Employer Quarterly Return Earned Income Tax Withholding 2023-2026

What is the Employer Quarterly Return Earned Income Tax Withholding

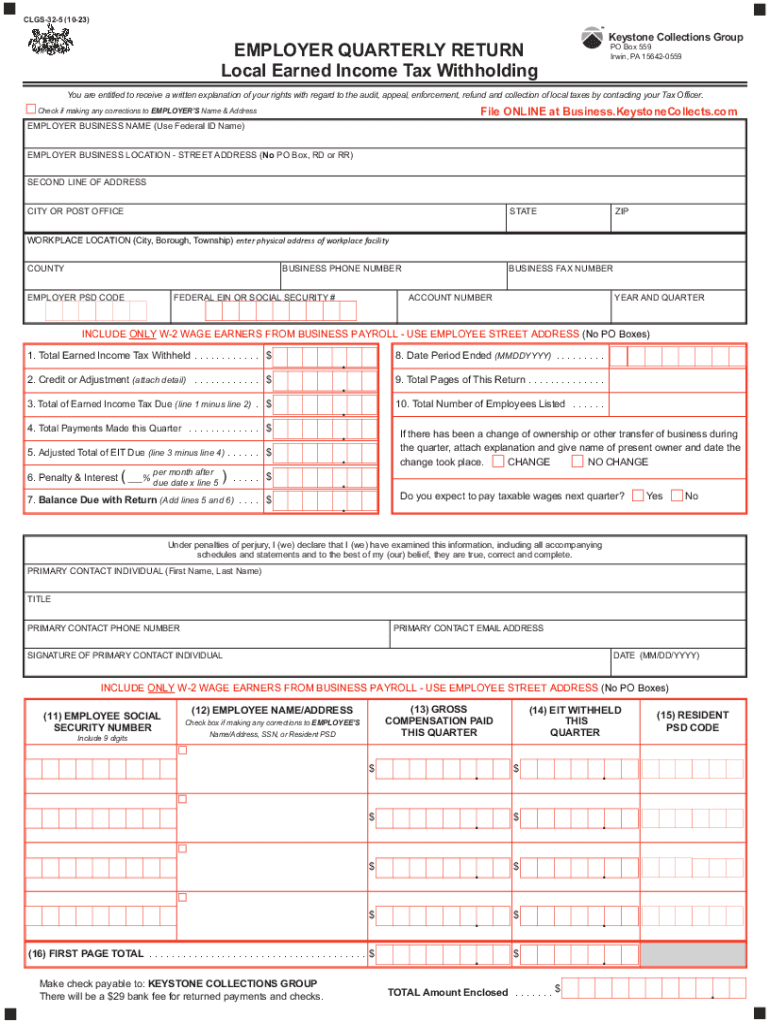

The Employer Quarterly Return, specifically the CLGS 32 1 form, is a crucial document for employers in Pennsylvania. It is used to report earned income tax withholding for employees. This form provides state and local governments with essential information regarding the taxes withheld from employees' wages during a specific quarter. Employers must accurately complete this form to ensure compliance with state tax regulations and to contribute to local funding initiatives.

How to use the Employer Quarterly Return Earned Income Tax Withholding

Using the CLGS 32 1 form involves several key steps. First, employers need to gather all necessary payroll information for the quarter, including total wages paid and the amount of tax withheld. Next, the form must be filled out with accurate details, ensuring that all calculations reflect the correct withholding amounts. Once completed, the form should be submitted to the appropriate local tax authority. Employers can choose to file this form electronically or via traditional mail, depending on their preference and the requirements of their local jurisdiction.

Steps to complete the Employer Quarterly Return Earned Income Tax Withholding

Completing the CLGS 32 1 form involves a systematic approach:

- Collect payroll data for the quarter, including employee earnings and tax withholdings.

- Fill out the form with accurate figures, ensuring all required fields are completed.

- Review the form for accuracy, checking calculations and ensuring compliance with local tax laws.

- Submit the completed form to the appropriate local tax authority by the specified deadline.

Legal use of the Employer Quarterly Return Earned Income Tax Withholding

The CLGS 32 1 form must be used in accordance with Pennsylvania state law. Employers are legally required to withhold earned income taxes from their employees' wages and report these withholdings quarterly. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their legal obligations and ensure timely and accurate filing of this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the CLGS 32 1 form. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines for filing are as follows:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Penalties for Non-Compliance

Failure to file the CLGS 32 1 form on time or to accurately report withholding amounts can lead to significant penalties. Employers may face fines for late submissions, as well as interest charges on any unpaid taxes. Additionally, repeated non-compliance can result in more severe legal consequences, including audits or increased scrutiny from tax authorities. It is crucial for employers to prioritize timely and accurate filing to avoid these repercussions.

Quick guide on how to complete employer quarterly return earned income tax withholding

Complete Employer Quarterly Return Earned Income Tax Withholding easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and store it securely online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Employer Quarterly Return Earned Income Tax Withholding on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

How to alter and eSign Employer Quarterly Return Earned Income Tax Withholding with ease

- Find Employer Quarterly Return Earned Income Tax Withholding and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Employer Quarterly Return Earned Income Tax Withholding and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employer quarterly return earned income tax withholding

Create this form in 5 minutes!

How to create an eSignature for the employer quarterly return earned income tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the clgs 32 1 form and how is it used?

The clgs 32 1 form is a document used in various legal and business transactions to ensure compliance and streamline processes. With airSlate SignNow, businesses can easily create, send, and eSign the clgs 32 1 form, ensuring a convenient and efficient workflow.

-

How does airSlate SignNow help with the clgs 32 1 form?

airSlate SignNow provides tools to simplify the creation and signing of the clgs 32 1 form. You can customize templates and track the signing process, making it an ideal solution for those needing to manage important documents with ease.

-

Are there any costs associated with using airSlate SignNow for the clgs 32 1 form?

Yes, airSlate SignNow offers various pricing plans depending on the features you need. You can select a plan that best suits your business requirements, especially if you're frequently handling the clgs 32 1 form and other documents that require eSigning.

-

Can I integrate airSlate SignNow with other applications for the clgs 32 1 form?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, making it easy to incorporate your workflow with the clgs 32 1 form into existing systems. This interoperability enhances productivity by centralizing document management.

-

What features does airSlate SignNow offer for the clgs 32 1 form process?

AirSlate SignNow offers a range of features including customizable templates, real-time tracking, secure storage, and electronic signatures for the clgs 32 1 form. These tools enhance security and efficiency in handling your documents.

-

Is airSlate SignNow secure for handling the clgs 32 1 form?

Yes, airSlate SignNow prioritizes security and compliance, providing encryption and secure authentication methods for the clgs 32 1 form. Your sensitive documents are protected, ensuring peace of mind while using the platform.

-

What benefits does airSlate SignNow provide for businesses using the clgs 32 1 form?

Using airSlate SignNow for the clgs 32 1 form brings numerous benefits, including reduced turnaround times and enhanced collaboration. This digital solution improves efficiency and minimizes the risks associated with paper documents.

Get more for Employer Quarterly Return Earned Income Tax Withholding

- Gcu professional counseling practicum manual form

- Quarterly safety meeting attendance form university of louisiana ulm

- Masters record of progress form

- Miami dade north campus request for appeal committe action form

- Enrollment verification academy of art university my academyart form

- Access your grades ampampamp transcripts at shawnee state university form

- From napa valley college to a campus in either the california state university csu or the university of california uc system form

- Chapter 14 section 1 guided reading and review the growth of presidential power answer key form

Find out other Employer Quarterly Return Earned Income Tax Withholding

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast