Tax Credit Scottsdale Unified School 2023-2026

Understanding the Tax Credit for Scottsdale Unified School

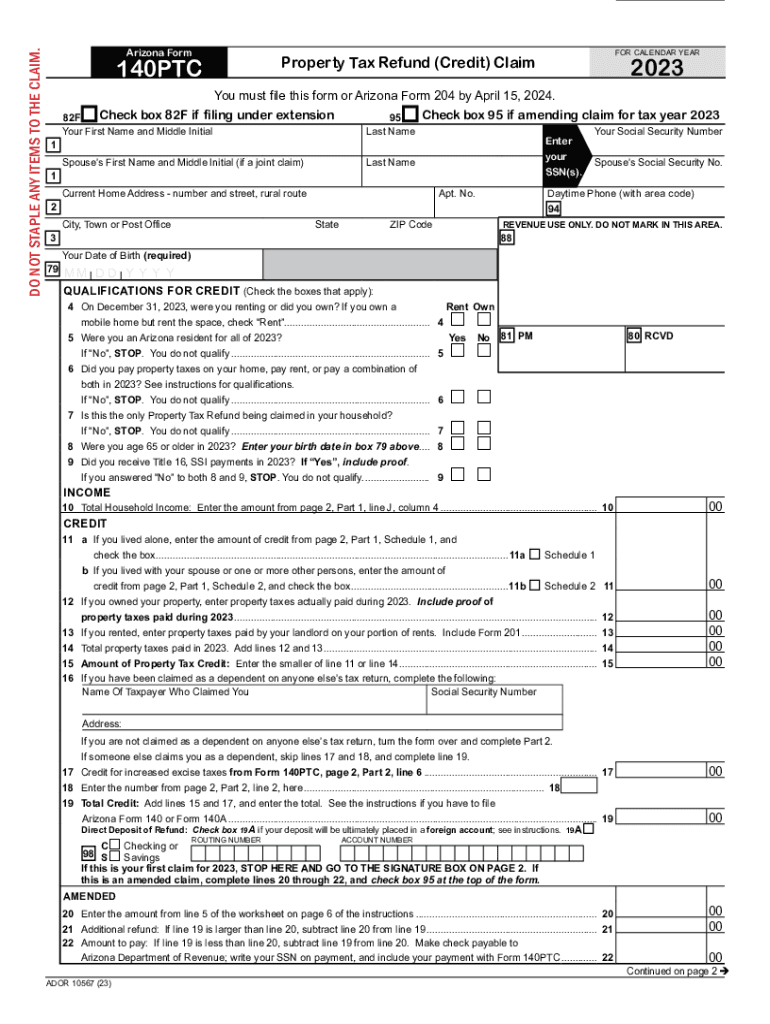

The Tax Credit for Scottsdale Unified School is designed to provide financial relief to taxpayers who contribute to public schools in Arizona. This credit allows individuals to receive a dollar-for-dollar reduction in their state tax liability for contributions made to public schools for extracurricular activities and character education programs. The maximum credit amount varies depending on the taxpayer's filing status, with single filers eligible for a specific limit and married couples filing jointly having a higher threshold.

Steps to Complete the Tax Credit for Scottsdale Unified School

Completing the Tax Credit for Scottsdale Unified School involves several straightforward steps:

- Gather necessary documentation, including proof of contributions made to the school.

- Obtain the AZ Form 140PTC, which is specifically designed for claiming this credit.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total amount of credit you are eligible for based on your contributions.

- Submit the form along with your state tax return, either electronically or by mail.

Eligibility Criteria for the Tax Credit for Scottsdale Unified School

To qualify for the Tax Credit for Scottsdale Unified School, taxpayers must meet specific eligibility criteria. These include:

- Being a resident of Arizona and filing a state income tax return.

- Making a qualified contribution to a public school within the state.

- Adhering to the contribution limits set by the Arizona Department of Revenue.

Required Documents for Claiming the Tax Credit

When claiming the Tax Credit for Scottsdale Unified School, it is essential to have the following documents ready:

- Proof of contribution, such as receipts or bank statements showing payment to the school.

- A completed AZ Form 140PTC, which details the contributions made.

- Your state tax return, which will include the tax credit information.

Filing Deadlines for the Tax Credit

Taxpayers should be aware of the filing deadlines for the Tax Credit for Scottsdale Unified School. Typically, the deadline aligns with the general state tax filing deadline, which is usually April 15. However, if additional time is needed, taxpayers can file for an extension, but they must ensure that any tax owed is paid by the original deadline to avoid penalties.

Form Submission Methods for the Tax Credit

The AZ Form 140PTC can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing a paper form to the appropriate address provided by the state.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete tax credit scottsdale unified school

Complete Tax Credit Scottsdale Unified School effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow provides you with all necessary tools to create, adjust, and eSign your documents swiftly without delays. Manage Tax Credit Scottsdale Unified School on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Tax Credit Scottsdale Unified School with ease

- Locate Tax Credit Scottsdale Unified School and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for those purposes.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Tax Credit Scottsdale Unified School and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax credit scottsdale unified school

Create this form in 5 minutes!

How to create an eSignature for the tax credit scottsdale unified school

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AZ Form 140PTC 2022, and how does it relate to airSlate SignNow?

The AZ Form 140PTC 2022 is a form used by businesses in Arizona to claim a tax credit. airSlate SignNow streamlines the process of completing and submitting this form by providing an electronic signature solution, ensuring that documents are sent securely and efficiently.

-

How can I fill out the AZ Form 140PTC 2022 using airSlate SignNow?

Filling out the AZ Form 140PTC 2022 is simple with airSlate SignNow. Our platform allows you to upload the form, fill in the required fields electronically, and sign it with a secure e-signature, making the process quick and hassle-free.

-

Is there a cost to use airSlate SignNow for the AZ Form 140PTC 2022?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Depending on the level of features and functionality you require for handling the AZ Form 140PTC 2022, there are cost-effective options available to fit your budget.

-

What features does airSlate SignNow offer for signing the AZ Form 140PTC 2022?

Some of the key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking. These features enhance your ability to manage the AZ Form 140PTC 2022 efficiently, making it easier to collect signatures and ensure all stakeholders are informed.

-

Are there any integrations available with airSlate SignNow for the AZ Form 140PTC 2022?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Microsoft Office. This allows users to manage and submit the AZ Form 140PTC 2022 directly from their preferred platforms, enhancing productivity and workflow efficiency.

-

What are the benefits of using airSlate SignNow for the AZ Form 140PTC 2022?

Using airSlate SignNow to complete the AZ Form 140PTC 2022 offers many benefits, including reduced turnaround times, improved accuracy, and enhanced security. Additionally, the platform's user-friendly interface simplifies the document signing process, promoting better compliance and customer satisfaction.

-

How does airSlate SignNow ensure the security of the AZ Form 140PTC 2022?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your documents. This ensures that your AZ Form 140PTC 2022 and any sensitive information are safeguarded throughout the signing process.

Get more for Tax Credit Scottsdale Unified School

Find out other Tax Credit Scottsdale Unified School

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors