Local Services Tax Keystone Collections Group 2022

What is the Local Services Tax?

The Local Services Tax (LST) is a tax imposed by local municipalities in Pennsylvania to fund various services, such as emergency services and infrastructure maintenance. This tax is typically levied on individuals who work within the jurisdiction of the municipality, regardless of their residency status. The Keystone Collections Group manages the collection and administration of this tax, ensuring that local governments receive the necessary funding to maintain public services.

How to use the Local Services Tax

Using the Local Services Tax involves understanding your obligations as a taxpayer. If you earn income in a municipality that imposes this tax, you are required to complete the appropriate forms, such as the PA local tax form, to report your earnings. This tax is typically deducted from your paycheck by your employer, but if you are self-employed or your employer does not withhold it, you must file the necessary forms to remit the tax directly to the local authority.

Steps to complete the Local Services Tax

Completing the Local Services Tax form involves several key steps:

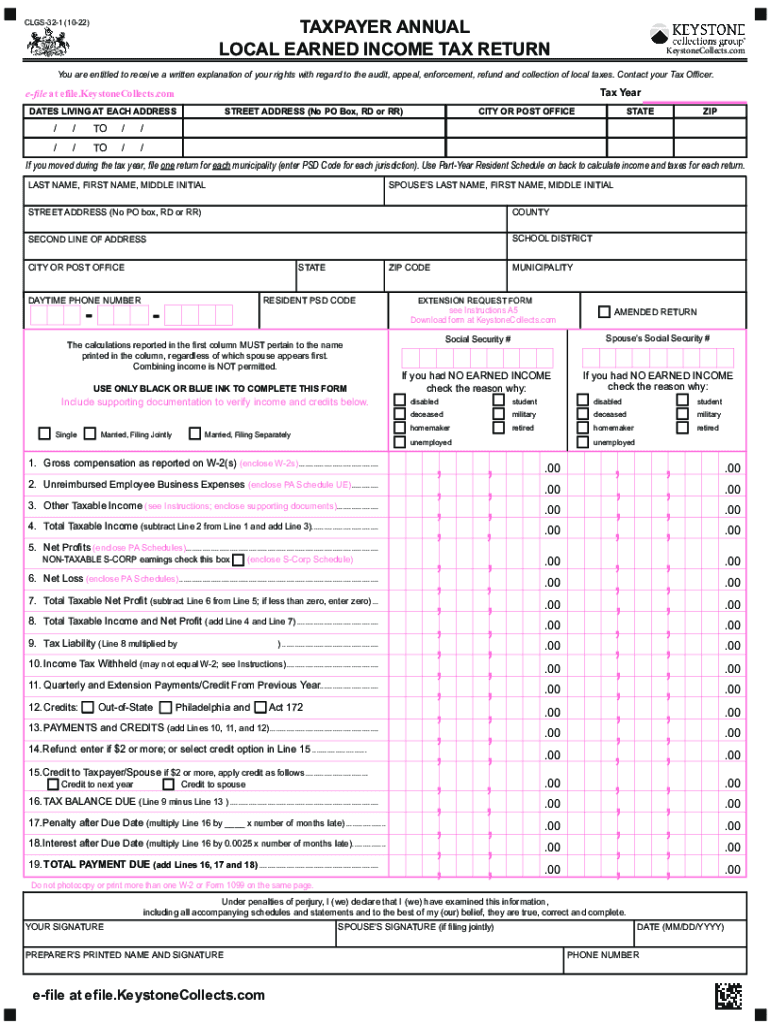

- Gather your income information, including W-2s or 1099s.

- Obtain the correct PA local tax form, such as the form CLGS-32-1.

- Fill out the form accurately, ensuring all income sources are reported.

- Submit the completed form to the appropriate local tax authority by the deadline.

- Retain a copy of the submitted form for your records.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines for the Local Services Tax to avoid penalties. Generally, the tax year aligns with the calendar year, and forms must be filed by April 15 of the following year. However, specific municipalities may have different deadlines, so it is advisable to check with your local tax authority for any variations.

Penalties for Non-Compliance

Failure to comply with the Local Services Tax requirements can result in penalties, including fines and interest on unpaid taxes. Municipalities may impose additional fees for late filings or non-payment, which can accumulate over time. It is essential to stay informed about your tax obligations and file the necessary forms on time to avoid these consequences.

Who Issues the Form

The PA local tax form is issued by local municipalities in Pennsylvania, often facilitated through the Keystone Collections Group. This organization is responsible for collecting the Local Services Tax and ensuring compliance with local tax regulations. Taxpayers should refer to their specific municipality for the correct forms and instructions related to the Local Services Tax.

Quick guide on how to complete local services tax keystone collections group

Effortlessly Prepare Local Services Tax Keystone Collections Group on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents swiftly and without holdups. Manage Local Services Tax Keystone Collections Group on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Local Services Tax Keystone Collections Group seamlessly

- Locate Local Services Tax Keystone Collections Group and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Local Services Tax Keystone Collections Group to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct local services tax keystone collections group

Create this form in 5 minutes!

How to create an eSignature for the local services tax keystone collections group

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA local tax form and why is it important?

A PA local tax form is a document required by Pennsylvania municipalities for local tax reporting. Businesses and employees must complete this form to ensure compliance with local tax regulations. By accurately filing the PA local tax form, you help avoid penalties and ensure the local tax obligations are met.

-

How does airSlate SignNow facilitate the signing of PA local tax forms?

airSlate SignNow offers a user-friendly platform that enables you to easily send, receive, and eSign PA local tax forms. Its electronic signature feature ensures that all parties can sign documents securely and quickly. This streamlines the process, saving time and ensuring compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for PA local tax forms?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. You can choose a plan that fits your budget and allows unlimited eSigning of PA local tax forms. The cost is outweighed by the time saved and the convenience gained, making it a cost-effective solution.

-

What features does airSlate SignNow provide for managing PA local tax forms?

airSlate SignNow includes features like customizable templates, secure cloud storage, and comprehensive tracking for PA local tax forms. These features enhance efficiency, allowing you to manage forms easily and securely. Additionally, you can automate reminders to ensure timely completion and submission.

-

Can I integrate airSlate SignNow with other software for PA local tax forms?

Yes, airSlate SignNow offers integrations with popular tools such as CRM systems, accounting software, and other tax-related platforms. This allows you to streamline workflows and automate processes related to PA local tax forms. Enhanced integrations mean less manual data entry and increased accuracy.

-

What are the benefits of using airSlate SignNow for PA local tax forms?

Using airSlate SignNow for your PA local tax forms improves efficiency, reduces turnaround time, and enhances document security. The platform’s intuitive design ensures that even those with limited technical skills can navigate it easily. Moreover, electronic signatures are legally binding, making your submissions compliant and reliable.

-

Is airSlate SignNow legally compliant for PA local tax form submission?

Absolutely! airSlate SignNow complies with e-signature laws, ensuring that electronic signatures on PA local tax forms are legally binding. The platform adheres to the latest regulations, which means you can submit your forms with confidence, knowing they meet legal requirements.

Get more for Local Services Tax Keystone Collections Group

Find out other Local Services Tax Keystone Collections Group

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple