Pa 40 Schedule C 2018

What is the PA 40 Schedule C?

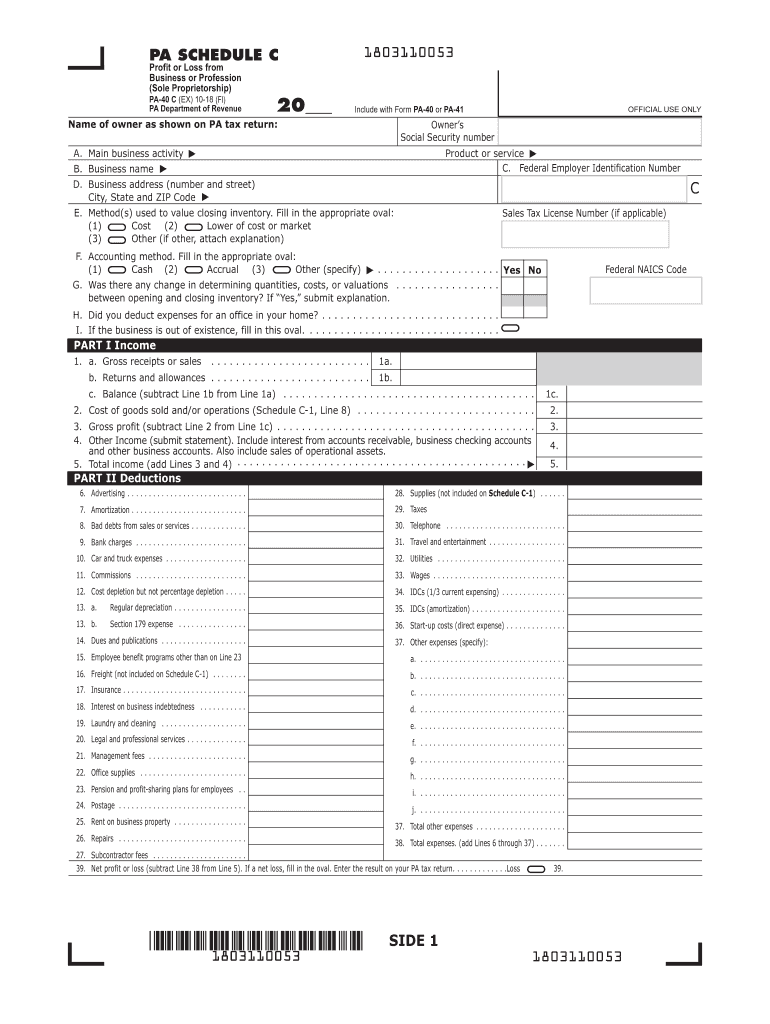

The PA 40 Schedule C is a tax form used by individuals in Pennsylvania to report income or loss from a business or profession. This form is essential for self-employed individuals, freelancers, and sole proprietors. It allows taxpayers to detail their business income and expenses, which are then used to calculate their overall taxable income for state tax purposes. Understanding the PA 40 Schedule C is crucial for accurate tax reporting and compliance with Pennsylvania tax laws.

How to use the PA 40 Schedule C

Using the PA 40 Schedule C involves several steps to ensure accurate reporting of business income and expenses. Taxpayers should begin by gathering all relevant financial documents, including income statements, receipts for business expenses, and any other necessary records. The form requires detailed information about the business, including its name, address, and type of business activity. After completing the form, it should be attached to the PA 40 tax return and submitted to the Pennsylvania Department of Revenue.

Steps to complete the PA 40 Schedule C

Completing the PA 40 Schedule C involves a systematic approach:

- Gather all income and expense records related to your business.

- Fill in your business name and address at the top of the form.

- Report all sources of income in the designated sections.

- List all business expenses, categorizing them appropriately to maximize deductions.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Ensure all calculations are accurate and double-check for any missing information.

- Attach the completed Schedule C to your PA 40 tax return before submission.

Legal use of the PA 40 Schedule C

The PA 40 Schedule C must be used in accordance with Pennsylvania tax laws. It is legally binding and must accurately reflect the taxpayer's business activities. Misreporting income or expenses can lead to penalties and legal consequences. To ensure compliance, taxpayers are encouraged to keep thorough records and consult with tax professionals if needed. The use of electronic signatures for submitting the form can also enhance security and legitimacy.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the PA 40 Schedule C. Generally, the deadline for submitting the PA 40 tax return, including the Schedule C, is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates to avoid late fees and penalties.

Required Documents

To complete the PA 40 Schedule C, certain documents are required:

- Income statements from all business activities.

- Receipts for all business-related expenses.

- Records of any other income sources that may affect tax calculations.

- Previous year’s tax return, if applicable, for reference.

Who Issues the Form

The PA 40 Schedule C is issued by the Pennsylvania Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the Department of Revenue's website or through authorized tax preparation services. It is important to use the most current version of the form to ensure compliance with any updates in tax regulations.

Quick guide on how to complete schedule c 2014 profit and loss 2018 2019 form

Prepare Pa 40 Schedule C effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Pa 40 Schedule C on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and electronically sign Pa 40 Schedule C effortlessly

- Obtain Pa 40 Schedule C and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pa 40 Schedule C and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c 2014 profit and loss 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the schedule c 2014 profit and loss 2018 2019 form

How to generate an eSignature for the Schedule C 2014 Profit And Loss 2018 2019 Form online

How to generate an eSignature for the Schedule C 2014 Profit And Loss 2018 2019 Form in Google Chrome

How to make an eSignature for putting it on the Schedule C 2014 Profit And Loss 2018 2019 Form in Gmail

How to generate an electronic signature for the Schedule C 2014 Profit And Loss 2018 2019 Form from your mobile device

How to make an electronic signature for the Schedule C 2014 Profit And Loss 2018 2019 Form on iOS devices

How to create an electronic signature for the Schedule C 2014 Profit And Loss 2018 2019 Form on Android devices

People also ask

-

What is the 2018 PA 40 tax form?

The 2018 PA 40 tax form is the Pennsylvania personal income tax return that residents must file if they have taxable income. Completing this form accurately is essential to ensure compliance with state tax laws. airSlate SignNow can help you eSign and send your 2018 PA 40 tax form efficiently.

-

How can I securely eSign my 2018 PA 40 tax form using airSlate SignNow?

Using airSlate SignNow, you can securely eSign your 2018 PA 40 tax form with just a few clicks. Our platform offers advanced encryption and security features, ensuring that your sensitive tax information is protected throughout the signing process. Plus, it’s user-friendly, making it easy to manage your documents.

-

What are the benefits of using airSlate SignNow for my 2018 PA 40 tax form?

Using airSlate SignNow for your 2018 PA 40 tax form provides you with a cost-effective and efficient way to manage your tax documents. You can esign forms quickly, reducing the time spent on paperwork and ensuring timely submissions. This speed can also help you avoid potential late fees.

-

Is there a cost associated with using airSlate SignNow for tax forms like the 2018 PA 40?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, including individuals and businesses. These plans provide flexibility depending on the number of documents you need to manage, including the 2018 PA 40 tax form. Check our pricing page for more information on subscription options.

-

Can I integrate airSlate SignNow with other tax software for filing the 2018 PA 40 tax form?

Absolutely! airSlate SignNow integrates seamlessly with popular tax preparation software, making it easier to prepare and file your 2018 PA 40 tax form. This integration streamlines your workflow and minimizes the risk of errors since you can manage all your tax documents in one place.

-

What features does airSlate SignNow offer for signing documents like the 2018 PA 40 tax form?

airSlate SignNow includes a range of features such as customizable templates, automated workflows, and secure cloud storage. These tools facilitate the eSigning process for documents like the 2018 PA 40 tax form, enabling you to complete your tax filings quickly and effortlessly.

-

How does airSlate SignNow ensure the security of my 2018 PA 40 tax form?

airSlate SignNow employs top-tier security measures, including SSL encryption and secure user authentication, to protect your documents. When you eSign your 2018 PA 40 tax form, you can be confident that your personal information is safe from unauthorized access or bsignNowes.

Get more for Pa 40 Schedule C

- Massachusetts contempt form

- Franklin county common pleas court clerkamp39s office franklincountyohio form

- Papua new guinea statutory declaration form word format

- Information collection consent form dfp recruitment

- Employment information handbook federal bureau of prisons bop

- Claim form chamber primary health plan westfield health

- Healthy paws claim form

- Ryanair travel insurance claim form

Find out other Pa 40 Schedule C

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free