Clgs 32 5 2016

What is the CLGS 32 5?

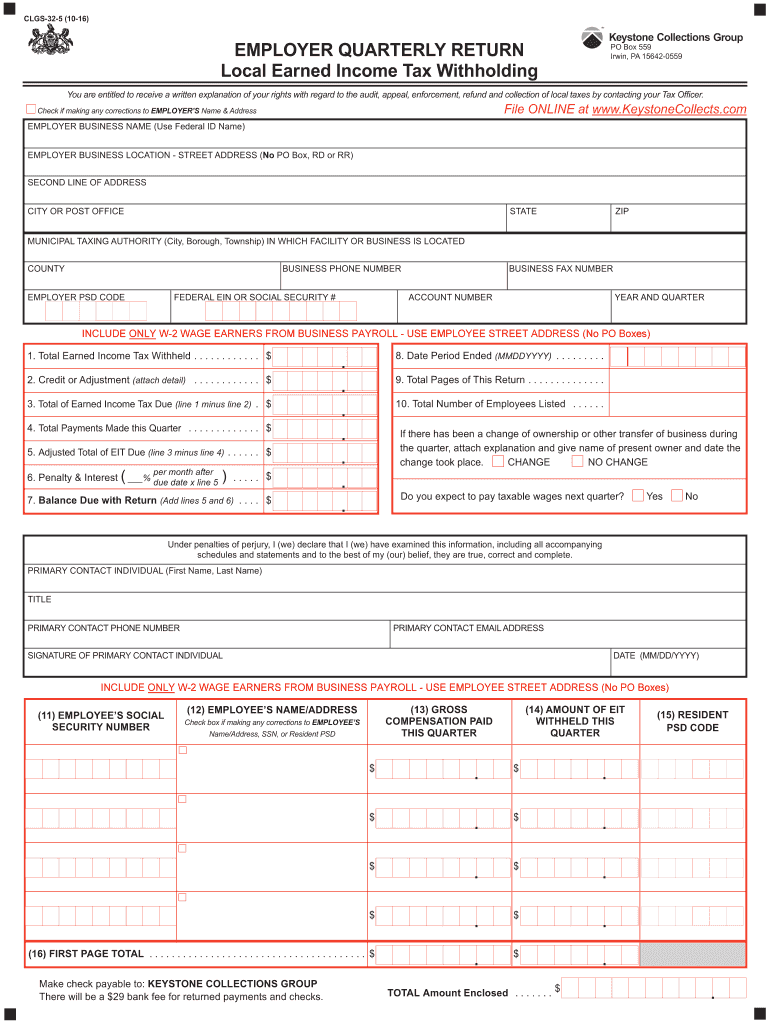

The CLGS 32 5 is a specific form used for employer quarterly returns in Pennsylvania. It is designed to report wages, taxes withheld, and other relevant information for employees. This form is crucial for employers to ensure compliance with state tax regulations. The information provided on the CLGS 32 5 is used by the Pennsylvania Department of Revenue to assess tax liabilities and ensure proper reporting of income and payroll taxes.

Steps to Complete the CLGS 32 5

Completing the CLGS 32 5 involves several key steps to ensure accuracy and compliance. First, gather all necessary data, including employee wages, tax withholdings, and any applicable deductions. Next, accurately fill in the required fields on the form, ensuring that all calculations are correct. It is important to double-check the information for any errors before submission. Finally, submit the completed form by the designated deadline to avoid penalties.

Legal Use of the CLGS 32 5

The CLGS 32 5 is legally recognized as a valid document for reporting employer payroll information in Pennsylvania. To ensure its legal standing, employers must adhere to state guidelines regarding eSignature regulations and data protection. Utilizing a compliant eSignature platform can enhance the security and legality of the submission process. This ensures that the form is not only filled out correctly but also submitted in a manner that meets legal requirements.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the CLGS 32 5 to avoid late fees or penalties. Typically, the form must be submitted quarterly, with deadlines falling on the last day of the month following the end of each quarter. For instance, the deadlines for the first quarter would be April 30, for the second quarter July 31, for the third quarter October 31, and for the fourth quarter January 31 of the following year. Staying informed about these dates is essential for compliance.

Form Submission Methods

The CLGS 32 5 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient and secure method, allowing for immediate processing. Employers can also choose to print the form and mail it to the appropriate state office. In-person submissions are available but may require scheduling an appointment. Each method has its own advantages, and employers should select the one that best fits their needs.

Required Documents

When completing the CLGS 32 5, employers should have several documents on hand to ensure accurate reporting. These include payroll records, employee tax withholding information, and any relevant financial statements. Having these documents readily available will streamline the process and help avoid errors. It is advisable to maintain organized records throughout the quarter to facilitate the timely completion of the form.

Quick guide on how to complete pa dced clgs 32 5 2016

Effortlessly Prepare Clgs 32 5 on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Clgs 32 5 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Clgs 32 5 with Ease

- Obtain Clgs 32 5 and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Adjust and eSign Clgs 32 5 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa dced clgs 32 5 2016

Create this form in 5 minutes!

How to create an eSignature for the pa dced clgs 32 5 2016

How to make an eSignature for your Pa Dced Clgs 32 5 2016 online

How to generate an eSignature for the Pa Dced Clgs 32 5 2016 in Google Chrome

How to create an electronic signature for signing the Pa Dced Clgs 32 5 2016 in Gmail

How to create an electronic signature for the Pa Dced Clgs 32 5 2016 from your smart phone

How to make an electronic signature for the Pa Dced Clgs 32 5 2016 on iOS devices

How to generate an eSignature for the Pa Dced Clgs 32 5 2016 on Android devices

People also ask

-

What are quarte fillable forms, and how can they benefit my business?

Quarte fillable forms are digital documents that allow users to input information directly into predefined fields. These forms streamline data collection and enhance efficiency by eliminating paper and manual processes. By utilizing quarte fillable forms, businesses can simplify workflows and improve accuracy in document handling.

-

How much does it cost to use airSlate SignNow for quarte fillable documents?

AirSlate SignNow offers flexible pricing plans tailored to different business needs when working with quarte fillable documents. Pricing varies based on the number of users and features you select, ensuring you can find a plan that fits your budget. Sign up today to explore our competitive pricing and discover cost-effective solutions for document management.

-

Can I integrate airSlate SignNow with other applications for managing quarte fillable forms?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance the management of quarte fillable forms. You can connect it with CRM systems, cloud storage services, and other tools to improve your workflow. These integrations help centralize your document processes and increase overall productivity.

-

What features does airSlate SignNow offer for creating quarte fillable forms?

AirSlate SignNow provides robust features for creating quarte fillable forms, including customizable fields, automated workflows, and real-time tracking. Users can design forms that meet specific requirements and add elements such as signatures or dates. These features enhance user experience and facilitate easier document handling.

-

Are quarte fillable forms secure when using airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes security for all quarte fillable documents, employing advanced encryption protocols to protect sensitive information. Additionally, our platform complies with industry regulations, ensuring that your data remains safe throughout the signing process. You can trust us to maintain the highest standards of document security.

-

How can quarte fillable forms speed up my document signing process?

Quarte fillable forms streamline the document signing process by allowing multiple users to input information and sign digitally in one unified platform. This eliminates delays associated with printing and mailing physical documents, resulting in faster turnaround times. By utilizing airSlate SignNow, you can enhance efficiency and accelerate your business operations.

-

Is it easy to create quarte fillable forms with airSlate SignNow?

Yes! Creating quarte fillable forms with airSlate SignNow is user-friendly and intuitive. You can easily drag and drop elements to design forms that suit your needs. This simplicity allows users of all skill levels to quickly create professional documents without any technical expertise.

Get more for Clgs 32 5

Find out other Clgs 32 5

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word