TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG 2024-2026

Understanding the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

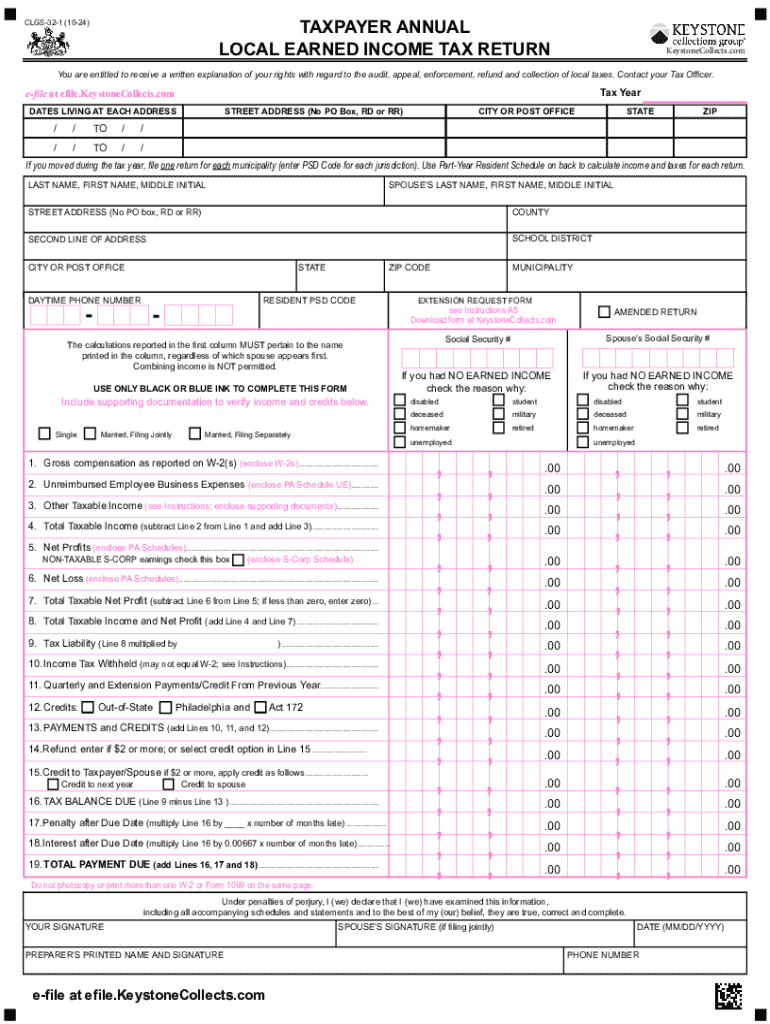

The TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG is a form used by residents in certain jurisdictions to report their earned income for local tax purposes. This form is essential for ensuring compliance with local tax laws and regulations. It typically requires taxpayers to provide information about their income, deductions, and any applicable credits. Understanding this form is crucial for accurate tax reporting and to avoid potential penalties.

Steps to Complete the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

Completing the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information such as name, address, and Social Security number.

- Report your total earned income from all sources.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the completed form for accuracy before submission.

Following these steps carefully will help ensure that your tax return is accurate and complete.

Required Documents for the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

To successfully complete the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG, you will need various documents, including:

- W-2 forms from employers that detail your earnings.

- 1099 forms for any freelance or contract work.

- Records of any deductions you plan to claim, such as receipts for business expenses.

- Proof of any local taxes withheld from your income.

Having these documents on hand will streamline the completion process and help ensure accuracy.

Filing Deadlines for the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

Timely filing of the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG is crucial to avoid penalties. Generally, local tax returns are due on the same date as federal tax returns, which is typically April fifteenth. However, some jurisdictions may have different deadlines. It is important to verify the specific due date for your locality to ensure compliance.

Legal Use of the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

The TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG is legally required for residents of certain areas to report their earned income. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. Additionally, accurate reporting is essential for maintaining good standing with local tax authorities. Understanding the legal implications of this form can help taxpayers avoid potential issues.

How to Obtain the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

The TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG can typically be obtained from your local tax authority's website or office. Many jurisdictions provide the form in a downloadable format, allowing for easy access. Additionally, some tax preparation services may offer the form as part of their services. It is advisable to ensure you are using the most current version of the form to comply with local regulations.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer annual local earned income tax return clg

Create this form in 5 minutes!

How to create an eSignature for the taxpayer annual local earned income tax return clg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG?

The TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG is a required document for individuals to report their local earned income for tax purposes. This return helps local authorities assess the income tax owed based on earnings. Completing this return accurately is essential to avoid penalties and ensure compliance with local tax regulations.

-

How can airSlate SignNow help with the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG?

airSlate SignNow provides an efficient platform for completing and eSigning the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG. With its user-friendly interface, you can easily fill out the necessary forms and securely send them to the relevant authorities. This streamlines the process, saving you time and reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and organizations handling the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Additionally, there are often promotional offers available for new users.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG. You can create, edit, and store your tax documents securely, ensuring easy access when needed. The platform also allows for collaboration with tax professionals, enhancing the overall efficiency of the tax filing process.

-

What benefits does airSlate SignNow offer for filing tax returns?

Using airSlate SignNow for your TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG offers numerous benefits, including increased efficiency and reduced paperwork. The platform's electronic signature capabilities ensure that your documents are signed quickly and securely. Additionally, you can track the status of your submissions, providing peace of mind during tax season.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions, making it easier to manage your TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG alongside your financial records. This integration allows for seamless data transfer and reduces the likelihood of errors. Check the integrations page for a list of compatible software.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive information related to the TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG. The platform employs advanced encryption and security protocols to protect your data. You can trust that your tax documents are secure while using our services.

Get more for TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

Find out other TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLG

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement