214 631 1342 or Www 2013-2026

Understanding the dallacad Form

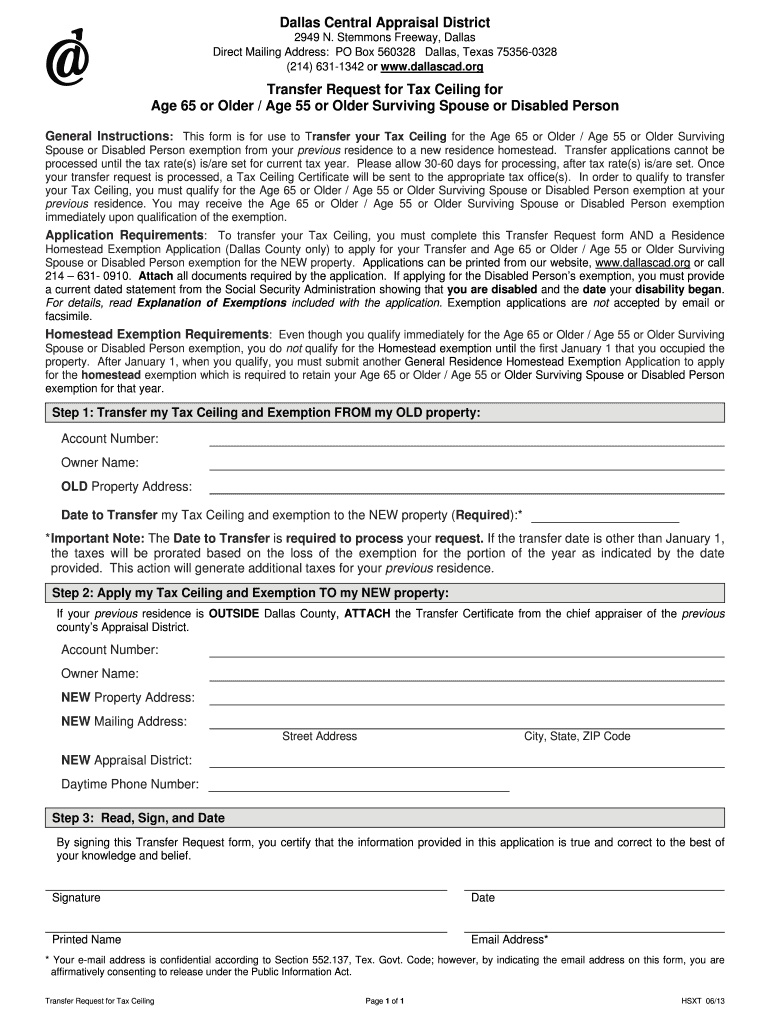

The dallacad form is an essential document used for property appraisal in Dallas County. It serves as a means for property owners to report and assess the value of their properties for tax purposes. This form is crucial for ensuring accurate property tax assessments and compliance with local regulations. By providing detailed information about the property, owners can influence the appraisal process, which ultimately affects their tax obligations.

Steps to Complete the dallacad Form

Completing the dallacad form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the property, including previous tax assessments, property deeds, and any recent improvements made. Next, fill out the form with precise details about the property, such as its location, size, and current condition. Once completed, review the information for accuracy before submitting it to the Dallas County Appraisal District. It is advisable to keep a copy of the submitted form for your records.

Legal Use of the dallacad Form

The dallacad form must be used in accordance with local laws and regulations governing property appraisal in Dallas County. It is legally binding and must be filled out truthfully to avoid penalties. Misrepresentation of property details can lead to severe consequences, including fines or increased tax liabilities. Understanding the legal implications of this form is vital for property owners to ensure compliance and protect their interests.

Required Documents for the dallacad Form

When preparing to submit the dallacad form, certain documents are required to support the information provided. These may include:

- Property deed or title

- Previous tax assessment notices

- Documentation of recent property improvements

- Photographs of the property

- Any relevant zoning or land use documents

Having these documents ready can streamline the completion process and enhance the credibility of the submitted information.

Form Submission Methods

The dallacad form can be submitted through various methods, ensuring flexibility for property owners. Options typically include:

- Online submission via the Dallas County Appraisal District website

- Mailing a physical copy to the appraisal district office

- In-person submission at designated appraisal district locations

Each method has its own advantages, and property owners should choose the one that best suits their needs and preferences.

Filing Deadlines for the dallacad Form

It is crucial to be aware of the filing deadlines associated with the dallacad form. Generally, property owners must submit their appraisal forms by a specific date each year to avoid penalties. Missing this deadline can result in automatic assessments based on previous years' valuations, which may not reflect current property values. Staying informed about these deadlines helps ensure that property owners can advocate for fair assessments.

Quick guide on how to complete 214 631 1342 or www

Your assistance manual on how to prepare your 214 631 1342 Or Www

If you're wondering how to create and send your 214 631 1342 Or Www, here are a few straightforward guidelines on how to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is a highly intuitive and effective document solution that allows you to modify, draft, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify responses as needed. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to finalize your 214 631 1342 Or Www in just a few moments:

- Create your account and start working on PDFs within minutes.

- Access our library to find any IRS tax form; browse through varieties and schedules.

- Click Get form to load your 214 631 1342 Or Www in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-valid eSignature (if required).

- Examine your document and rectify any errors.

- Save changes, print your copy, dispatch it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to errors and delay refunds. It is advisable to check the IRS website for submission guidelines pertinent to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 214 631 1342 or www

FAQs

-

How can I get an F1 visa? I only discovered after my first interview that I made some mistakes in filling out the DS 160 form and caused 214(b).

At any time you can apply again.Correct the mistakesWhat made for 214b?

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the 214 631 1342 or www

How to generate an eSignature for your 214 631 1342 Or Www online

How to make an eSignature for your 214 631 1342 Or Www in Chrome

How to make an electronic signature for signing the 214 631 1342 Or Www in Gmail

How to make an electronic signature for the 214 631 1342 Or Www straight from your smart phone

How to make an eSignature for the 214 631 1342 Or Www on iOS

How to generate an electronic signature for the 214 631 1342 Or Www on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Dallas CAD?

airSlate SignNow is an electronic signature solution that streamlines the process of sending and signing documents. For businesses in the Dallas CAD area, it provides a cost-effective way to handle paperwork digitally, improving efficiency and reducing delays in approvals.

-

How can airSlate SignNow benefit businesses in Dallas CAD?

Businesses in Dallas CAD can signNowly benefit from airSlate SignNow by simplifying document workflows and ensuring secure eSignatures. This user-friendly platform allows for seamless collaboration, reducing the time spent on document management and enhancing overall productivity.

-

What pricing options are available for airSlate SignNow users in Dallas CAD?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses in Dallas CAD. Whether you are a small startup or a large corporation, there are various options that can fit your budget while still providing access to essential features to manage your signing processes.

-

Does airSlate SignNow support integrations with other tools commonly used in Dallas CAD?

Yes, airSlate SignNow easily integrates with many popular applications and tools used by businesses in Dallas CAD. This capability allows users to enhance their current workflows, making it simple to connect with CRM systems, cloud storage solutions, and other software to create a seamless document management experience.

-

What features make airSlate SignNow a preferred choice for users in Dallas CAD?

airSlate SignNow stands out with its user-friendly interface, robust security features, and customizable templates. For users in Dallas CAD, the ability to track document status in real-time and set reminders ensures that important signatures are obtained without unnecessary delays.

-

Is there a mobile app for airSlate SignNow that Dallas CAD users can utilize?

Yes, airSlate SignNow offers a mobile app that allows users in Dallas CAD to manage and sign documents on the go. This feature is particularly beneficial for professionals who require flexibility and convenience while completing their signing tasks from their smartphones or tablets.

-

How fast can documents be signed using airSlate SignNow in Dallas CAD?

Using airSlate SignNow, documents can be signed and processed almost instantly, which is crucial for businesses in Dallas CAD that need to maintain a fast-paced environment. Many users report that the eSignature process is completed within minutes, signNowly speeding up transactions compared to traditional methods.

Get more for 214 631 1342 Or Www

- W 3n 462486136 form

- Math 154b completing the square worksheet form

- New hampshire fish game form

- Critical areas review checklist city of edgewood cityofedgewood form

- Fraud complain form

- Registered tow truck operator master log dol wa form

- Screenplay purchase agreement template form

- Scrum team agreement template form

Find out other 214 631 1342 Or Www

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now