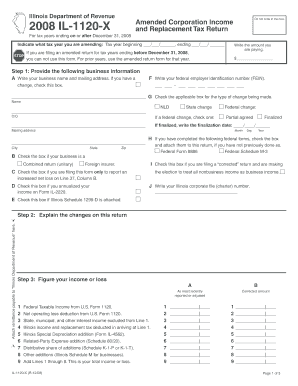

Illinois Department of Revenue Do Not Write in This Box Form

What is the Illinois Department Of Revenue Do Not Write In This Box

The Illinois Department Of Revenue Do Not Write In This Box is a specific instruction found on various tax forms issued by the Illinois Department of Revenue. This directive indicates a designated area on the form that should remain blank, as it is reserved for official use only. Understanding this instruction is crucial for taxpayers to ensure their forms are processed correctly and to avoid potential delays or issues with their tax filings.

How to use the Illinois Department Of Revenue Do Not Write In This Box

When filling out forms from the Illinois Department of Revenue, it is important to carefully follow the instructions provided. The section marked "Do Not Write In This Box" should be left empty. This area is typically used by the department for internal purposes, such as tracking or processing information. Writing in this box can lead to confusion and may result in the form being returned or rejected.

Steps to complete the Illinois Department Of Revenue Do Not Write In This Box

To ensure proper completion of the form, follow these steps:

- Read all instructions thoroughly before starting.

- Fill out the required fields outside of the "Do Not Write In This Box" area.

- Double-check your entries for accuracy.

- Leave the designated box completely blank.

- Submit the form according to the specified submission methods.

Key elements of the Illinois Department Of Revenue Do Not Write In This Box

Key elements to consider when dealing with the "Do Not Write In This Box" instruction include:

- The purpose of the box is for internal processing by the Illinois Department of Revenue.

- Any writing in this area could lead to complications in the processing of your form.

- Understanding the context of the form can help clarify why certain areas are restricted.

State-specific rules for the Illinois Department Of Revenue Do Not Write In This Box

Each state has its own regulations regarding tax forms. In Illinois, the instruction to not write in specific boxes is part of a broader set of guidelines designed to streamline the tax filing process. Adhering to these state-specific rules helps ensure compliance and reduces the risk of errors that could lead to penalties or delays.

Form Submission Methods

Submitting your form correctly is essential for timely processing. The Illinois Department of Revenue allows several methods for form submission, including:

- Online submission through the department's official website.

- Mailing the completed form to the appropriate address.

- In-person submission at designated locations.

Regardless of the method chosen, ensure that the "Do Not Write In This Box" section remains unaltered to avoid complications.

Quick guide on how to complete illinois department of revenue do not write in this box

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the features you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign [SKS] Smoothly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Do Not Write In This Box

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue do not write in this box

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'Illinois Department Of Revenue Do Not Write In This Box' mean?

The phrase 'Illinois Department Of Revenue Do Not Write In This Box' typically indicates that a specific section of a form is reserved for administrative use only. It serves as guidance to prevent users from inputting information that could interfere with processing. Understanding this directive is essential for proper compliance with Illinois tax regulations.

-

How can airSlate SignNow help with forms requiring 'Illinois Department Of Revenue Do Not Write In This Box'?

airSlate SignNow streamlines the signing process for documents that include directives like 'Illinois Department Of Revenue Do Not Write In This Box.' Our platform ensures that all participants can sign and send forms electronically, reducing the risk of errors in critical sections. This makes it easier to comply with state guidelines.

-

What are the pricing options available for airSlate SignNow?

Our pricing for airSlate SignNow is competitive and designed to suit various business needs. Plans include options for occasional users to larger enterprises, all offering the ability to manage documents with instructions such as 'Illinois Department Of Revenue Do Not Write In This Box.' Visit our pricing page for detailed options.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow provides seamless integrations with various applications such as CRM systems and document management tools. These integrations facilitate the smooth handling of forms and documents that may include statements like 'Illinois Department Of Revenue Do Not Write In This Box,' ensuring that all data is synchronized efficiently.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features including document templates, secure eSignature capabilities, and real-time tracking for document status. This ensures that when you're handling forms with specific instructions like 'Illinois Department Of Revenue Do Not Write In This Box,' you can manage everything from creation to signing seamlessly and securely.

-

Can airSlate SignNow assist with compliance regarding state regulations?

Absolutely, airSlate SignNow is designed to assist businesses in maintaining compliance with various state regulations, including those issued by the Illinois Department of Revenue. By following the guidelines indicated in forms such as 'Illinois Department Of Revenue Do Not Write In This Box,' you can ensure that your documentation meets required legal standards.

-

Is it easy to use airSlate SignNow for someone unfamiliar with digital signatures?

Yes, airSlate SignNow is incredibly user-friendly, even for those unfamiliar with digital signatures. With a straightforward interface and guided processes, users can easily navigate tasks including following instructions like 'Illinois Department Of Revenue Do Not Write In This Box' without technical difficulties or confusion.

Get more for Illinois Department Of Revenue Do Not Write In This Box

- Gym membership reimbursement form atrio health plans

- Child care immunization form minnesota dept of health form to record your childs immunizations or exemptions for your child

- Formulario informe para el manejo de caso oat rama

- Form adv example

- Form st 7 virginia business consumer s use tax return tax virginia

- Vin correction form us bank

- Check in check out forms

- Journal of dual diagnosis author form taylor amp francis tandf co

Find out other Illinois Department Of Revenue Do Not Write In This Box

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word