Form Ct 8857 2010

What is the Form Ct 8857

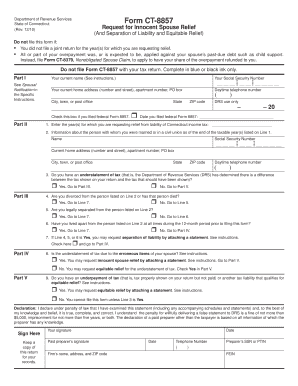

The Form Ct 8857 is a legal document used in the state of Connecticut, primarily for tax purposes. This form is utilized by individuals to request a waiver of certain tax obligations under specific circumstances. It is important for taxpayers to understand the purpose of this form and its implications on their tax responsibilities. The form serves as a formal request to the Connecticut Department of Revenue Services, allowing individuals to present their case for relief from certain tax liabilities.

How to use the Form Ct 8857

Using the Form Ct 8857 involves several steps to ensure that it is completed accurately and submitted correctly. First, gather all necessary information, including your personal details, tax identification number, and the specific tax obligations you are seeking relief from. Next, fill out the form carefully, ensuring that all sections are completed as required. It is essential to provide any supporting documentation that substantiates your request. Once completed, the form can be submitted to the appropriate tax authority as specified in the instructions.

Steps to complete the Form Ct 8857

Completing the Form Ct 8857 requires careful attention to detail. Follow these steps:

- Begin by downloading the form from the Connecticut Department of Revenue Services website.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax year and the type of tax for which you are requesting relief.

- Provide a detailed explanation of your circumstances that warrant the waiver.

- Attach any necessary documentation that supports your request, such as financial statements or correspondence with tax authorities.

- Review the form for accuracy and completeness before submission.

Legal use of the Form Ct 8857

The legal use of the Form Ct 8857 is governed by the regulations set forth by the Connecticut Department of Revenue Services. To ensure that the form is legally valid, it must be filled out completely and truthfully. Providing false information can lead to penalties or disqualification of the request. It is advisable to consult with a tax professional if you have questions regarding the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 8857 vary depending on the tax year and specific circumstances surrounding the request. Generally, it is important to submit the form as soon as you determine that you need a waiver. For tax year-related deadlines, refer to the Connecticut Department of Revenue Services for the most current information. Missing the deadline may result in the denial of your request for relief.

Required Documents

When submitting the Form Ct 8857, certain documents may be required to support your request. These documents can include:

- Proof of income, such as pay stubs or tax returns.

- Financial statements that demonstrate your current financial situation.

- Any correspondence with the Connecticut Department of Revenue Services related to your tax obligations.

- Documentation of any extenuating circumstances that justify your request for a waiver.

Quick guide on how to complete form ct 8857

Effortlessly Prepare Form Ct 8857 on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form Ct 8857 on any device using the airSlate SignNow Android or iOS apps and streamline any document-related operation today.

The Easiest Way to Edit and eSign Form Ct 8857 Without Effort

- Find Form Ct 8857 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form Ct 8857 and ensure seamless communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 8857

Create this form in 5 minutes!

People also ask

-

What is Form Ct 8857 and why is it important?

Form Ct 8857 is a crucial document used for requesting a grant of relief from joint and several liability for certain tax obligations. It is important because it helps individuals protect themselves from unfair tax responsibilities that may arise from a spouse or partner. Completing this form accurately is essential for ensuring your rights are preserved.

-

How does airSlate SignNow simplify the process of completing Form Ct 8857?

airSlate SignNow streamlines the process of completing Form Ct 8857 by providing an intuitive platform that allows users to fill out and eSign the document electronically. This eliminates the hassle of printing, scanning, or mailing paper forms. Additionally, our guided workflows ensure you don't miss any critical steps in the process.

-

Is there a cost associated with using airSlate SignNow for Form Ct 8857?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing that is designed to be cost-effective for individuals and businesses alike. Our pricing plans provide excellent value while ensuring you have access to all the necessary tools for managing Form Ct 8857 and other documents. Check our pricing page for details.

-

What features does airSlate SignNow offer for managing Form Ct 8857?

airSlate SignNow offers a range of features for managing Form Ct 8857, including customizable templates, electronic signatures, document sharing, and tracking capabilities. These features ensure that you can easily manage your documents and store them securely. Moreover, you can collaborate with others in real time for added convenience.

-

Can I integrate airSlate SignNow with other platforms for Form Ct 8857?

Absolutely! airSlate SignNow supports integrations with various platforms, including CRM systems, cloud storage services, and productivity tools. This allows you to streamline your workflow and easily access Form Ct 8857 alongside other important documents without any hassle. Check our integrations page for more options.

-

What benefits does eSigning Form Ct 8857 offer?

eSigning Form Ct 8857 offers several benefits, including improved efficiency, security, and convenience. By using our platform, you can sign documents from anywhere without needing to print or mail copies. Additionally, eSigning ensures that your documents are securely stored and easily retrievable whenever you need them.

-

How secure is my information when using airSlate SignNow for Form Ct 8857?

Your information is extremely secure when using airSlate SignNow for Form Ct 8857. We utilize advanced encryption technology and comply with industry standards to protect your data. You can trust that your sensitive information remains confidential and safe from unauthorized access.

Get more for Form Ct 8857

- Rule 67 process to enforce judgments nj ct r 67 form

- Tenant protection plan revised tpp1 form new york city

- Credit card payment re 909 rev 102020 credit card payment re 909 form

- Wshfcamctax credit compliance procedures manual form

- Alabama medicaid referral form fill online printable

- State of washington landlord laws faq lawcom form

- Registration renewal form nsbaidrd

- Update the officers directors form

Find out other Form Ct 8857

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online