Installment Payment AgreementDepartment of Revenue 2023-2026

What is the Installment Payment Agreement Department Of Revenue

The Installment Payment Agreement is a formal arrangement between a taxpayer and the Department of Revenue that allows individuals or businesses to pay their tax liabilities over time, rather than in a single lump sum. This agreement is particularly beneficial for those who may face financial difficulties but still want to meet their tax obligations. By entering into this agreement, taxpayers can avoid penalties and interest that accrue when taxes go unpaid.

How to obtain the Installment Payment Agreement Department Of Revenue

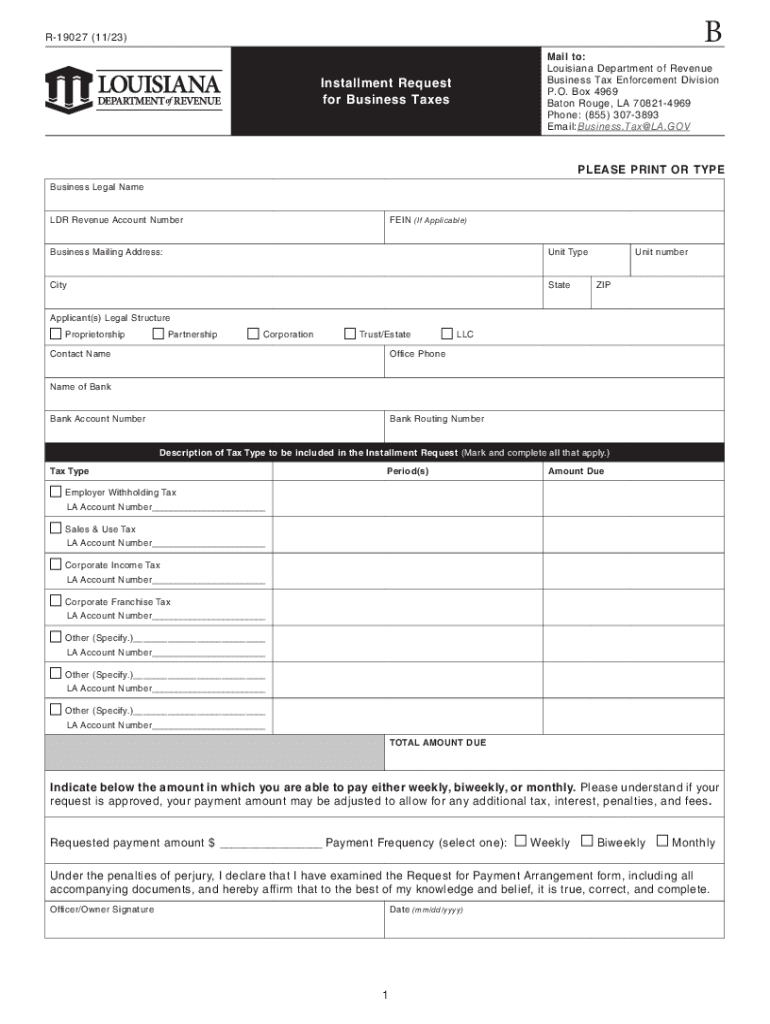

To obtain an Installment Payment Agreement, taxpayers typically need to contact their state Department of Revenue directly. This process may involve filling out a specific application form, which can often be found on the department's website. Taxpayers may also need to provide financial information to demonstrate their ability to make installment payments. Some states allow for online applications, while others may require submission by mail or in person.

Steps to complete the Installment Payment Agreement Department Of Revenue

Completing an Installment Payment Agreement generally involves several key steps:

- Gather necessary financial documents, such as income statements and expense records.

- Determine the total amount of tax owed and assess your ability to pay.

- Fill out the required application form accurately, ensuring all information is complete.

- Submit the application to the Department of Revenue, following the specified submission method.

- Await confirmation of the agreement and any additional instructions regarding payment schedules.

Key elements of the Installment Payment Agreement Department Of Revenue

Several key elements are essential in an Installment Payment Agreement. These include:

- The total amount owed, which must be clearly stated.

- The proposed payment schedule, including the amount and frequency of payments.

- Terms regarding penalties and interest, ensuring taxpayers understand their obligations.

- Conditions under which the agreement may be modified or terminated.

Eligibility Criteria for the Installment Payment Agreement Department Of Revenue

Eligibility for an Installment Payment Agreement typically depends on several factors, including:

- The total amount of tax owed, as some states have minimum thresholds.

- The taxpayer's current financial situation, which may require documentation.

- Past compliance with tax obligations, as a history of non-compliance may affect eligibility.

Penalties for Non-Compliance with the Installment Payment Agreement Department Of Revenue

Failure to adhere to the terms of an Installment Payment Agreement can result in significant penalties. These may include:

- Immediate acceleration of the total amount owed, requiring full payment.

- Additional interest charges on the unpaid balance.

- Potential legal action by the Department of Revenue to recover owed taxes.

Quick guide on how to complete installment payment agreementdepartment of revenue

Complete Installment Payment AgreementDepartment Of Revenue effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Installment Payment AgreementDepartment Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to alter and eSign Installment Payment AgreementDepartment Of Revenue with ease

- Find Installment Payment AgreementDepartment Of Revenue and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark essential sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Installment Payment AgreementDepartment Of Revenue and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct installment payment agreementdepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the installment payment agreementdepartment of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Installment Payment Agreement Department Of Revenue?

An Installment Payment Agreement Department Of Revenue is a payment plan allowing individuals or businesses to pay tax liabilities over time. This agreement provides flexibility, helping to alleviate financial strain while ensuring compliance with tax obligations. It's designed to make tax payments manageable without accruing additional penalties.

-

How can airSlate SignNow help with the Installment Payment Agreement Department Of Revenue?

airSlate SignNow streamlines the process of managing your Installment Payment Agreement Department Of Revenue by enabling you to easily create, sign, and send documents securely online. This eliminates the need for physical paperwork and ensures you meet deadlines conveniently. Plus, you can track the status of agreements in real-time.

-

Are there any costs associated with using airSlate SignNow for Installment Payment Agreement Department Of Revenue?

Yes, while airSlate SignNow offers a cost-effective solution for managing the Installment Payment Agreement Department Of Revenue, the pricing may vary based on the features you choose. We provide several plans to fit different business needs, ensuring you only pay for what you use. You can check our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for the Installment Payment Agreement Department Of Revenue?

airSlate SignNow includes essential features such as eSigning, document templates, and workflow automation specifically tailored for the Installment Payment Agreement Department Of Revenue. Our platform allows multiple parties to sign simultaneously, enhancing efficiency. You can also customize documents to suit your specific requirements.

-

Can airSlate SignNow integrate with other tools I use for Installment Payment Agreement Department Of Revenue?

Absolutely! airSlate SignNow offers various integrations with popular CRM, accounting, and document management software. This ensures that you can seamlessly incorporate the management of the Installment Payment Agreement Department Of Revenue into your existing workflow. Check our integration page to see all available options.

-

How secure is airSlate SignNow for handling Installment Payment Agreement Department Of Revenue documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your data during upload and storage, ensuring the confidentiality of your Installment Payment Agreement Department Of Revenue documents. Additionally, our platform complies with industry security standards, giving you peace of mind when managing sensitive information.

-

What benefits can I expect from using airSlate SignNow for Installment Payment Agreement Department Of Revenue?

Using airSlate SignNow for your Installment Payment Agreement Department Of Revenue brings numerous benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. You can eliminate the hassle of manual paperwork and enjoy the convenience of eSigning. This ultimately helps you focus more on your business rather than administrative tasks.

Get more for Installment Payment AgreementDepartment Of Revenue

- Disciplinary action form viking template

- Sample suspension date name address hand delivery form

- Coaching ampamp corrective action texas tech university form

- 1 sample progressive discipline policy jax chamber form

- Sample written reprimand form

- This final warning will confirm our discussion of date in which we reviewed your attendance records form

- Sample disciplinary letter for excessive absenteeism form

- Letter confirming verbal warning discipline abdo form

Find out other Installment Payment AgreementDepartment Of Revenue

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile