Form CT 8857, Request for Innocent Spouse Relief

What is the Form CT 8857, Request For Innocent Spouse Relief

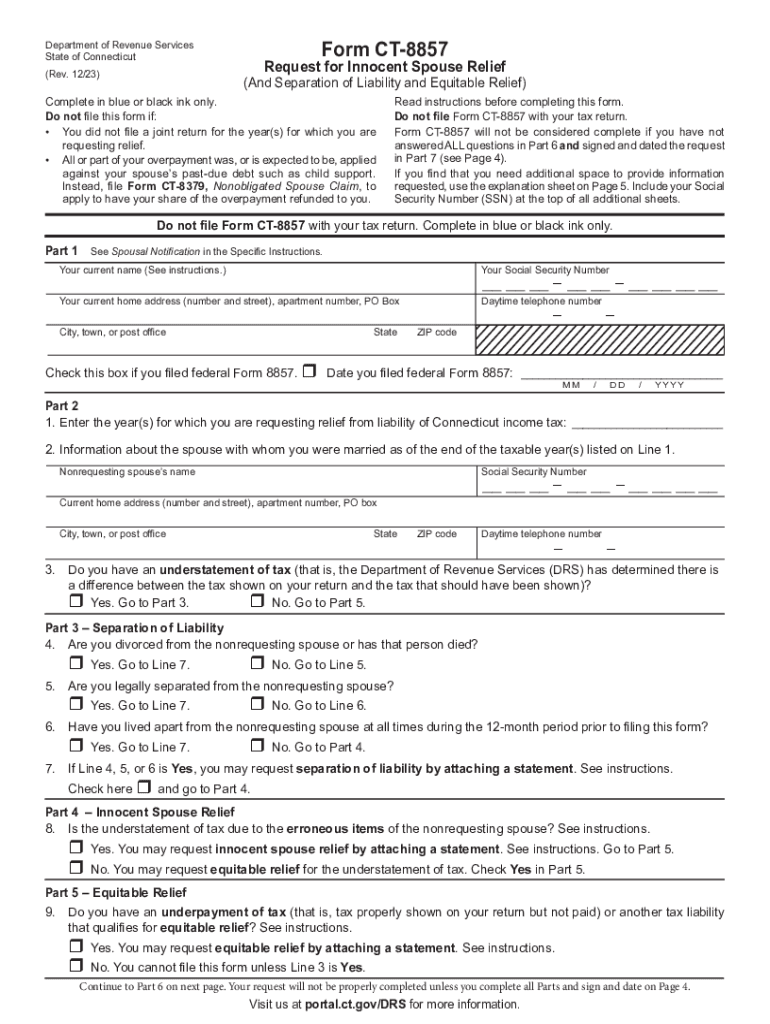

The Form CT 8857, Request For Innocent Spouse Relief, is a tax form used by individuals in the United States who seek relief from joint tax liabilities incurred during a marriage. This form allows a spouse to request that the Internal Revenue Service (IRS) relieve them of the responsibility for paying tax, interest, and penalties if they can demonstrate that they were unaware of the tax issues and that it would be unfair to hold them liable. The form is particularly relevant in cases where one spouse has underreported income or claimed improper deductions.

How to use the Form CT 8857, Request For Innocent Spouse Relief

To use the Form CT 8857 effectively, individuals should first ensure they meet the eligibility criteria outlined by the IRS. Once eligibility is confirmed, the form can be completed by providing necessary personal information, including details about the marriage and the tax liability in question. It is essential to provide accurate and complete information to support the request for relief. After filling out the form, it should be submitted to the IRS for consideration, following the specific submission guidelines provided by the agency.

Steps to complete the Form CT 8857, Request For Innocent Spouse Relief

Completing the Form CT 8857 involves several key steps:

- Gather necessary documentation, including tax returns and any relevant financial records.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill out the form with accurate personal information and details about the tax liability.

- Provide a narrative explanation of why you believe you qualify for innocent spouse relief.

- Sign and date the form to certify that the information provided is true and complete.

- Submit the completed form to the IRS, ensuring it is sent to the correct address based on your location.

Eligibility Criteria

To qualify for relief using the Form CT 8857, individuals must meet specific eligibility criteria set by the IRS. Generally, applicants must have filed a joint tax return with their spouse, and the tax liability must be attributable to the spouse’s income or deductions. Additionally, the requesting spouse must not have had knowledge or reason to know about the erroneous items on the return. The request must be made within two years of the IRS's first attempt to collect the tax owed.

Required Documents

When filing the Form CT 8857, it is important to include supporting documents that substantiate the request for relief. Required documents may include:

- Copies of the joint tax returns in question.

- Any correspondence from the IRS related to the tax liability.

- Financial records that demonstrate the requesting spouse's lack of knowledge about the tax issues.

- Proof of income and expenses during the time the tax return was filed.

Form Submission Methods

The Form CT 8857 can be submitted to the IRS through various methods. Individuals have the option to file the form by mail, ensuring it is sent to the appropriate IRS address based on their location. While electronic submission is not typically available for this specific form, it is advisable to check the IRS website for any updates regarding submission methods. When mailing the form, it is recommended to use certified mail to confirm delivery.

Quick guide on how to complete form ct 8857 request for innocent spouse relief

Complete Form CT 8857, Request For Innocent Spouse Relief effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form CT 8857, Request For Innocent Spouse Relief on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Form CT 8857, Request For Innocent Spouse Relief without hassle

- Locate Form CT 8857, Request For Innocent Spouse Relief and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Form CT 8857, Request For Innocent Spouse Relief and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 8857 request for innocent spouse relief

Create this form in 5 minutes!

How to create an eSignature for the form ct 8857 request for innocent spouse relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 8857, Request For Innocent Spouse Relief?

Form CT 8857, Request For Innocent Spouse Relief, is a tax form used to request relief from tax liability on joint returns filed with a spouse. This form is crucial for individuals who feel they should not be held responsible for unpaid taxes due to the actions of their spouse. Utilizing airSlate SignNow can streamline the process of filling out and submitting this form.

-

How can airSlate SignNow help with Form CT 8857?

airSlate SignNow provides an efficient platform to complete and eSign Form CT 8857, Request For Innocent Spouse Relief. Our easy-to-use interface allows users to fill in required information quickly, ensuring that your request is submitted accurately. With our solution, you can eliminate paperwork hassles and keep your documents securely stored online.

-

What are the costs associated with using airSlate SignNow for Form CT 8857?

airSlate SignNow offers a range of pricing plans designed to meet diverse business needs when handling documents like Form CT 8857, Request For Innocent Spouse Relief. Our competitive pricing ensures that you get a cost-effective solution without compromising on features. We also offer a free trial so you can explore our services before committing.

-

Are there any features specific to Form CT 8857 in airSlate SignNow?

Yes, airSlate SignNow includes specific features tailored for Form CT 8857, Request For Innocent Spouse Relief, such as customizable templates and intuitive editing tools. These features allow users to craft precise requests and ensure all necessary information is included. Additionally, our platform helps you track document statuses, simplifying follow-up processes.

-

Is my data safe when using airSlate SignNow for tax forms like Form CT 8857?

Absolutely! airSlate SignNow prioritizes data security, employing industry-standard encryption to protect sensitive information related to Form CT 8857, Request For Innocent Spouse Relief. Our secure environment ensures that your documents are safeguarded against unauthorized access, giving you peace of mind while preparing your tax documents.

-

Can I integrate airSlate SignNow with other tools for managing Form CT 8857?

Yes, airSlate SignNow offers seamless integrations with various third-party applications to enhance your workflow when dealing with Form CT 8857, Request For Innocent Spouse Relief. These integrations can allow for easier data transfer and management, making it simpler to maintain comprehensive records. You can connect with tools you already use for a more streamlined process.

-

How does airSlate SignNow simplify the eSigning process for Form CT 8857?

airSlate SignNow simplifies the eSigning process for Form CT 8857, Request For Innocent Spouse Relief, by allowing you and your spouse to sign documents digitally from anywhere. This feature eliminates the need for printing, scanning, or mailing physical copies, saving time and resources. The platform also provides a detailed audit trail for each document to ensure compliance.

Get more for Form CT 8857, Request For Innocent Spouse Relief

- 2017 2018 minnesota board of dentistry self minnesotagov mn form

- Dhs 5274 eng minnesota child care assistance program application form used to determine ongoing eligibility for households that

- Dhs 2120 eng 2017 2019 form

- Marriage license application form 2014

- Marriage license application form 2018 2019

- Nj family care renewal applicationpdffillercom 2014 form

- Njfamilycare 2018 2019 form

- Entry form 779098609

Find out other Form CT 8857, Request For Innocent Spouse Relief

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document