Apply to Have Your Share of the Overpayment Refunded to You 2018

What is the Apply To Have Your Share Of The Overpayment Refunded To You

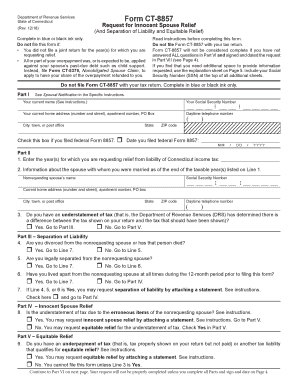

The form to apply to have your share of the overpayment refunded to you is a document used primarily in tax and financial contexts. It allows individuals or businesses to request the return of excess payments made to a government agency or financial institution. This form is essential for ensuring that any overpayments are accurately identified and refunded in a timely manner. Understanding the purpose of this form is crucial for anyone who has made an overpayment and wishes to reclaim those funds.

Steps to complete the Apply To Have Your Share Of The Overpayment Refunded To You

Completing the form requires attention to detail to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information, including your identification details and payment history.

- Fill out the form accurately, providing all requested information, such as the amount of overpayment and the reason for the refund request.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether electronically or via mail.

Legal use of the Apply To Have Your Share Of The Overpayment Refunded To You

The legal validity of the form hinges on compliance with relevant regulations. When filled out correctly, it serves as a formal request for the return of funds. It is important to ensure that the form is signed and dated appropriately, as this can affect its acceptance by the issuing agency. Utilizing a reliable electronic signature service can enhance the form's legal standing, ensuring that it meets the requirements set forth by laws governing electronic signatures.

Required Documents

To successfully complete the form, you may need to provide several supporting documents. These typically include:

- Proof of identity, such as a driver's license or Social Security number.

- Documentation of the overpayment, which may include receipts or bank statements.

- Any previous correspondence related to the overpayment.

Having these documents ready can streamline the process and help avoid delays in processing your refund request.

Form Submission Methods

The form can generally be submitted through various methods, depending on the requirements of the agency involved. Common submission methods include:

- Online submission through a secure portal, which often allows for faster processing.

- Mailing the completed form to the appropriate address, ensuring it is sent via a traceable method.

- In-person submission at designated offices, which may provide immediate confirmation of receipt.

Eligibility Criteria

Eligibility to apply for a refund of overpayment typically depends on several factors, including:

- The nature of the overpayment, such as whether it was made to a tax authority or another entity.

- Your status as an individual or business, as different rules may apply.

- Compliance with any time limits or deadlines for submitting the refund request.

Understanding these criteria is essential to ensure that your application is valid and stands a good chance of approval.

Quick guide on how to complete apply to have your share of the overpayment refunded to you

Easily manage Apply To Have Your Share Of The Overpayment Refunded To You on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents efficiently without delays. Handle Apply To Have Your Share Of The Overpayment Refunded To You on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and electronically sign Apply To Have Your Share Of The Overpayment Refunded To You effortlessly

- Access Apply To Have Your Share Of The Overpayment Refunded To You and click Obtain Form to begin.

- Take advantage of the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Finish button to save your changes.

- Select your preferred method of sharing your form, whether it’s via email, SMS, or invite link, or save it directly to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Apply To Have Your Share Of The Overpayment Refunded To You and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct apply to have your share of the overpayment refunded to you

Create this form in 5 minutes!

People also ask

-

What is the process to Apply To Have Your Share Of The Overpayment Refunded To You?

To Apply To Have Your Share Of The Overpayment Refunded To You, start by gathering your relevant payment documentation. Then, use airSlate SignNow to efficiently eSign and send your refund request directly to the appropriate department. Our platform streamlines the entire process, ensuring that your application is processed swiftly.

-

Are there any fees associated with applying for an overpayment refund?

airSlate SignNow offers a cost-effective solution with no hidden fees when you Apply To Have Your Share Of The Overpayment Refunded To You. We provide transparent pricing models so that you can manage your finances without unnecessary charges. Review our pricing plans to see how we fit into your budget.

-

What features does airSlate SignNow offer to help with the refund application process?

airSlate SignNow provides a variety of features that simplify the process of applying for refunds. When you Apply To Have Your Share Of The Overpayment Refunded To You, you can take advantage of our electronic signatures, document templates, and secure cloud storage. These tools enhance your efficiency and keep your documents organized.

-

Can I track the status of my refund application via airSlate SignNow?

Yes, you can easily track the status of your refund application with airSlate SignNow. Once you Apply To Have Your Share Of The Overpayment Refunded To You, our platform provides updates on your application's progress, ensuring you're informed every step of the way. This feature helps you stay on top of your finances and understand the timeline for your refund.

-

What are the benefits of using airSlate SignNow for my refund application?

Using airSlate SignNow to apply for your refund comes with numerous benefits, including time savings and enhanced document security. When you Apply To Have Your Share Of The Overpayment Refunded To You, our user-friendly interface allows you to complete tasks quickly and efficiently. Plus, your sensitive information is protected with our robust security measures.

-

Does airSlate SignNow integrate with other financial systems for refund applications?

Absolutely! airSlate SignNow seamlessly integrates with various financial systems, making it easier for you to Apply To Have Your Share Of The Overpayment Refunded To You. This integration allows for smoother data transfer and ensures that your documents and financial information are aligned across platforms for optimal efficiency.

-

Is airSlate SignNow suitable for businesses of all sizes looking to apply for refunds?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you are a small startup or a large corporation, when you Apply To Have Your Share Of The Overpayment Refunded To You, our platform scales to meet your needs effectively. We aim to provide solutions that work for every business regardless of the size.

Get more for Apply To Have Your Share Of The Overpayment Refunded To You

- Authorization to release medical record information brown

- Healthstyles new membership application amp agreement form

- Membership change form member information

- Pennsylvania military family relief program application form

- Tdi application form

- Cmh scdhhsgov form

- Bhns new appointment forms black hills neurosurgery

- Black hills neurosurgery amp spine form

Find out other Apply To Have Your Share Of The Overpayment Refunded To You

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors