Cu 301 Vermont 2014-2026

What is the CU 301 Vermont

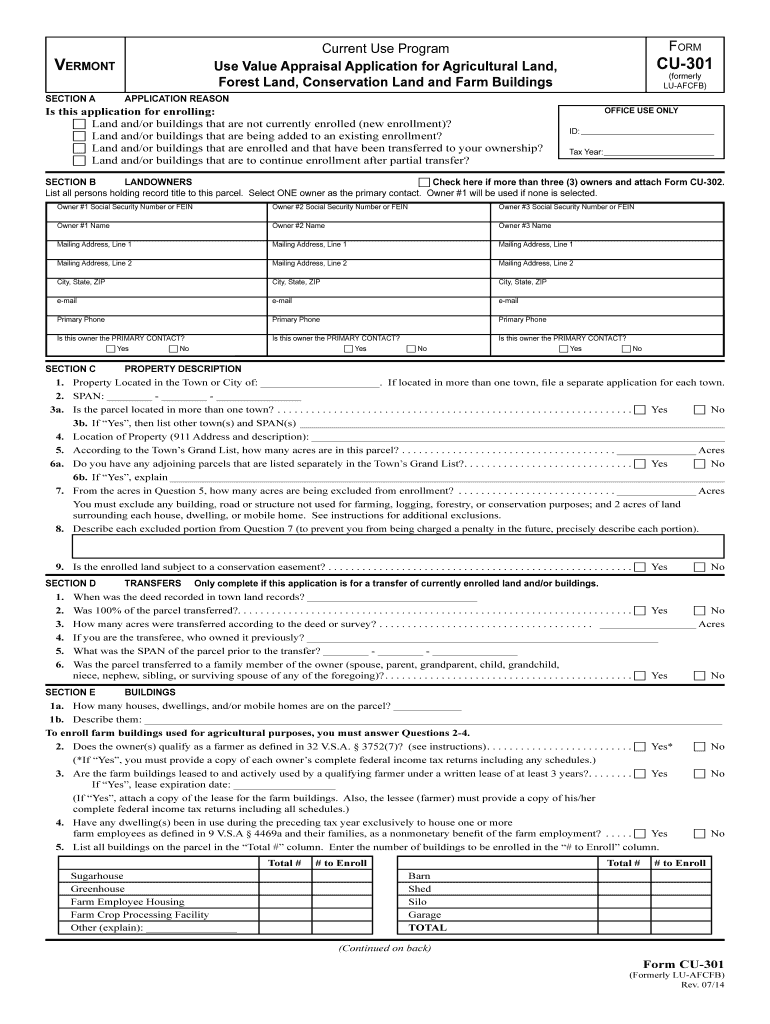

The CU 301 form, issued by the Department of Taxes in Vermont, is a crucial document for landowners participating in the Vermont Current Use Program. This program allows eligible property owners to have their land assessed based on its agricultural or forest use rather than its market value, resulting in lower property taxes. The CU 301 form serves as an application for this program, helping landowners to formally declare their intent to enroll their property and benefit from the associated tax reductions.

Steps to Complete the CU 301 Vermont

Completing the CU 301 form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering necessary information about your property, including its size, location, and current use. Next, fill out the form, providing detailed descriptions of how the land is utilized, whether for agriculture, forestry, or other qualifying purposes. It is essential to review the form for any errors before submission. Once completed, submit the form to the appropriate local tax authority by the specified deadline to ensure enrollment in the Current Use Program.

Eligibility Criteria

To qualify for the CU 301 form and the Vermont Current Use Program, landowners must meet specific eligibility criteria. The property must be at least 25 acres in size, although smaller parcels may qualify under certain conditions. The land must be primarily used for agricultural or forest purposes, and the owner must demonstrate a commitment to maintaining this use. Additionally, the property should not be developed for non-agricultural purposes, as this could disqualify it from the program.

Required Documents

When submitting the CU 301 form, landowners must include certain documents to support their application. These may include proof of ownership, a detailed map of the property indicating its boundaries and current use, and any additional documentation that demonstrates compliance with the program's requirements. It is advisable to check with the local tax authority for any specific documentation requirements that may apply to your situation.

Form Submission Methods

The CU 301 form can be submitted through various methods to accommodate landowners' preferences. Options typically include online submission via the Vermont Department of Taxes website, mailing a physical copy to the local tax office, or delivering it in person. Each method has its own advantages, so landowners should choose the one that best suits their needs while ensuring they meet submission deadlines.

Legal Use of the CU 301 Vermont

The legal use of the CU 301 form is governed by Vermont state law, which outlines the requirements and processes for participating in the Current Use Program. Proper completion and submission of the form are essential for landowners to benefit from the tax reductions associated with the program. Failure to comply with the legal stipulations may result in penalties or disqualification from the program. Therefore, understanding the legal framework surrounding the CU 301 form is vital for all applicants.

Quick guide on how to complete current use program form cu 301 formerly lu vermontgov state vt 6963147

Your assistance manual on preparing your Cu 301 Vermont

If you’re wondering how to complete and submit your Cu 301 Vermont, here are some straightforward instructions to make tax filing easier.

To get started, you just need to create your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is an intuitive and powerful document solution that allows you to edit, generate, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to modify data as necessary. Enhance your tax processes with advanced PDF editing, eSigning, and easy sharing.

Follow these instructions to complete your Cu 301 Vermont in a matter of minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax document; browse through forms and schedules.

- Select Get form to access your Cu 301 Vermont in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can introduce return mistakes and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct current use program form cu 301 formerly lu vermontgov state vt 6963147

Create this form in 5 minutes!

How to create an eSignature for the current use program form cu 301 formerly lu vermontgov state vt 6963147

How to generate an eSignature for your Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 online

How to create an electronic signature for your Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 in Google Chrome

How to make an eSignature for signing the Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 in Gmail

How to generate an eSignature for the Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 straight from your smart phone

How to generate an electronic signature for the Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 on iOS devices

How to create an eSignature for the Current Use Program Form Cu 301 Formerly Lu Vermontgov State Vt 6963147 on Android

People also ask

-

What is the CU 301 form department of taxes Vermont?

The CU 301 form department of taxes Vermont is a tax document used by businesses for reporting and paying sales and use taxes in the state. It is crucial for compliance with Vermont tax regulations, ensuring that your business fulfills its obligations.

-

How can airSlate SignNow help with the CU 301 form department of taxes Vermont?

airSlate SignNow allows users to easily eSign and send the CU 301 form department of taxes Vermont digitally. This streamlines the filing process, ensuring that your documents are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for handling the CU 301 form department of taxes Vermont?

Our platform offers a variety of features such as customizable templates, secure eSignature capabilities, and cloud storage, all designed to enhance the filing process for the CU 301 form department of taxes Vermont. These tools simplify documents management and help ensure compliance.

-

Is airSlate SignNow cost-effective for filing the CU 301 form department of taxes Vermont?

Yes, airSlate SignNow offers a cost-effective solution that can save your business both time and money when filing the CU 301 form department of taxes Vermont. With its subscription plans tailored for various business sizes, you can find an option that fits your budget.

-

Can I integrate airSlate SignNow with accounting software for the CU 301 form department of taxes Vermont?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, allowing for efficient tracking and management of the CU 301 form department of taxes Vermont. This integration ensures that all your financial data is in one place, simplifying your tax filing process.

-

What are the benefits of using airSlate SignNow for the CU 301 form department of taxes Vermont?

Using airSlate SignNow for the CU 301 form department of taxes Vermont offers multiple benefits, including improved accuracy, faster submission, and enhanced document security. These advantages help businesses avoid issues with tax compliance and ensure peace of mind.

-

How do I get started with airSlate SignNow for the CU 301 form department of taxes Vermont?

Getting started is easy! Simply visit the airSlate SignNow website, sign up for an account, and begin exploring our features designed for the CU 301 form department of taxes Vermont. Our user-friendly interface will guide you through the process effortlessly.

Get more for Cu 301 Vermont

- Divorce sheet form

- Rental agreement form 2788736

- Chemical checklist template form

- Visa application form guyana news and information guyana

- Pennsylvania exemption certificate form

- Regular donor form fall qxp pages cs wisc

- Www miltontownshipassessor com assets docs2019 milton inquiry form milton township assessor

- Service level kpi agreement template form

Find out other Cu 301 Vermont

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter