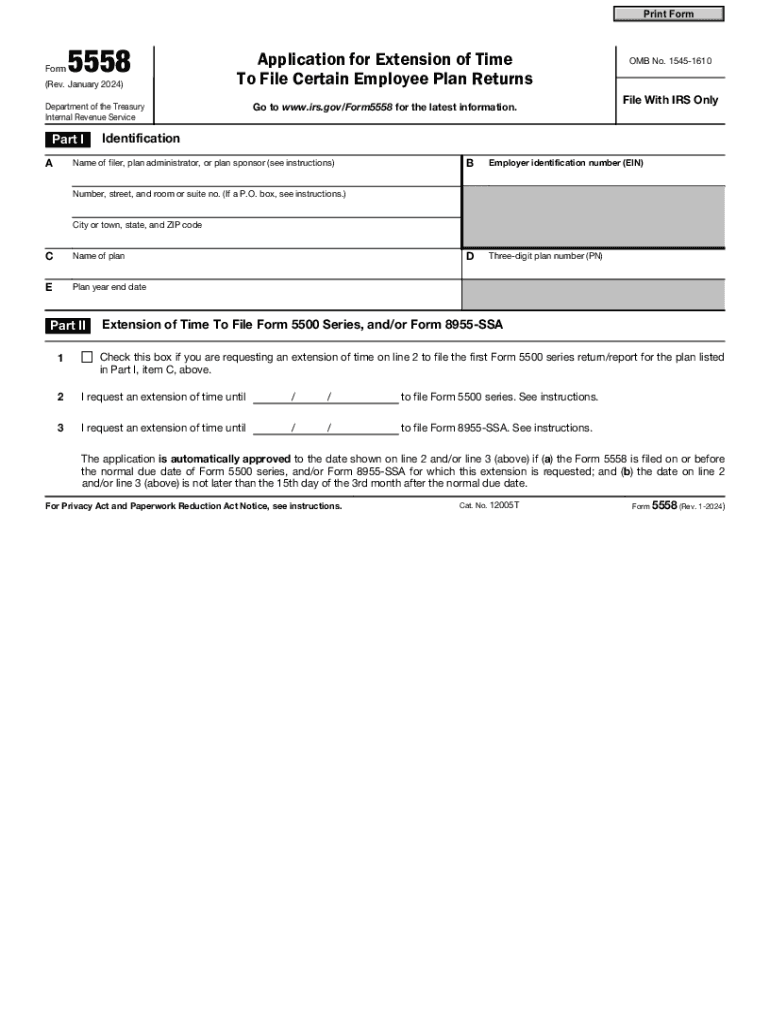

Form 5558 Rev January Application for Extension of Time to File Certain Employee Plan Returns 2024-2026

Quick guide on how to complete form 5558 rev january application for extension of time to file certain employee plan returns

Effortlessly Prepare Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the right format and securely archive it online. airSlate SignNow provides all the essential tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns without hassle

- Locate Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5558 rev january application for extension of time to file certain employee plan returns

Create this form in 5 minutes!

How to create an eSignature for the form 5558 rev january application for extension of time to file certain employee plan returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5558?

Form 5558 is a document used to apply for an extension of time to file certain employee benefit plan returns. It is essential for businesses managing employee benefits to ensure compliance with IRS requirements.

-

How can airSlate SignNow help with filing form 5558?

airSlate SignNow streamlines the process of completing and eSigning form 5558 by providing a user-friendly interface. You can easily fill out the form, ensuring all necessary information is included, and eSign it to submit electronically.

-

What are the pricing options for using airSlate SignNow for form 5558?

airSlate SignNow offers flexible pricing plans tailored to varying business needs, ranging from basic to advanced features. Choosing an appropriate plan allows you to efficiently manage the eSigning and filing of form 5558 while controlling costs.

-

Does airSlate SignNow integrate with other applications for form 5558 processing?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the workflow of filing form 5558. These integrations allow for easy document sharing and improved collaboration across your business tools.

-

What features does airSlate SignNow provide for completing form 5558?

airSlate SignNow offers powerful features such as customizable templates, secure storage, and real-time tracking for form 5558. These functionalities simplify the document management process and ensure that your filing is efficient and secure.

-

Can I ensure compliance when using airSlate SignNow for form 5558?

Absolutely! Using airSlate SignNow helps maintain compliance by providing a clear and structured way to complete and file form 5558. The platform ensures all necessary fields are filled out, and eSignatures are securely handled to meet legal standards.

-

What benefits does airSlate SignNow offer for managing form 5558?

The key benefits of using airSlate SignNow for managing form 5558 include increased efficiency, reduced paperwork, and enhanced security. This solution allows businesses to save time and eliminate errors associated with manual form processing.

Get more for Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns

- Mortgage pre approval application crescent mortgage corp crescentmortgage form

- Gsthst new housing rebate application for houses purchased from a builder form

- Claim form for payment of accrued benefits form mpfs w

- Kso sucofindo form

- Ppa1 form

- Aib paylink euro application form

- Prqa 01 form

- Sports scholarship application form

Find out other Form 5558 Rev January Application For Extension Of Time To File Certain Employee Plan Returns

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF