Separation of Liability ReliefInternal Revenue Service 2022-2026

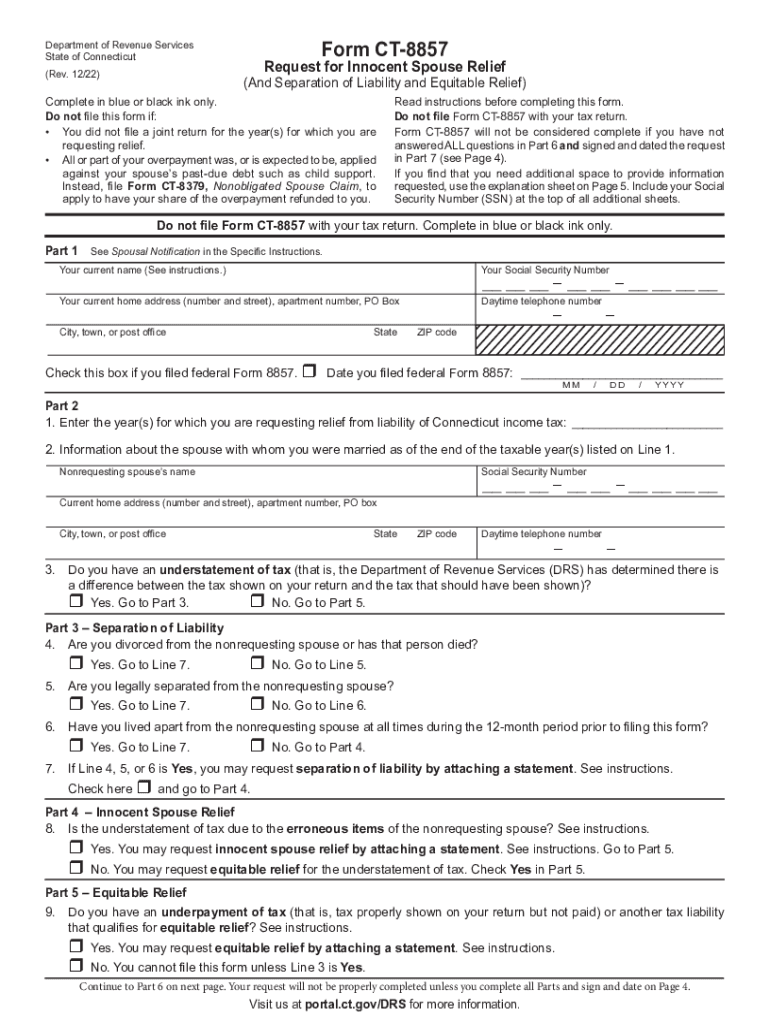

What is the Separation of Liability Relief?

The Separation of Liability Relief is a provision offered by the Internal Revenue Service (IRS) that allows individuals to separate their tax liabilities from those of their ex-spouse or former partner. This relief is particularly relevant in cases of divorce or separation, where one party may be held liable for taxes owed by the other. By applying for this relief, individuals can protect themselves from being responsible for tax debts that were incurred during the marriage or partnership without their knowledge or consent.

How to Use the Separation of Liability Relief

To utilize the Separation of Liability Relief, individuals must file Form 8857, Request for Innocent Spouse Relief. This form allows taxpayers to request relief from joint tax liabilities. It is essential to provide detailed information regarding the circumstances of the tax liabilities and the reasons for requesting relief. Supporting documentation may also be required to substantiate claims, such as financial records or evidence of the spouse's income and tax filings.

Eligibility Criteria for Separation of Liability Relief

Eligibility for Separation of Liability Relief typically requires that the individual must have filed a joint tax return with their spouse. Additionally, the individual must demonstrate that they did not know, and had no reason to know, that there was an understatement of tax on the joint return. Other factors, such as the time elapsed since the filing of the joint return and the nature of the tax liability, may also influence eligibility.

Steps to Complete the Separation of Liability Relief

Completing the process for Separation of Liability Relief involves several steps:

- Gather necessary documentation, including joint tax returns and financial records.

- Complete Form 8857 accurately, ensuring all required information is provided.

- Submit the form to the IRS, either electronically or via mail, depending on the specific instructions provided.

- Await a response from the IRS regarding the approval or denial of the request.

IRS Guidelines for Separation of Liability Relief

The IRS provides specific guidelines for individuals seeking Separation of Liability Relief. It is crucial to adhere to these guidelines to ensure a smooth application process. The IRS outlines the necessary documentation, the timeline for submitting requests, and the criteria for evaluating claims. Familiarizing oneself with these guidelines can significantly enhance the chances of a successful outcome.

Required Documents for Separation of Liability Relief

When applying for Separation of Liability Relief, individuals must prepare various documents to support their claim. Required documents may include:

- Copies of joint tax returns filed during the marriage.

- Evidence of income and expenses, such as pay stubs and bank statements.

- Any correspondence received from the IRS regarding tax liabilities.

- Documentation that demonstrates the lack of knowledge about the tax issues, such as communication records with the spouse.

Quick guide on how to complete separation of liability reliefinternal revenue service

Complete Separation Of Liability ReliefInternal Revenue Service effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without issues. Handle Separation Of Liability ReliefInternal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Separation Of Liability ReliefInternal Revenue Service with ease

- Obtain Separation Of Liability ReliefInternal Revenue Service and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Determine how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from your preferred device. Alter and eSign Separation Of Liability ReliefInternal Revenue Service to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct separation of liability reliefinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the separation of liability reliefinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Separation Of Liability ReliefInternal Revenue Service?

The Separation Of Liability ReliefInternal Revenue Service is a provision that allows eligible taxpayers to separate their liability for certain taxes. This can provide relief in specific cases involving tax liabilities associated with spouse or joint tax returns. Understanding this concept is crucial for taxpayers seeking to mitigate their liabilities through the IRS.

-

How can airSlate SignNow help with the Separation Of Liability ReliefInternal Revenue Service documentation?

airSlate SignNow streamlines the process of preparing and signing necessary documents related to the Separation Of Liability ReliefInternal Revenue Service. Our platform enables users to create, send, and eSign important IRS documents securely and efficiently. This ease of use is vital for meeting compliance requirements and submitting forms on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to different business needs, making it a cost-effective solution for handling documents related to the Separation Of Liability ReliefInternal Revenue Service. Our pricing is transparent, ensuring customers understand the costs associated with accessing our features. Essential features for tax documentation are available across all plans.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows that simplify the handling of documents relevant to the Separation Of Liability ReliefInternal Revenue Service. These tools enhance efficiency and reduce the likelihood of errors in critical tax documentation processes. Users benefit from a user-friendly interface designed for quick access to essential tools.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various software platforms like accounting and tax management tools to support processes related to the Separation Of Liability ReliefInternal Revenue Service. These integrations allow for smoother workflows and easier data management, ensuring that all documents and tax-related files are efficiently handled within your existing ecosystem.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of your documents, featuring advanced encryption and compliance with privacy regulations, which is essential for the Separation Of Liability ReliefInternal Revenue Service. Our secure platform keeps sensitive information protected during the entire document lifecycle, from creation to eSigning. Customers can trust that their data is safeguarded against unauthorized access.

-

What benefits can users expect from using airSlate SignNow for tax documentation?

Users of airSlate SignNow can expect signNow time savings and reduced operational costs when managing documents related to the Separation Of Liability ReliefInternal Revenue Service. The ability to eSign documents quickly ensures that compliance deadlines are met, and manual errors are minimized. Moreover, our intuitive platform allows users to focus on their core business activities instead of paperwork.

Get more for Separation Of Liability ReliefInternal Revenue Service

- Social skills group fall registration form cost is 550 for

- Date parentlegal guardian started residing at address form

- Cari s craft club registration form

- Pdf park reservation application city of dalworthington gardens form

- Burn permit application krum ci krum tx form

- Western riding score sheet pattern 2 aqha form

- Habitat compliance form

- Jrca expects big crowd for weekend rodeo clarendon live form

Find out other Separation Of Liability ReliefInternal Revenue Service

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement