review is complete, applicants will receive notification of approval or denial, along with any terms and conditions associated with the loan.

Required Documents

To complete the ON LINE LOAN APPLICATION Loan Information Collateral, applicants typically need to provide several supporting documents. Commonly required documents include:

- Proof of Identity: Government-issued ID or driver's license.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Collateral Documentation: Titles, appraisals, or purchase receipts for the assets being offered.

- Credit History: Some lenders may request a credit report to assess creditworthiness.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Quick guide on how to complete on line loan application loan information collateral

Complete [SKS] effortlessly on any device

Virtual document management has become increasingly popular with businesses and individuals alike. It offers an excellent environmentally friendly option to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow manages your document management needs in just a few clicks from a device of your choice. Edit and electronically sign [SKS] and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ON LINE LOAN APPLICATION Loan Information Collateral

Create this form in 5 minutes!

How to create an eSignature for the on line loan application loan information collateral

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ON LINE LOAN APPLICATION Loan Information Collateral process?

The ON LINE LOAN APPLICATION Loan Information Collateral process enables you to submit necessary documents digitally, streamlining your application. You can easily upload collateral documentation and receive updates about your application status electronically. This efficient method saves time and reduces paperwork.

-

How much does the ON LINE LOAN APPLICATION Loan Information Collateral service cost?

Our ON LINE LOAN APPLICATION Loan Information Collateral service is competitively priced, ensuring businesses of all sizes can access our features affordably. Pricing may vary based on usage, with cost-effective plans tailored for different needs. Detailed pricing information is available on our website.

-

What features are included in the ON LINE LOAN APPLICATION Loan Information Collateral?

The ON LINE LOAN APPLICATION Loan Information Collateral includes features such as electronic signatures, real-time document tracking, and customizable templates. These features enhance your experience by simplifying the loan process and ensuring compliance with regulations. You'll find that our platform is user-friendly and efficient.

-

How does airSlate SignNow ensure the security of my ON LINE LOAN APPLICATION Loan Information Collateral?

Security is a top priority for airSlate SignNow. We utilize advanced encryption technologies and secure servers to protect your ON LINE LOAN APPLICATION Loan Information Collateral data throughout the process. Regular security audits and compliance with industry standards further ensure your information remains safe.

-

Can I integrate ON LINE LOAN APPLICATION Loan Information Collateral with other software solutions?

Yes, airSlate SignNow allows seamless integration with various software solutions, including CRM systems and document management tools. This compatibility enhances your experience by providing centralized access to your ON LINE LOAN APPLICATION Loan Information Collateral information. Our easy integration process simplifies your workflow.

-

What are the benefits of using airSlate SignNow for ON LINE LOAN APPLICATION Loan Information Collateral?

Using airSlate SignNow for ON LINE LOAN APPLICATION Loan Information Collateral brings numerous benefits, including increased efficiency, reduced turnaround time, and enhanced mobility. You can complete your loan applications from anywhere, making it convenient for your business. Additionally, the user-friendly interface boosts user adoption.

-

How long does it take to process an ON LINE LOAN APPLICATION Loan Information Collateral request?

The processing time for ON LINE LOAN APPLICATION Loan Information Collateral requests can vary based on specific requirements and document completeness. Generally, our system is designed to expedite the process, often providing feedback within a few hours. Our goal is to minimize delays and streamline your application experience.

Get more for ON LINE LOAN APPLICATION Loan Information Collateral

- Travel request form kalitta air

- Other tobacco products tax return ohio department of taxation tax ohio form

- Business plan for a nonprofit form

- Assumption of liability form pdf

- Hunting the elements video questions form

- Helpsheet for form r85 tesco bank

- Wi tractor safety certificate fyi uwex form

- Group dental enrollment form complete for tda

Find out other ON LINE LOAN APPLICATION Loan Information Collateral

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online