Property Tax Refund Credit Claim Form Fillable 2022

What is the Property Tax Refund Credit Claim Form?

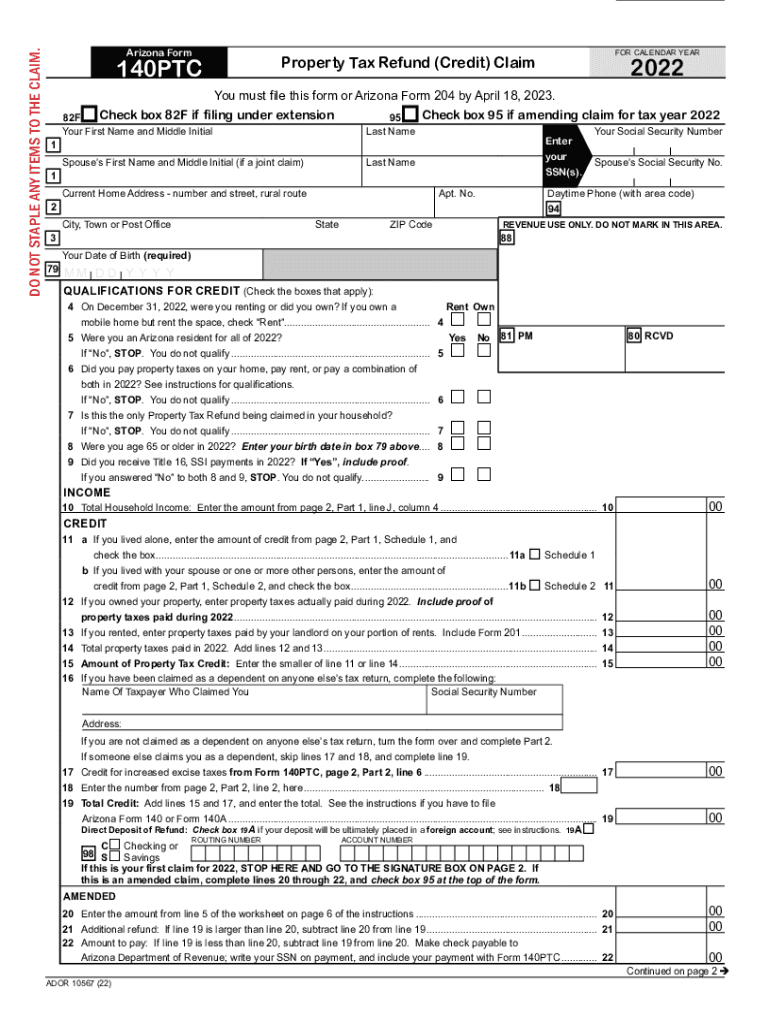

The Property Tax Refund Credit Claim Form is a crucial document for Arizona residents seeking to claim a refund on property taxes paid. This form allows eligible taxpayers to receive a credit based on their property taxes, which can significantly reduce their financial burden. It is specifically designed for individuals who meet certain income and residency criteria, ensuring that the benefits are directed towards those who need them most. Understanding the purpose and requirements of this form is essential for maximizing potential refunds.

Eligibility Criteria for the Property Tax Refund Credit

To qualify for the 2022 Arizona property tax credit, applicants must meet specific eligibility criteria. Generally, the requirements include:

- Being a resident of Arizona for the entire tax year.

- Having a total household income that does not exceed certain limits.

- Owning or renting a home that is subject to property taxes.

- Filing the appropriate tax returns, including the AZ Form 140PTC 2022.

It is essential to review these criteria carefully to ensure eligibility before completing the claim form.

Steps to Complete the Property Tax Refund Credit Claim Form

Filling out the Property Tax Refund Credit Claim Form involves several key steps:

- Gather necessary documentation, including proof of income and property tax statements.

- Obtain the AZ Form 140PTC 2022 from the Arizona Department of Revenue.

- Fill out the form accurately, ensuring all personal and financial information is correct.

- Attach any required supporting documents, such as income verification.

- Review the completed form for accuracy before submission.

Following these steps will help ensure a smooth application process and increase the likelihood of receiving the refund.

How to Submit the Property Tax Refund Credit Claim Form

Once the Property Tax Refund Credit Claim Form is completed, it can be submitted in various ways. Taxpayers have the option to:

- File the form electronically through the Arizona Department of Revenue's online portal.

- Mail the completed form to the designated address provided on the form.

- Deliver the form in person at local tax offices, if preferred.

Choosing the right submission method can impact the processing time, so it is advisable to consider the most convenient option for your circumstances.

Required Documents for the Claim

To successfully file the Property Tax Refund Credit Claim Form, certain documents are required. These typically include:

- Proof of residency in Arizona.

- Income documentation, such as W-2 forms or 1099 statements.

- Property tax statements or receipts showing the amount paid.

- Any additional forms that may be relevant to your specific situation.

Having these documents ready will facilitate a smoother filing process and help avoid delays in receiving the credit.

Quick guide on how to complete property tax refund credit claim form fillable

Complete Property Tax Refund Credit Claim Form Fillable with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Property Tax Refund Credit Claim Form Fillable on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Property Tax Refund Credit Claim Form Fillable effortlessly

- Locate Property Tax Refund Credit Claim Form Fillable and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tiring form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Property Tax Refund Credit Claim Form Fillable to ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax refund credit claim form fillable

Create this form in 5 minutes!

How to create an eSignature for the property tax refund credit claim form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Arizona property tax credit?

The 2022 Arizona property tax credit is a financial benefit offered to eligible residents to help reduce their property tax burden. This credit is designed specifically for those with low to moderate income and aims to make homeownership more affordable. To qualify, applicants must meet certain income and residency requirements.

-

Who is eligible for the 2022 Arizona property tax credit?

Eligibility for the 2022 Arizona property tax credit is generally limited to homeowners who meet specific income criteria and are residents of Arizona. Typically, individuals aged 65 and older, or those with disabilities, may find additional provisions to qualify. It's important to review the latest guidelines to ensure compliance and eligibility.

-

How do I apply for the 2022 Arizona property tax credit?

To apply for the 2022 Arizona property tax credit, you can complete the Arizona Form 140PTC, which is available on the Arizona Department of Revenue website. Ensure you gather all necessary documentation, including proof of income and property ownership. Timely submission of your application can increase your chances of approval.

-

What are the benefits of the 2022 Arizona property tax credit?

The primary benefit of the 2022 Arizona property tax credit is the signNow reduction in property taxes for qualifying homeowners, providing crucial financial relief. This credit enhances affordability and makes it easier for residents to manage their housing costs. Additionally, it can free up funds for other essential expenses.

-

Is the 2022 Arizona property tax credit automatically applied?

No, the 2022 Arizona property tax credit is not automatically applied to your property taxes. Homeowners must actively apply for the credit before the relevant deadlines to receive the benefit. Checking with local authorities can help ensure you take the necessary steps for your application.

-

What documents do I need for the 2022 Arizona property tax credit application?

To complete the application for the 2022 Arizona property tax credit, you will typically need documents that verify your income, property ownership, and Arizona residency. Commonly required documents include tax returns, W-2 forms, and proof of address. It’s vital to gather these documents beforehand for a smoother application process.

-

Can I appeal a denial of the 2022 Arizona property tax credit?

Yes, if your application for the 2022 Arizona property tax credit is denied, you have the right to appeal the decision. Start by reviewing the reasons for the denial and gather supporting evidence to demonstrate eligibility. Contact your local assessor's office for information on the appeal process and necessary steps.

Get more for Property Tax Refund Credit Claim Form Fillable

Find out other Property Tax Refund Credit Claim Form Fillable

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe