QUARTERLY ESTIMATE Local Earned Income Tax 2023

What is the quarterly estimate local earned income tax?

The quarterly estimate local earned income tax is a tax that individuals must pay on their earned income throughout the year, typically calculated on a quarterly basis. This tax is applicable to residents of certain localities in Pennsylvania, including Bethlehem. The purpose of this tax is to ensure that local governments receive a steady stream of revenue to fund public services. Taxpayers are required to estimate their annual income and make payments based on that estimate, rather than waiting until the end of the year to settle their tax obligations.

How to use the quarterly estimate local earned income tax

To effectively use the quarterly estimate local earned income tax, individuals should first determine their expected annual income. This involves reviewing past earnings and considering any changes that may affect income throughout the year. Once the estimated income is established, taxpayers can calculate the quarterly payments due. It is important to keep accurate records of income and expenses, as these will inform future estimates and ensure compliance with local tax regulations.

Steps to complete the quarterly estimate local earned income tax

Completing the quarterly estimate local earned income tax involves several key steps:

- Estimate your annual income based on previous earnings and expected changes.

- Calculate the total local earned income tax due for the year using the local tax rate.

- Divide the total tax due by four to determine the quarterly payment amount.

- Complete the appropriate local tax form, ensuring all information is accurate.

- Submit the form and payment by the designated deadlines to avoid penalties.

Filing deadlines / important dates

Filing deadlines for the quarterly estimate local earned income tax are crucial for compliance. Typically, payments are due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is essential to adhere to these deadlines to avoid late fees and penalties.

Required documents

When filing the quarterly estimate local earned income tax, several documents may be required:

- Proof of income, such as pay stubs or tax returns from previous years.

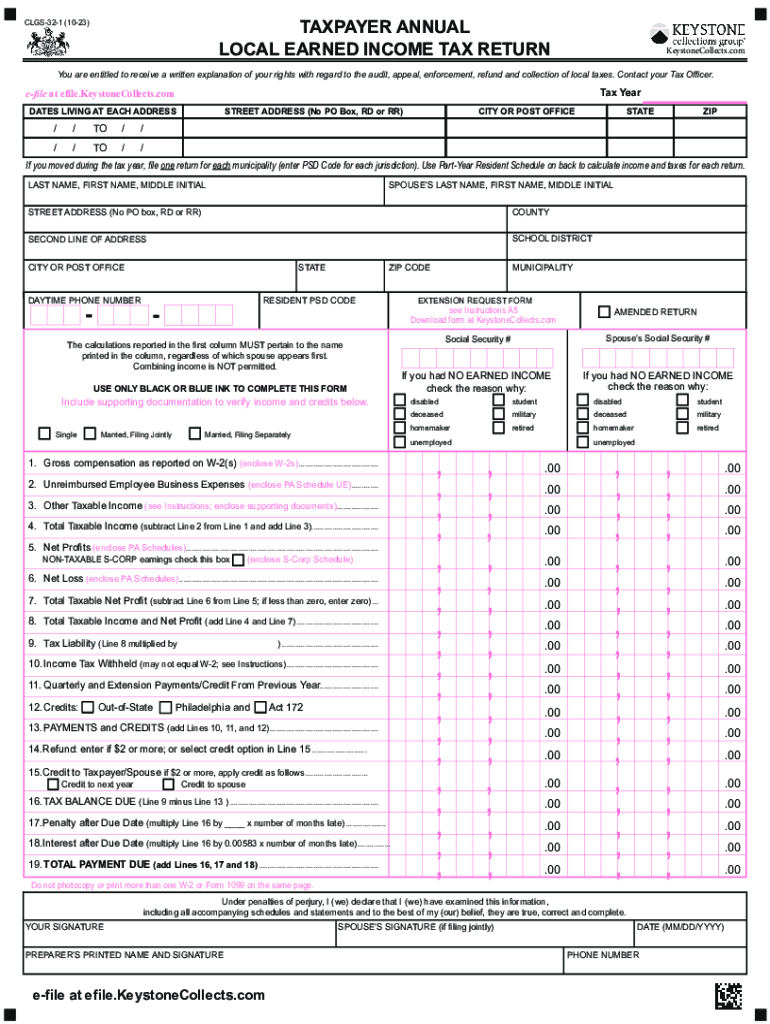

- Completed local tax forms, such as the CLGS 32 or other relevant documents.

- Any additional documentation that supports your income estimates or deductions.

Having these documents ready can streamline the filing process and ensure accuracy.

Penalties for non-compliance

Failure to comply with the quarterly estimate local earned income tax requirements can result in significant penalties. These may include:

- Late payment fees, which can accumulate over time.

- Interest charges on unpaid taxes, increasing the overall amount owed.

- Potential legal action for persistent non-compliance, which may lead to wage garnishment or other enforcement measures.

Understanding these penalties emphasizes the importance of timely and accurate tax filings.

Quick guide on how to complete quarterly estimate local earned income tax

Effortlessly Prepare QUARTERLY ESTIMATE Local Earned Income Tax on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents quickly and seamlessly. Manage QUARTERLY ESTIMATE Local Earned Income Tax across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign QUARTERLY ESTIMATE Local Earned Income Tax with ease

- Find QUARTERLY ESTIMATE Local Earned Income Tax and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet-ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign QUARTERLY ESTIMATE Local Earned Income Tax to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly estimate local earned income tax

Create this form in 5 minutes!

How to create an eSignature for the quarterly estimate local earned income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow in relation to Keystone Collections Group Bethlehem reviews?

AirSlate SignNow offers a variety of features that streamline document management and electronic signatures. In Keystone Collections Group Bethlehem reviews, users often highlight the user-friendly interface, customizable templates, and efficient workflow automation as standout elements. These features enhance productivity and make document signing straightforward.

-

How does airSlate SignNow handle pricing compared to other services mentioned in Keystone Collections Group Bethlehem reviews?

Pricing for airSlate SignNow is competitive and flexible, making it accessible for businesses of all sizes. Many Keystone Collections Group Bethlehem reviews indicate that users appreciate the affordable plans that fit various budgets and the value provided for the features included. This ensures that customers get the best return on their investment.

-

What benefits do customers report in Keystone Collections Group Bethlehem reviews when using airSlate SignNow?

Customers frequently report that airSlate SignNow signNowly reduces the time needed to eSign documents, as highlighted in Keystone Collections Group Bethlehem reviews. The solution not only accelerates the signing process but also enhances security and compliance. Users enjoy the peace of mind that comes with having legally binding signatures.

-

Are there integrations available with airSlate SignNow that are mentioned in Keystone Collections Group Bethlehem reviews?

Yes, airSlate SignNow offers a range of integrations with popular business tools such as Salesforce, Google Drive, and Microsoft Office. Many Keystone Collections Group Bethlehem reviews emphasize how these integrations improve workflow efficiency and data management. This flexibility helps businesses connect their existing systems seamlessly.

-

Can airSlate SignNow accommodate various document types as noted in Keystone Collections Group Bethlehem reviews?

Absolutely, airSlate SignNow supports multiple document types, from contracts to approvals, which is often noted in Keystone Collections Group Bethlehem reviews. This versatility makes it an excellent choice for different industries, enhancing user experience and document handling capabilities. Users can easily manage various formats without hassle.

-

What kind of customer support does airSlate SignNow provide that is reflected in Keystone Collections Group Bethlehem reviews?

AirSlate SignNow provides robust customer support, including tutorials, live chat, and email assistance, which is frequently mentioned in Keystone Collections Group Bethlehem reviews. Customers appreciate the responsiveness and expertise of the support team, making it easier to resolve issues and maximize the use of the platform. This commitment to service enhances customer satisfaction.

-

Is there a free trial available for airSlate SignNow according to Keystone Collections Group Bethlehem reviews?

Yes, airSlate SignNow offers a free trial that allows potential customers to explore its features and functionalities. According to Keystone Collections Group Bethlehem reviews, this trial is beneficial as it helps users evaluate the service before committing financially. Many users find that the trial period showcases the software's capabilities effectively.

Get more for QUARTERLY ESTIMATE Local Earned Income Tax

Find out other QUARTERLY ESTIMATE Local Earned Income Tax

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast