700 14 HR Payroll Policy NC 4 Tax Compliance 2024

Understanding the NC-4 Form

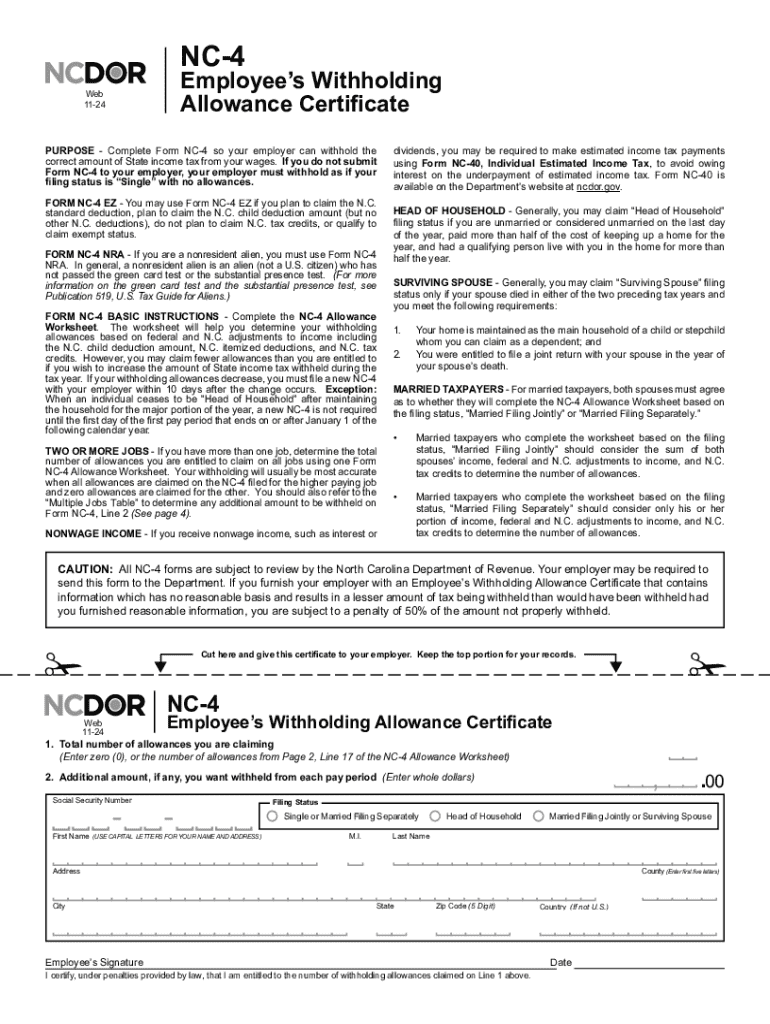

The NC-4 form, also known as the North Carolina Employee's Withholding Allowance Certificate, is essential for employees in North Carolina to determine the amount of state income tax withheld from their paychecks. This form allows employees to claim allowances based on their personal situation, such as marital status and number of dependents. Understanding how to fill out the NC-4 form correctly can help ensure that the appropriate amount of tax is withheld, preventing underpayment or overpayment throughout the tax year.

Steps to Complete the NC-4 Form

Filling out the NC-4 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Complete the allowances section, where you can claim allowances based on your dependents and other factors. Use the NC-4 allowance worksheet if needed to calculate the correct number of allowances.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be submitted to your employer, who will use it to adjust your withholding accordingly.

Eligibility Criteria for the NC-4 Form

To be eligible to complete the NC-4 form, you must be an employee working in North Carolina and subject to state income tax withholding. This includes full-time, part-time, and temporary employees. If you are self-employed or working as an independent contractor, the NC-4 form is not applicable, and you may need to follow different tax guidelines.

Filing Deadlines for the NC-4 Form

While the NC-4 form itself does not have a specific filing deadline, it is crucial to submit it to your employer before the first paycheck of the tax year. This ensures that the correct amount of state tax is withheld from your earnings. If you need to make changes to your withholding allowances during the year, you can submit a new NC-4 form at any time.

Penalties for Non-Compliance

Failure to complete the NC-4 form accurately or to submit it on time can lead to penalties. If too little tax is withheld, you may owe a significant amount when filing your state tax return, potentially incurring interest and penalties for underpayment. Conversely, excessive withholding can result in a smaller paycheck, affecting your cash flow throughout the year. It is essential to review your withholding periodically to ensure compliance with North Carolina tax regulations.

Digital vs. Paper Version of the NC-4 Form

The NC-4 form is available in both digital and paper formats. The fillable digital version allows for easy completion and submission, which can streamline the process for both employees and employers. The paper version can be printed and filled out manually. Regardless of the format chosen, it is important to ensure that the information is accurate and submitted promptly to avoid any issues with state tax withholding.

Handy tips for filling out 700 14 HR Payroll Policy NC 4 Tax Compliance online

Quick steps to complete and e-sign 700 14 HR Payroll Policy NC 4 Tax Compliance online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant solution for maximum efficiency. Use signNow to electronically sign and send out 700 14 HR Payroll Policy NC 4 Tax Compliance for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct 700 14 hr payroll policy nc 4 tax compliance

Create this form in 5 minutes!

How to create an eSignature for the 700 14 hr payroll policy nc 4 tax compliance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an NC4 form fillable?

An NC4 form fillable is a digital version of the North Carolina Employee's Withholding Allowance Certificate that allows users to complete and submit the form electronically. With airSlate SignNow, you can easily fill out the NC4 form fillable, ensuring accuracy and compliance with state regulations.

-

How can I create an NC4 form fillable using airSlate SignNow?

Creating an NC4 form fillable with airSlate SignNow is simple. You can upload the NC4 form, customize it to your needs, and make it fillable for your users. This process streamlines data collection and enhances the efficiency of your document management.

-

Is there a cost associated with using the NC4 form fillable feature?

Yes, airSlate SignNow offers various pricing plans that include access to the NC4 form fillable feature. Depending on your business needs, you can choose a plan that fits your budget while providing the necessary tools for efficient document handling.

-

What are the benefits of using an NC4 form fillable?

Using an NC4 form fillable offers numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. With airSlate SignNow, you can ensure that your forms are completed correctly and submitted on time, enhancing your overall workflow.

-

Can I integrate the NC4 form fillable with other applications?

Absolutely! airSlate SignNow allows for seamless integration with various applications, enabling you to connect your NC4 form fillable with tools like CRM systems and cloud storage services. This integration enhances your productivity and ensures that all your documents are easily accessible.

-

Is the NC4 form fillable secure?

Yes, security is a top priority for airSlate SignNow. The NC4 form fillable is protected with advanced encryption and compliance measures, ensuring that your sensitive information remains safe during the filling and signing process.

-

Can multiple users fill out the NC4 form fillable simultaneously?

Yes, airSlate SignNow allows multiple users to fill out the NC4 form fillable at the same time. This feature is particularly useful for businesses with several employees needing to complete the form, streamlining the process and saving valuable time.

Get more for 700 14 HR Payroll Policy NC 4 Tax Compliance

- Il4506 request for copy of tax return form

- Jaws keystrokes freedom scientific home page form

- 2019 form il 1040 individual income tax return illinoisgov

- Filing the estate tax return maryland taxes comptroller of form

- Application for bulk transfer permit form

- Instructions for form 1 2020 instructions for form 1 2020

- Withholding kentucky income tax kentucky dor form

- Ty 2019 106 ty 2019 106 stop payment request form

Find out other 700 14 HR Payroll Policy NC 4 Tax Compliance

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract