Article 3B North Carolina Department of Revenue 2022

Understanding the North Carolina State Tax

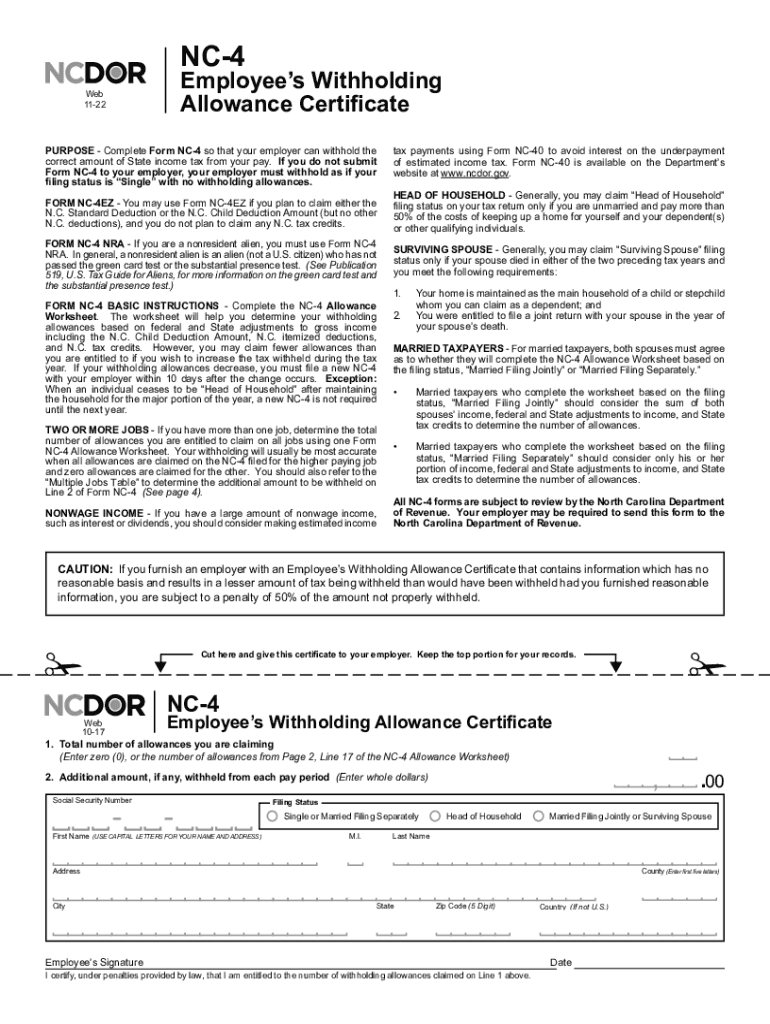

The North Carolina state tax system is governed by the North Carolina Department of Revenue. It encompasses various tax forms, including the NC-4 form, which is essential for withholding tax purposes. This form allows employees to indicate their withholding allowances and is crucial for accurate state tax deductions from paychecks. Understanding how the NC state tax operates ensures compliance and helps individuals manage their tax liabilities effectively.

Steps to Complete the NC-4 Form

Completing the NC-4 form requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can affect your withholding amount.

- List the number of allowances you are claiming. This number influences the amount withheld from your paycheck.

- If applicable, specify any additional amount you want withheld from your paycheck.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to your employer to ensure proper withholding from your wages.

Filing Deadlines for North Carolina State Tax

Filing deadlines for North Carolina state tax forms are crucial for compliance. Generally, individual income tax returns are due on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is essential to stay informed about these dates to avoid penalties and interest on late payments.

Required Documents for Filing State Taxes

When filing your North Carolina state taxes, certain documents are necessary to ensure accuracy and compliance:

- W-2 forms from all employers, detailing your earnings and tax withholdings.

- Any 1099 forms received for additional income, such as freelance work or interest.

- Documentation for any deductions or credits you plan to claim, such as receipts for charitable donations or medical expenses.

- Previous year’s tax return, which can provide a reference for your current filing.

Penalties for Non-Compliance with NC State Tax Regulations

Failure to comply with North Carolina state tax regulations can result in significant penalties. Common penalties include:

- Failure-to-file penalty, which can be a percentage of the unpaid tax for each month the return is late.

- Failure-to-pay penalty, which is assessed on any unpaid tax amount.

- Interest on unpaid taxes, which accrues daily until the balance is paid in full.

Understanding these penalties emphasizes the importance of timely and accurate tax filings.

Eligibility Criteria for North Carolina State Tax Deductions

Eligibility for various deductions in North Carolina state taxes can vary based on individual circumstances. Common criteria include:

- Residency status in North Carolina for at least half of the tax year.

- Income level, as certain deductions may phase out at higher income levels.

- Specific expenses incurred, such as medical costs or educational expenses, which may qualify for deductions.

Reviewing these criteria is essential for maximizing potential tax benefits.

Quick guide on how to complete article 3b north carolina department of revenue

Effortlessly prepare Article 3B North Carolina Department Of Revenue on any device

Managing documents online has become widely adopted by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Handle Article 3B North Carolina Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Article 3B North Carolina Department Of Revenue with ease

- Obtain Article 3B North Carolina Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invite link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed out. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Article 3B North Carolina Department Of Revenue and ensure seamless communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct article 3b north carolina department of revenue

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's solution for managing nc state tax documents?

airSlate SignNow offers a robust platform for managing nc state tax documents efficiently. With our easy-to-use interface, businesses can quickly send and eSign tax documents, ensuring compliance and timely submissions. This streamlined process reduces the hassle of paperwork associated with nc state tax filings.

-

How does airSlate SignNow integrate with nc state tax filing software?

airSlate SignNow seamlessly integrates with various nc state tax filing software to enhance your document management experience. This integration allows you to import data directly into your tax documents and maintain accurate records. Our solution ensures that all nc state tax filings are easily accessible and organized.

-

What are the pricing options for using airSlate SignNow for nc state tax purposes?

airSlate SignNow offers competitive pricing tailored for businesses managing nc state tax documents. Our plans are scalable and designed to fit a variety of business sizes and needs. Whether you require basic features or advanced functionalities, we provide flexible options to effectively manage nc state tax processes.

-

Can airSlate SignNow help in reducing errors in nc state tax filings?

Absolutely! airSlate SignNow minimizes errors in nc state tax filings through automated workflows and templates. By utilizing our platform’s features such as eSigning and document tracking, you can ensure that all necessary information is accurately captured, leading to more reliable nc state tax submissions.

-

What features does airSlate SignNow include for tracking nc state tax documents?

airSlate SignNow includes powerful tracking features that allow you to monitor the status of your nc state tax documents in real-time. You receive notifications when documents are viewed, signed, or require actions, ensuring nothing falls through the cracks. This level of transparency is crucial for efficient nc state tax management.

-

How can airSlate SignNow improve collaboration on nc state tax projects?

With airSlate SignNow, collaboration on nc state tax projects is simplified through shared access to documents. Team members can work together in real-time, providing input and revisions directly on the platform. This feature fosters efficient teamwork, ensuring everyone is aligned on nc state tax requirements.

-

Is airSlate SignNow secure for handling sensitive nc state tax information?

Yes, airSlate SignNow employs industry-leading security measures to protect your sensitive nc state tax information. Our platform uses encryption for data in transit and at rest, ensuring that your documents are secure. We are committed to maintaining the highest standards of compliance for handling nc state tax data.

Get more for Article 3B North Carolina Department Of Revenue

Find out other Article 3B North Carolina Department Of Revenue

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT