Check If Making Any Corrections to EMPLOYERS Name & Address 2019

What is the Check If Making Any Corrections To EMPLOYERS Name & Address

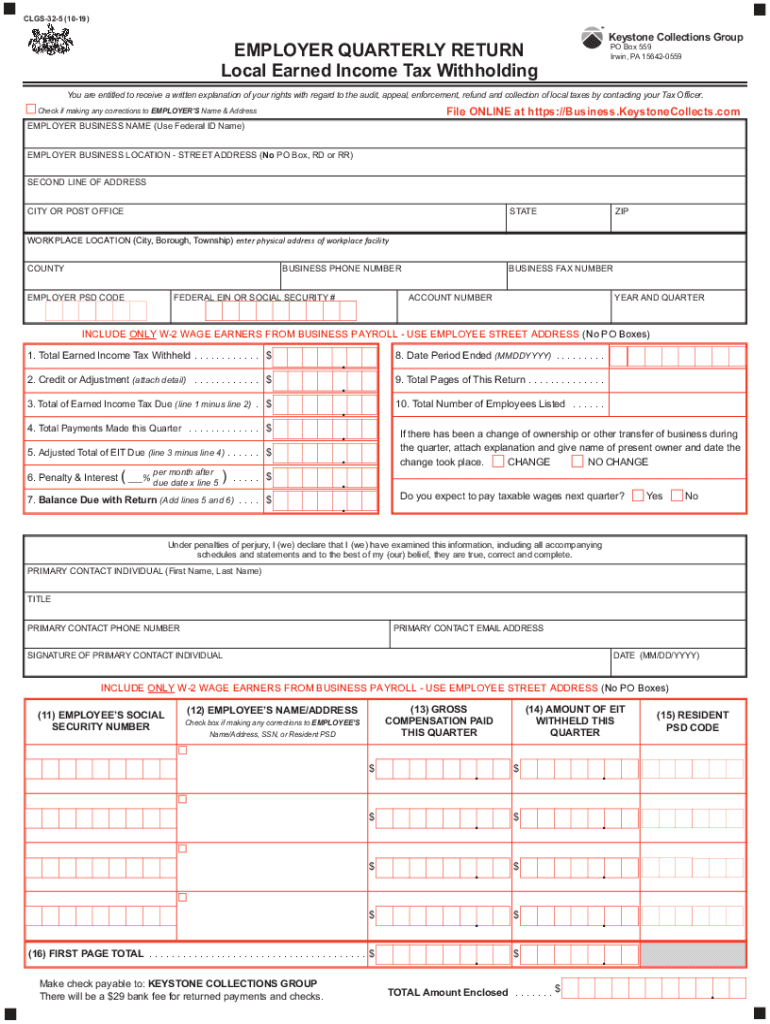

The "Check If Making Any Corrections To EMPLOYERS Name & Address" section on the Pennsylvania employer quarterly return is crucial for ensuring that all employer information is accurate. This section allows employers to indicate if there are any changes to their name or address since the last filing. Accurate information is essential for proper tax processing and communication with state agencies. If an employer fails to update this information, it may lead to delays in processing returns or issues with correspondence from the state.

Steps to complete the Check If Making Any Corrections To EMPLOYERS Name & Address

Completing the "Check If Making Any Corrections To EMPLOYERS Name & Address" section involves a few straightforward steps:

- Locate the section on the Pennsylvania employer quarterly return.

- If there are no corrections, leave the box unchecked.

- If corrections are needed, check the box and provide the updated name and address in the designated fields.

- Ensure that the new information is accurate and matches official records.

Double-checking this information helps prevent future complications with tax filings and communications.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Pennsylvania employer quarterly return is essential for compliance. Employers must submit their quarterly returns by the last day of the month following the end of each quarter. The specific deadlines are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

Missing these deadlines can result in penalties and interest on unpaid taxes, making timely filing critical.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Pennsylvania employer quarterly return. The available methods include:

- Online: Employers can file electronically through the Pennsylvania Department of Revenue's online portal, which offers a streamlined process.

- Mail: The completed form can be mailed to the appropriate address listed on the form. Ensure that it is postmarked by the filing deadline.

- In-Person: Some employers may choose to deliver their forms in person to their local tax office for immediate processing.

Choosing the right submission method can enhance efficiency and ensure that the return is filed on time.

Penalties for Non-Compliance

Failure to comply with the requirements of the Pennsylvania employer quarterly return can lead to several penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which increases the total amount owed.

- Potential audits or additional scrutiny from the Pennsylvania Department of Revenue.

Employers should be aware of these consequences and take steps to ensure timely and accurate submissions.

Quick guide on how to complete check if making any corrections to employers name amp address

Effortlessly Prepare Check If Making Any Corrections To EMPLOYERS Name & Address on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Check If Making Any Corrections To EMPLOYERS Name & Address on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Check If Making Any Corrections To EMPLOYERS Name & Address Without Stress

- Find Check If Making Any Corrections To EMPLOYERS Name & Address and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and electronically sign Check If Making Any Corrections To EMPLOYERS Name & Address and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct check if making any corrections to employers name amp address

Create this form in 5 minutes!

How to create an eSignature for the check if making any corrections to employers name amp address

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is a PA employer quarterly return?

A PA employer quarterly return is a report that employers in Pennsylvania must file to report their employees' wages and taxes withheld. It includes details such as employee compensation and the amounts withheld for state income tax, local taxes, and unemployment compensation. Understanding this return is crucial for legal compliance and maintaining good standing with state authorities.

-

How does airSlate SignNow help with the PA employer quarterly return process?

airSlate SignNow streamlines the process of preparing and submitting your PA employer quarterly return by allowing you to easily create, eSign, and share documents. With its user-friendly interface, you can manage and sign forms quickly, ensuring that your quarterly return is filed accurately and on time. This efficiency saves both time and effort, reducing the hassle typically associated with paperwork.

-

Are there any costs associated with using airSlate SignNow for PA employer quarterly returns?

Yes, while airSlate SignNow offers cost-effective pricing plans, the specific cost may vary based on the features you need and the volume of documents you'll manage. You can choose from various subscription options that fit your business size and usage requirements. It's recommended to review the plans to find the best fit for managing your PA employer quarterly return.

-

What features does airSlate SignNow offer for managing my PA employer quarterly return?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and automated reminders to help you manage your PA employer quarterly return efficiently. Additionally, it allows for document tracking and audit trails, making it easier to keep records organized. These features enhance the accuracy and reliability of your submissions.

-

Can I integrate airSlate SignNow with other software for filing PA employer quarterly returns?

Yes, airSlate SignNow offers integrations with a variety of accounting software and HR platforms that facilitate filing your PA employer quarterly return. This capability ensures that your financial data is synchronized and readily accessible, simplifying the entire filing process. You can streamline workflows, reduce errors, and save valuable time.

-

How secure is the data when using airSlate SignNow for submissions related to the PA employer quarterly return?

Security is a top priority for airSlate SignNow; hence, all data, including information related to your PA employer quarterly return, is transmitted and stored using encryption protocols. We also offer features such as multi-factor authentication and user access controls to safeguard your information. This ensures that your sensitive data remains protected throughout the entire process.

-

What support options are available for users needing help with the PA employer quarterly return?

airSlate SignNow provides comprehensive support options, including a dedicated help center, live chat assistance, and email support for users preparing their PA employer quarterly return. Our knowledgeable support team is ready to help resolve any issues or answer questions you may have, ensuring you can effectively use our platform without disruptions. Training resources are also available to enhance your experience.

Get more for Check If Making Any Corrections To EMPLOYERS Name & Address

- Curtin college application form

- Rhb bank draft form

- Ct road test evaluation sheet form

- Taxi knowledge test questions luton form

- Anthem coordination of benefits form

- Western pennsylvania electrical 5 hot metal street suite form

- Las colinas association form

- Application to attend beto kairos prison ministry closing service form

Find out other Check If Making Any Corrections To EMPLOYERS Name & Address

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now