PA Schedule C Profit or Loss from Business or Profession Form and Instructions PA 40 C 2023-2026

Understanding the PA Schedule C: Profit or Loss From Business or Profession Form

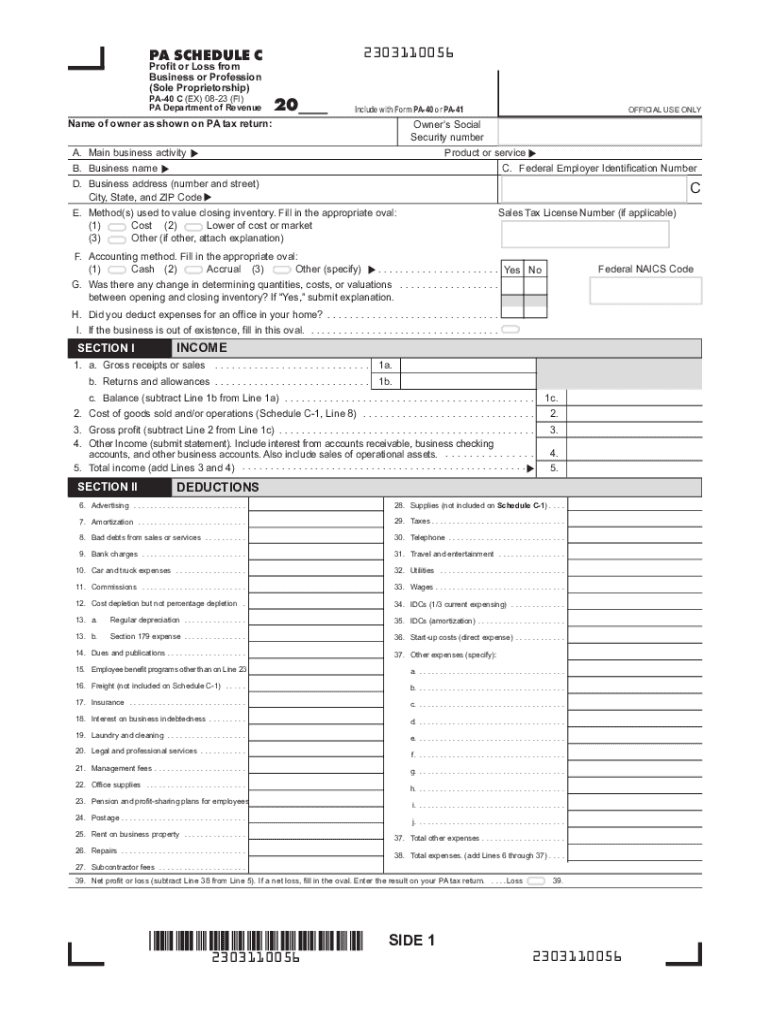

The PA Schedule C, also known as the 2018 PA40C, is a crucial form for individuals reporting income from self-employment or business activities in Pennsylvania. This form allows taxpayers to detail their profits or losses from their business operations, which is essential for accurate tax reporting. It is specifically designed for sole proprietors and single-member LLCs who need to report income and expenses associated with their trade or business.

Key elements of the PA Schedule C include sections for reporting gross receipts, cost of goods sold, and various business expenses. Understanding these components is vital for ensuring that all income and deductions are accurately reported, which can affect overall tax liability.

Steps to Complete the PA Schedule C

Completing the PA Schedule C involves several steps to ensure accuracy and compliance with state tax laws. Begin by gathering all relevant financial records, including income statements and receipts for expenses. Follow these steps for completion:

- Enter your business name and address at the top of the form.

- Report total gross receipts from your business activities.

- Calculate the cost of goods sold if applicable, providing details on inventory and purchases.

- List all business expenses, categorizing them appropriately to maximize deductions.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Review the completed form for accuracy before submission.

Each section requires careful attention to detail, as errors can lead to delays or issues with tax processing.

Obtaining the PA Schedule C Form

The 2018 PA40C form can be obtained through several methods. Taxpayers can download a printable version directly from the Pennsylvania Department of Revenue website. Additionally, many tax preparation software programs include the PA Schedule C form, allowing for easier completion and electronic filing. For those who prefer paper forms, local tax offices may also provide physical copies upon request.

Legal Use of the PA Schedule C

Using the PA Schedule C is legally required for individuals who earn income from self-employment or business activities in Pennsylvania. Accurate reporting on this form ensures compliance with state tax regulations and helps avoid penalties. It is essential to maintain detailed records of all income and expenses related to the business to support the information reported on the form.

Filing Deadlines for the PA Schedule C

Taxpayers must adhere to specific filing deadlines when submitting the PA Schedule C. Generally, the form is due on April 15 of the year following the tax year being reported. For those who file for an extension, the deadline may be extended to October 15. It is crucial to submit the form on time to avoid interest and penalties on any taxes owed.

Examples of Using the PA Schedule C

Common scenarios for using the PA Schedule C include reporting income from freelance work, consulting services, or small business operations. For instance, a graphic designer who works independently would report all income earned from clients on the PA Schedule C, along with any related expenses such as software subscriptions and office supplies. This allows for a clear picture of profitability and ensures that all income is accounted for in tax filings.

Quick guide on how to complete pa schedule c profit or loss from business or profession form and instructions pa 40 c

Complete PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C effortlessly

- Find PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device of your preference. Edit and eSign PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule c profit or loss from business or profession form and instructions pa 40 c

Create this form in 5 minutes!

How to create an eSignature for the pa schedule c profit or loss from business or profession form and instructions pa 40 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 PA40 form and why do I need it?

The 2018 PA40 form is a state income tax return used by residents of Pennsylvania to report their income and calculate their tax liability. It is essential for compliance with state tax laws and can impact your tax refund or amount owed. Using airSlate SignNow makes it easier to fill out and submit the 2018 PA40 form electronically.

-

How can airSlate SignNow simplify the process of submitting my 2018 PA40 form?

AirSlate SignNow streamlines the submission of your 2018 PA40 form by allowing you to fill it out online and eSign it securely. Our platform reduces the need for paperwork and physical signatures, making the process faster and more efficient. You can also track the status of your submission in real-time, ensuring everything is in order.

-

What are the pricing options for using airSlate SignNow for my 2018 PA40 form?

AirSlate SignNow offers a variety of pricing plans to cater to different business needs. Whether you're a small business or a larger enterprise, you'll find a plan that includes features specifically designed to assist with forms like the 2018 PA40 form. We provide a cost-effective solution, ensuring that you only pay for what you need.

-

Can I integrate airSlate SignNow with other software for my 2018 PA40 form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software. This allows for easy data import and export for your 2018 PA40 form, ensuring accuracy and saving you valuable time. By integrating our platform with your existing systems, you can enhance productivity and streamline your tax filing process.

-

What features does airSlate SignNow offer for managing the 2018 PA40 form?

AirSlate SignNow includes multiple features tailored specifically for managing the 2018 PA40 form, such as customizable templates, automatic reminders, and secure eSigning. These features help ensure that you never miss a deadline and that your documents are always compliant with state regulations. Additionally, you can access your documents anytime, anywhere.

-

Is it safe to use airSlate SignNow to handle my 2018 PA40 form?

Absolutely. AirSlate SignNow prioritizes security with advanced encryption and secure data storage practices. Your 2018 PA40 form and any related sensitive information are protected to comply with industry standards. We take privacy seriously, so you can focus on completing your forms without worrying about data bsignNowes.

-

How can I get support if I have questions about my 2018 PA40 form?

AirSlate SignNow provides robust customer support for any questions you might have regarding your 2018 PA40 form. You can signNow our support team via live chat, email, or phone, ensuring that you receive timely assistance. We also offer comprehensive resources and guides to help you navigate your forms easily.

Get more for PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C

- Legacy medical group business health services form

- Delta dental small business program enrollment change fillable form

- Park street 3rd floor madison wi 53715 form

- Cu 3918 unum form

- Ccht recertification nephrology nursing certification commission form

- Tracking form for disclosure of protected health information

- Consent for medical treatment of a minor consent for medical treatment of a minor form

- Health declearation form of max newyork life

Find out other PA Schedule C Profit Or Loss From Business Or Profession Form And Instructions PA 40 C

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors