AZ ADOR 140PTC Form 2021

What is the AZ ADOR 140PTC Form

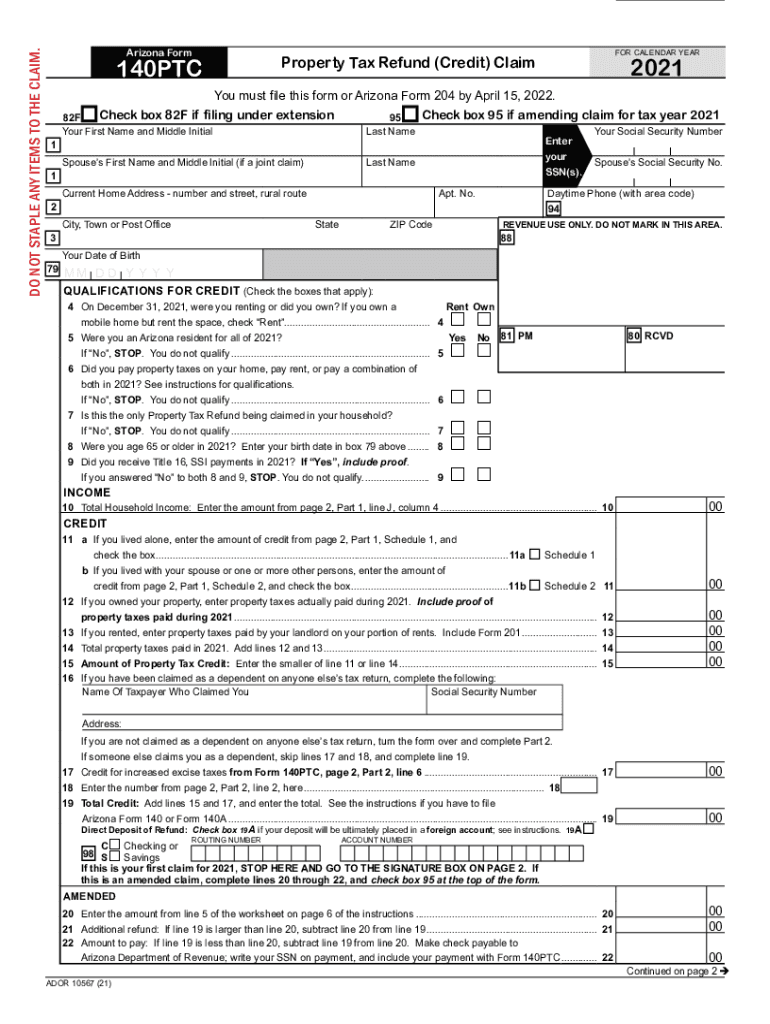

The AZ ADOR 140PTC Form is a tax document used by Arizona residents to claim the credit for taxes paid to other states. This form is essential for individuals who earn income in multiple states and wish to avoid double taxation. By filing this form, taxpayers can ensure they receive appropriate credits, thereby reducing their overall tax liability in Arizona.

How to use the AZ ADOR 140PTC Form

Using the AZ ADOR 140PTC Form involves several steps. First, gather all relevant income documentation from both Arizona and the other states where income was earned. Next, complete the form by accurately reporting income and taxes paid to other states. It is crucial to follow the instructions carefully to ensure that all information is correct. Once completed, the form should be submitted along with your Arizona tax return.

Steps to complete the AZ ADOR 140PTC Form

Completing the AZ ADOR 140PTC Form requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Then, list the income earned in Arizona and the other states. Calculate the taxes paid to the other states and enter this information in the designated sections. Finally, review the form for accuracy and sign it before submission.

Legal use of the AZ ADOR 140PTC Form

The AZ ADOR 140PTC Form is legally recognized as a valid means for claiming tax credits in Arizona. To ensure compliance with state tax laws, it must be filled out accurately and submitted within the designated filing deadlines. It is important to maintain copies of the form and any supporting documents, as these may be requested by the Arizona Department of Revenue for verification.

Filing Deadlines / Important Dates

Filing deadlines for the AZ ADOR 140PTC Form align with Arizona's tax return submission dates. Typically, individual tax returns are due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Arizona Department of Revenue's website for any updates regarding filing deadlines and important dates related to tax credits.

Required Documents

To complete the AZ ADOR 140PTC Form, certain documents are necessary. These include W-2 forms from employers, 1099 forms for any additional income, and documentation of taxes paid to other states. Having these documents readily available will facilitate a smoother completion process and help ensure that the information provided is accurate and complete.

Form Submission Methods (Online / Mail / In-Person)

The AZ ADOR 140PTC Form can be submitted through various methods. Taxpayers have the option to file online through the Arizona Department of Revenue's e-filing system, which is convenient and efficient. Alternatively, the form can be mailed to the appropriate address listed on the form or submitted in person at local tax offices. Each method has its own processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete az ador 140ptc form

Complete AZ ADOR 140PTC Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the suitable form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage AZ ADOR 140PTC Form on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

The easiest way to modify and electronically sign AZ ADOR 140PTC Form without stress

- Obtain AZ ADOR 140PTC Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive data with the features airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign AZ ADOR 140PTC Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct az ador 140ptc form

Create this form in 5 minutes!

How to create an eSignature for the az ador 140ptc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AZ ADOR 140PTC Form?

The AZ ADOR 140PTC Form is a tax credit form provided by the Arizona Department of Revenue for individuals claiming the Family Tax Credit. This form allows residents to report their eligibility and claim benefits owed to them during tax season. Completing the AZ ADOR 140PTC Form accurately is essential for ensuring you receive the maximum credit available.

-

How can airSlate SignNow help with the AZ ADOR 140PTC Form?

airSlate SignNow simplifies the process of completing and signing the AZ ADOR 140PTC Form by providing a secure and user-friendly platform. Our solution allows users to fill out the necessary details digitally and ensures that your tax documentation is properly eSigned and stored. This streamlines the tax filing process, saving you valuable time and effort.

-

What features does airSlate SignNow offer for handling the AZ ADOR 140PTC Form?

airSlate SignNow offers features like customizable templates, real-time collaboration, and an intuitive eSignature solution specifically tailored for forms like the AZ ADOR 140PTC Form. These features enable users to create, share, and sign documents in one place, ensuring compliance and reducing errors. Additionally, our platform keeps your data organized and accessible.

-

Is there a cost associated with using airSlate SignNow for the AZ ADOR 140PTC Form?

Yes, airSlate SignNow operates on a subscription-based model, providing various plans to fit your business needs and budget. Depending on the plan you choose, you can access tools specifically catered to completing forms like the AZ ADOR 140PTC Form. Consider our pricing options to find the most cost-effective solution for your organization.

-

How does airSlate SignNow ensure the security of the AZ ADOR 140PTC Form?

Security is a priority at airSlate SignNow, especially when dealing with sensitive documents like the AZ ADOR 140PTC Form. Our platform employs advanced encryption protocols and secure cloud storage to protect your information. Additionally, user authentication and access controls ensure that your documents remain confidential and tamper-proof.

-

Can I integrate airSlate SignNow with other applications for the AZ ADOR 140PTC Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications, enhancing the process of managing the AZ ADOR 140PTC Form. Whether you are using CRM systems, accounting software, or cloud storage solutions, our platform can connect with your existing tools to streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the AZ ADOR 140PTC Form?

Using airSlate SignNow for the AZ ADOR 140PTC Form provides numerous benefits, including efficiency and accuracy in document preparation and signing. The platform also facilitates easier collaboration among stakeholders, allowing you to manage the form process from start to finish. By choosing airSlate SignNow, you can enhance your tax filing experience and maximize your credits.

Get more for AZ ADOR 140PTC Form

- N d bhatt engineering drawing book solutions pdf download form

- Standard industrialcommercial single tenant lease gross form

- Non commercial invoice form

- Esic form 18 for maternity leave download pdf

- Lifeline program application form

- Pre anesthesia assessment form pdf

- Health and activity card cbse how to fill form

- Vehicle registration new registrations form

Find out other AZ ADOR 140PTC Form

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later