Taxpayer Annual Local Earned Income Tax Return Form 2021

What is the Taxpayer Annual Local Earned Income Tax Return Form

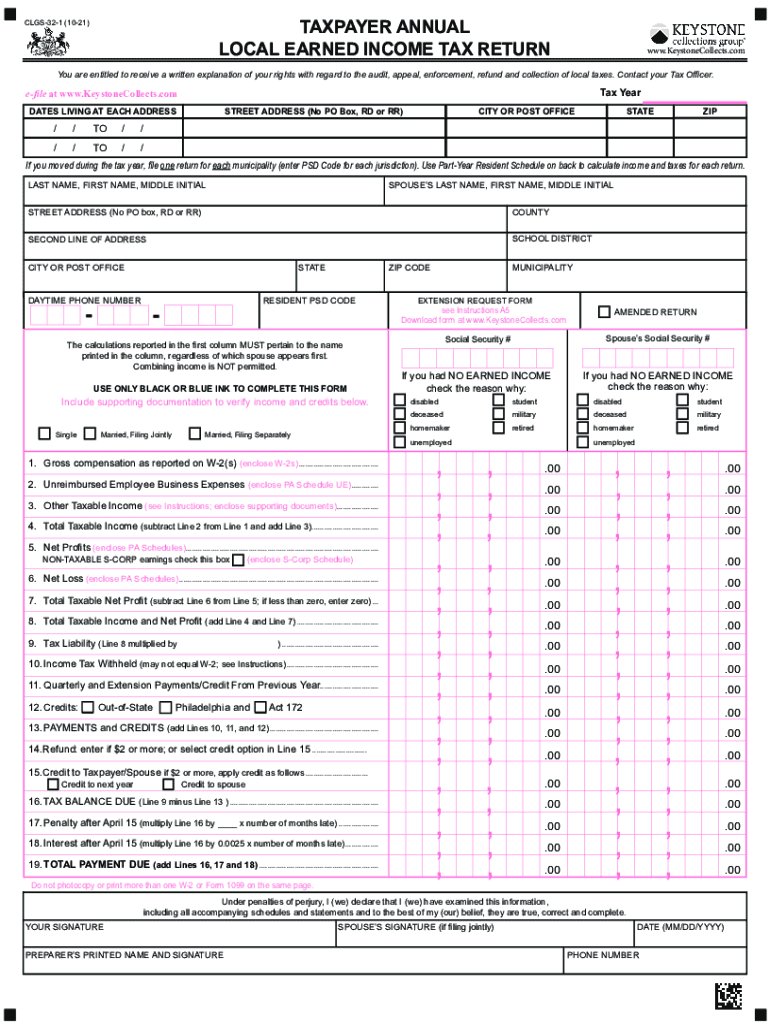

The taxpayer annual local earned income tax return form, often referred to as Form F-1, is a crucial document for residents in various jurisdictions across the United States. This form is used to report earned income to local tax authorities, ensuring compliance with local tax regulations. It typically includes information about your income, deductions, and any credits you may be eligible for. Understanding this form is essential for accurate tax reporting and to avoid potential penalties.

Steps to complete the Taxpayer Annual Local Earned Income Tax Return Form

Filling out the taxpayer annual local earned income tax return form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Provide personal information, such as your name, address, and Social Security number.

- Report your total earned income from all sources for the tax year.

- Include any deductions or credits that apply to your situation.

- Review the completed form for accuracy before submission.

How to use the Taxpayer Annual Local Earned Income Tax Return Form

Using the taxpayer annual local earned income tax return form effectively requires understanding its structure and purpose. Begin by filling out your personal information accurately. Next, ensure that you report all sources of income, including wages, tips, and any freelance earnings. After detailing your income, you can apply any relevant deductions or credits, which can reduce your overall tax liability. Once completed, the form can be submitted electronically or via mail, depending on your local tax authority's requirements.

Legal use of the Taxpayer Annual Local Earned Income Tax Return Form

The legal use of the taxpayer annual local earned income tax return form is governed by local tax laws. To ensure that your form is legally binding, it is important to comply with all relevant regulations regarding signatures and submission methods. Utilizing a reliable eSignature solution can enhance the legal standing of your form, as it ensures that all necessary authentication measures are met. This compliance is essential for your form to be accepted by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the taxpayer annual local earned income tax return form vary by jurisdiction, but they typically align with federal tax deadlines. It is important to check with your local tax authority for specific dates. Missing the filing deadline can result in penalties or interest on any taxes owed. Keeping track of these dates ensures timely submissions and helps avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

Submitting the taxpayer annual local earned income tax return form can be done through various methods. Most local tax authorities allow for online submission, which can expedite the processing of your return. Alternatively, you may choose to mail your completed form to the appropriate tax office. Some jurisdictions also offer the option to submit forms in person. Each method has its own requirements and processing times, so it is advisable to select the one that best suits your needs.

Quick guide on how to complete taxpayer annual local earned income tax return form 558277372

Accomplish Taxpayer Annual Local Earned Income Tax Return Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Taxpayer Annual Local Earned Income Tax Return Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Taxpayer Annual Local Earned Income Tax Return Form with ease

- Locate Taxpayer Annual Local Earned Income Tax Return Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Taxpayer Annual Local Earned Income Tax Return Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer annual local earned income tax return form 558277372

Create this form in 5 minutes!

How to create an eSignature for the taxpayer annual local earned income tax return form 558277372

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the airSlate SignNow platform?

AirSlate SignNow is an easy-to-use, cost-effective solution that enables businesses to send and eSign documents securely. It simplifies processes such as how to fill out taxpayer annual local earned income tax return f 1, enhancing efficiency and compliance.

-

How do I get started with airSlate SignNow?

To get started with airSlate SignNow, simply sign up for an account on our website. After registration, you can explore our tools and features, making it easier to learn how to fill out taxpayer annual local earned income tax return f 1 efficiently.

-

Does airSlate SignNow offer a free trial?

Yes, airSlate SignNow provides a free trial option for users interested in exploring the platform's capabilities. This trial allows you to see firsthand how easy it is to fill out taxpayer annual local earned income tax return f 1 and other documents.

-

What features does airSlate SignNow offer for document signing?

AirSlate SignNow includes features such as customizable templates, reusable workflows, and real-time tracking. These tools make it simple for users to understand how to fill out taxpayer annual local earned income tax return f 1 and streamline the signing process.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers various integrations with popular third-party applications, enhancing your workflow. This capability ensures that users can efficiently manage tasks including how to fill out taxpayer annual local earned income tax return f 1 with minimal disruption.

-

Is airSlate SignNow compliant with legal regulations?

Absolutely, airSlate SignNow complies with all legal standards for electronic signatures. This compliance guarantees that when you learn how to fill out taxpayer annual local earned income tax return f 1 using our platform, your documents remain legally valid.

-

What support options are available if I need help?

AirSlate SignNow provides excellent customer support through various channels, including live chat and email. If you have questions about how to fill out taxpayer annual local earned income tax return f 1, our support team is ready to assist you with detailed guidance.

Get more for Taxpayer Annual Local Earned Income Tax Return Form

Find out other Taxpayer Annual Local Earned Income Tax Return Form

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure