Schedule C Profit and Loss Form 2017

What is the Schedule C Profit And Loss Form

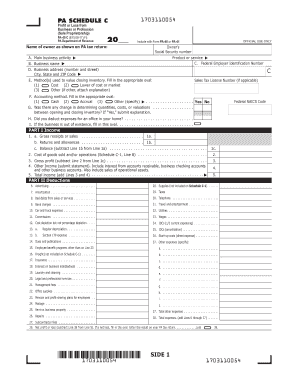

The Schedule C Profit and Loss Form is a tax document used by sole proprietors in the United States to report income and expenses from their business operations. This form is essential for self-employed individuals as it helps determine the net profit or loss from their business activities, which is then reported on their personal income tax return. The Schedule C form captures various aspects of business finances, including gross receipts, cost of goods sold, and operating expenses.

How to use the Schedule C Profit And Loss Form

To effectively use the Schedule C Profit and Loss Form, begin by gathering all relevant financial records, such as income statements, receipts, and invoices. The form is divided into sections that require detailed information about your business income and expenses. Fill out the gross income section first, followed by the expenses section, which includes categories like advertising, utilities, and wages. Ensure accuracy in reporting to facilitate a smooth tax filing process.

Steps to complete the Schedule C Profit And Loss Form

Completing the Schedule C Profit and Loss Form involves several key steps:

- Gather all necessary financial documents, including income and expense records.

- Fill in your business information, including the name, address, and type of business.

- Report your gross receipts or sales in the appropriate section.

- Deduct any cost of goods sold if applicable, and calculate your gross profit.

- Detail your business expenses in the designated categories, ensuring you include all relevant costs.

- Calculate your net profit or loss by subtracting total expenses from gross profit.

Legal use of the Schedule C Profit And Loss Form

The Schedule C Profit and Loss Form is legally recognized by the Internal Revenue Service (IRS) as a valid method for reporting business income and expenses. To ensure compliance, it is important to accurately complete the form and retain supporting documentation for all reported figures. Misreporting or failing to file the Schedule C can lead to penalties or audits by the IRS, making it crucial to adhere to all tax regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Profit and Loss Form. These guidelines include instructions on how to categorize income and expenses, as well as information on allowable deductions. It is advisable to review the IRS instructions carefully to ensure that all entries are accurate and compliant with current tax laws. This will help in avoiding potential issues during the filing process.

Filing Deadlines / Important Dates

Filing the Schedule C Profit and Loss Form must align with the overall tax filing deadlines set by the IRS. Typically, the deadline for submitting your tax return, including Schedule C, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax deadlines to avoid late filing penalties.

Form Submission Methods

The Schedule C Profit and Loss Form can be submitted through various methods, including online filing, mail, or in-person submission at designated IRS offices. Online filing is often preferred for its convenience and speed, allowing for quicker processing times. When submitting by mail, ensure that the form is sent to the correct IRS address based on your location and that it is postmarked by the filing deadline.

Quick guide on how to complete schedule c 2014 profit and loss 2017 form

Prepare Schedule C Profit And Loss Form effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage Schedule C Profit And Loss Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Schedule C Profit And Loss Form without hassle

- Obtain Schedule C Profit And Loss Form and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to distribute your form, through email, SMS, or shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule C Profit And Loss Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c 2014 profit and loss 2017 form

Create this form in 5 minutes!

How to create an eSignature for the schedule c 2014 profit and loss 2017 form

How to make an electronic signature for the Schedule C 2014 Profit And Loss 2017 Form online

How to generate an eSignature for the Schedule C 2014 Profit And Loss 2017 Form in Google Chrome

How to create an eSignature for signing the Schedule C 2014 Profit And Loss 2017 Form in Gmail

How to make an eSignature for the Schedule C 2014 Profit And Loss 2017 Form straight from your mobile device

How to make an electronic signature for the Schedule C 2014 Profit And Loss 2017 Form on iOS devices

How to make an eSignature for the Schedule C 2014 Profit And Loss 2017 Form on Android

People also ask

-

What is a Schedule C Profit And Loss Form?

The Schedule C Profit And Loss Form is a tax document used by sole proprietors to report income and expenses from their business. It helps in calculating the net profit or loss, which is necessary for tax filing. Understanding this form is crucial for correctly reporting your earnings to the IRS.

-

How can airSlate SignNow assist me with completing my Schedule C Profit And Loss Form?

airSlate SignNow provides a user-friendly platform that enables you to create, edit, and eSign your Schedule C Profit And Loss Form efficiently. You can easily input your income and expenses, saving time and ensuring accuracy. With our electronic signature feature, you can also ensure your documents are securely signed and stored.

-

Is there a cost associated with using airSlate SignNow for my Schedule C Profit And Loss Form?

Yes, airSlate SignNow offers competitive pricing plans that are designed to fit various business needs. Depending on the plan you choose, you’ll gain access to features that facilitate the preparation and signing of your Schedule C Profit And Loss Form. Check our website for the latest pricing and features.

-

What features does airSlate SignNow offer for managing my Schedule C Profit And Loss Form?

airSlate SignNow provides multiple features for handling your Schedule C Profit And Loss Form, including customizable templates, seamless document sharing, and cloud storage. You can also track document status and receive notifications when your forms are signed. These tools enhance efficiency and support thorough documentation of your financial activities.

-

Can I integrate airSlate SignNow with other applications for my tax preparation?

Yes, airSlate SignNow integrates with various accounting and tax preparation software, making it easy to manage your Schedule C Profit And Loss Form alongside your other financial documents. This integration streamlines your workflow and ensures that all your data is in sync, enhancing accuracy and saving valuable time.

-

What are the benefits of using airSlate SignNow for my Schedule C Profit And Loss Form?

Using airSlate SignNow for your Schedule C Profit And Loss Form offers several benefits, including time-saving automation, secure e-signature capabilities, and easy access to your forms from anywhere. Our platform reduces paperwork, enhances collaboration, and helps ensure your tax reporting is timely and compliant.

-

Is my data secure when using airSlate SignNow for my Schedule C Profit And Loss Form?

Absolutely! airSlate SignNow prioritizes data security and uses advanced encryption to protect your information. When you use our platform for your Schedule C Profit And Loss Form, you can be assured that your sensitive financial data is kept safe and private throughout the eSigning process.

Get more for Schedule C Profit And Loss Form

Find out other Schedule C Profit And Loss Form

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure