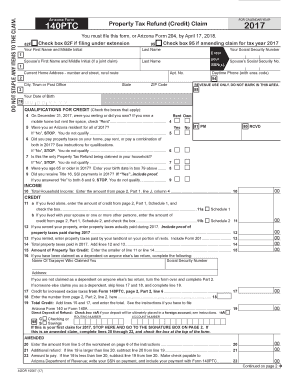

Check Box 95 If Amending Claim for Tax Year 2017

What is the Check Box 95 If Amending Claim For Tax Year

The Check Box 95 is a specific section on the 1099-SA form that indicates whether a taxpayer is amending a prior claim for the tax year 2017. This box is crucial for individuals who need to correct previously submitted information regarding distributions from Health Savings Accounts (HSAs) or Archer Medical Savings Accounts (MSAs). By checking this box, the taxpayer signals to the IRS that the submitted information should replace the earlier claim, ensuring that the records are accurate and up-to-date.

How to Use the Check Box 95 If Amending Claim For Tax Year

To properly utilize the Check Box 95 on the 1099-SA form, taxpayers should first ensure that they have the correct version of the form for the tax year 2017. When filling out the form, locate Check Box 95 and mark it clearly if you are amending a prior claim. It is essential to provide accurate information in all other sections of the form as well, including the amounts distributed and the reason for the amendment. This helps to facilitate a smooth review process by the IRS.

Steps to Complete the Check Box 95 If Amending Claim For Tax Year

Completing the Check Box 95 involves several key steps:

- Obtain the 1099-SA form for the tax year 2017.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Locate Check Box 95 on the form and mark it if you are amending a prior claim.

- Provide the necessary details regarding your distributions, including amounts and any relevant explanations.

- Review the entire form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for using the 1099-SA form, particularly when it comes to amendments. Taxpayers should refer to the IRS instructions for the 1099-SA form to ensure compliance with all requirements. This includes understanding the implications of marking Check Box 95 and the necessary documentation that may accompany the amended claim. Adhering to these guidelines helps prevent delays in processing and potential issues with the IRS.

Filing Deadlines / Important Dates

When filing an amended claim using the Check Box 95 on the 1099-SA form, it is important to be aware of the relevant deadlines. Typically, the IRS requires that amended returns be filed within three years of the original due date. For the tax year 2017, this means that the amended claim should be submitted by the appropriate deadline to avoid penalties. Keeping track of these dates ensures compliance and helps taxpayers avoid unnecessary complications.

Penalties for Non-Compliance

Failing to properly complete and submit the 1099-SA form, including the Check Box 95 when applicable, can result in penalties from the IRS. These penalties may include fines for late submissions or inaccuracies in the reported information. It is crucial for taxpayers to ensure that all information is correct and submitted on time to mitigate the risk of incurring penalties.

Quick guide on how to complete check box 95 if amending claim for tax year 2017

Easily Prepare Check Box 95 If Amending Claim For Tax Year on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Check Box 95 If Amending Claim For Tax Year seamlessly on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related tasks today.

How to Alter and Electronically Sign Check Box 95 If Amending Claim For Tax Year Effortlessly

- Locate Check Box 95 If Amending Claim For Tax Year and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Check Box 95 If Amending Claim For Tax Year and ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct check box 95 if amending claim for tax year 2017

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

If I filled out an application form for the CAT 2017, but did not take the exam, what will be the consequences if I want to take the exam next year?

Thanks For A2ANo, You will not have to bear any consequence except the money you will loose while paying the fees i.e., 1800 for general.No one will be bothered next year to check your CAT 2017 application status.Raavan

-

My company pays the TDS for the current financial year and the amount of tax was Rs. 0 because I am in the first slab. Do I still need to fill out an ITR-1 if I have Form 16 from my employer?

Receiving a Form 16 from your employer does not directly imply that you need to file an Income Tax Return. A Return has to be filed if your total income (including salary and any income from say savings bank account interest, interest income on fixed deposits, rental income) is more than the minimum income which is exempt from tax. This minimum exempt income is Rs 2,00,000 for FY 2013-14 and Rs 2,50,000 for FY 2014-15 and FY 2015-16.So you need to sum up the total income earned by you in a financial year and see if you are required to pay tax and file a Return.Return filing has several advantages too -Need a Refund – In case excess TDS has been deducted on your income and you need to claim a refund - in this situation you must file a return to claim the tax refund. For example, even though your total income is below the taxable limit, a bank deducted TDS on your FD interest - to get the refund of this TDS you'll have to file a Return.Need a Loan – When you signNow out to a bank or a financial institution for a loan a house loan or a personal loan - they usually require copies of your IT returns to check your credit worthiness. And therefore, it makes sense to keep your finances in order and file an IT return.Visas - Some countries require copies of your IT returns when they provide you a travel or a work visa.You can read more in detail here Are You required to file an IT Return in India?You'll find a lot of helpful topics here which have been addressed in very simple and easy format ClearTax's Series on Salary Income. Understand Salary Income, Deductions, Form-16Do note that if you file with http://www.cleartax.in you never have to choose which form to file since we do that for you automatically.signNow out to us support@cleartax.in if you need help!

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

Create this form in 5 minutes!

How to create an eSignature for the check box 95 if amending claim for tax year 2017

How to make an eSignature for the Check Box 95 If Amending Claim For Tax Year 2017 in the online mode

How to create an electronic signature for your Check Box 95 If Amending Claim For Tax Year 2017 in Chrome

How to generate an electronic signature for putting it on the Check Box 95 If Amending Claim For Tax Year 2017 in Gmail

How to make an eSignature for the Check Box 95 If Amending Claim For Tax Year 2017 from your smart phone

How to create an electronic signature for the Check Box 95 If Amending Claim For Tax Year 2017 on iOS

How to create an eSignature for the Check Box 95 If Amending Claim For Tax Year 2017 on Android

People also ask

-

What does 'Check Box 95 If Amending Claim For Tax Year' mean in the context of tax documents?

The 'Check Box 95 If Amending Claim For Tax Year' is a specific instruction on tax forms, indicating that you are making an amendment to your previously filed tax claim. When filling out such forms, it’s essential to check this box to ensure that the IRS processes your amendment correctly. Utilizing airSlate SignNow can simplify this process by allowing you to eSign documents securely.

-

How can airSlate SignNow help with the 'Check Box 95 If Amending Claim For Tax Year'?

With airSlate SignNow, you can easily include the 'Check Box 95 If Amending Claim For Tax Year' in your electronic documents. Our platform allows you to create, edit, and eSign tax forms seamlessly, ensuring that your amendments are accurately filed and processed. This functionality supports a smooth filing experience for your tax claims.

-

Is there a cost associated with using airSlate SignNow for tax amendments?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. Depending on the features you require for tasks like marking the 'Check Box 95 If Amending Claim For Tax Year', you can choose a plan that fits your budget. Our cost-effective solution ensures that you get the necessary tools without overspending.

-

What features does airSlate SignNow offer to streamline tax document processing?

airSlate SignNow provides several features to enhance your tax document processing, including customizable templates, secure eSigning, and real-time collaboration. When amending claims and needing to check the 'Check Box 95 If Amending Claim For Tax Year', these features ensure that your documents are both accurate and compliant with IRS regulations.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Yes, airSlate SignNow offers seamless integrations with various tax preparation software. This capability allows you to incorporate the 'Check Box 95 If Amending Claim For Tax Year' into your existing workflows, enhancing productivity and ensuring that all necessary information is captured efficiently.

-

What are the benefits of using airSlate SignNow for amending tax claims?

Using airSlate SignNow to amend tax claims offers numerous benefits, including efficiency, security, and ease of use. By checking the 'Check Box 95 If Amending Claim For Tax Year' digitally, you can expedite the process, reduce the risk of errors, and ensure that your amendments are filed correctly with the IRS.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes the security of your sensitive tax documents with advanced encryption and compliance with industry standards. When you use our platform to check the 'Check Box 95 If Amending Claim For Tax Year', you can be confident that your information remains protected throughout the eSigning process.

Get more for Check Box 95 If Amending Claim For Tax Year

Find out other Check Box 95 If Amending Claim For Tax Year

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile