Pr 230 Form 2017

What is the PR-230 Form?

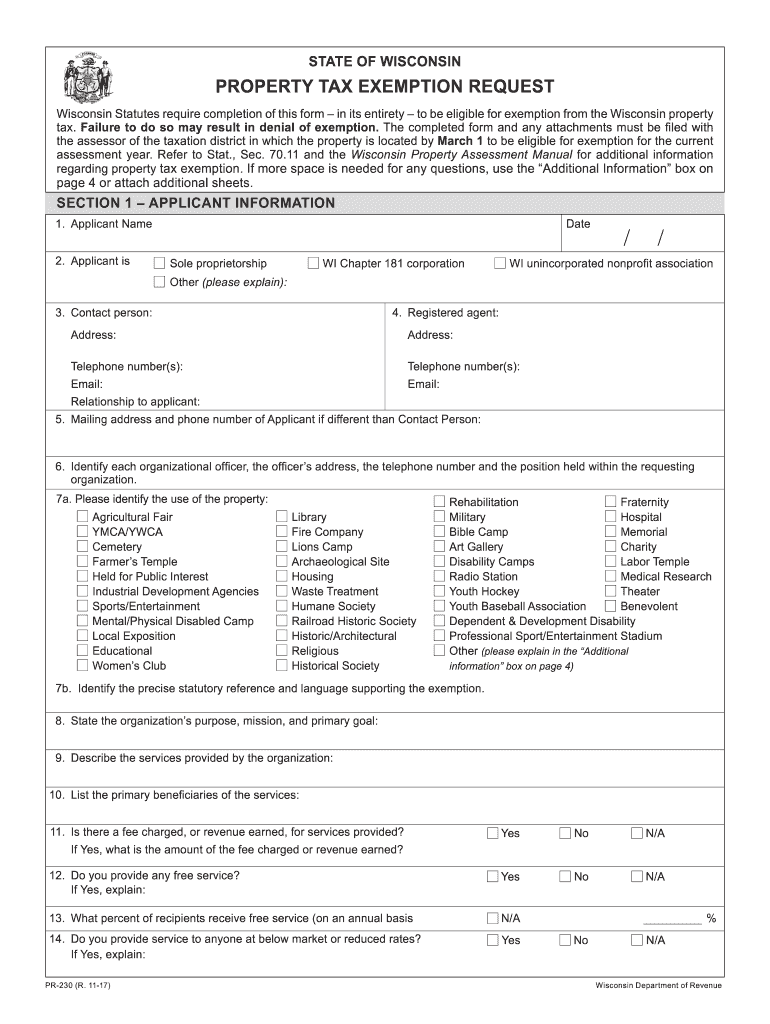

The PR-230 form, officially known as the Wisconsin Property Tax Exemption Request, is a critical document for property owners in Wisconsin seeking to claim exemptions on their property taxes. This form is specifically designed for individuals and entities that qualify for property tax exemptions under state law. The PR-230 form helps facilitate the process of applying for these exemptions, ensuring that applicants provide the necessary information to support their claims. Understanding the purpose and requirements of the PR-230 form is essential for property owners looking to reduce their tax liabilities.

Steps to Complete the PR-230 Form

Completing the PR-230 form involves several key steps to ensure accuracy and compliance with Wisconsin tax regulations. Start by gathering all required information, including property details and ownership documentation. Next, fill out the form accurately, providing all requested information in the designated fields. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or by mail, depending on local guidelines. Ensuring that the form is filled out correctly will help avoid delays in processing your exemption request.

Eligibility Criteria for the PR-230 Form

To qualify for the property tax exemption using the PR-230 form, applicants must meet specific eligibility criteria set forth by the state of Wisconsin. Generally, these criteria include ownership of the property, the intended use of the property, and compliance with local tax regulations. Certain properties, such as those used for charitable, educational, or religious purposes, may be eligible for exemption. It is vital for applicants to review these criteria thoroughly to determine their eligibility before submitting the PR-230 form.

Required Documents for the PR-230 Form

When submitting the PR-230 form, applicants must provide several supporting documents to substantiate their exemption claims. Commonly required documents include proof of property ownership, detailed descriptions of the property’s use, and any relevant financial statements or tax returns. These documents help tax authorities verify the information provided on the PR-230 form and assess the validity of the exemption request. Ensuring that all required documents are included with the submission can expedite the review process.

Form Submission Methods

The PR-230 form can be submitted through various methods, providing flexibility for applicants. Property owners may choose to submit the form online through designated state portals, ensuring a quicker processing time. Alternatively, the form can be mailed to the appropriate local tax authority or submitted in person at designated offices. Each submission method has its own guidelines and processing times, so applicants should choose the method that best suits their needs while ensuring compliance with local regulations.

Legal Use of the PR-230 Form

The PR-230 form is legally recognized in Wisconsin as the official document for requesting property tax exemptions. Proper use of this form is essential for compliance with state tax laws. Filing the PR-230 form accurately and within the designated time frames protects property owners from potential penalties or denial of their exemption requests. Understanding the legal implications of using the PR-230 form can help applicants navigate the property tax exemption process more effectively.

Quick guide on how to complete wisconsin property tax exemption 2017 2019 form

Your assistance manual on how to prepare your Pr 230 Form

If you’re wondering how to create and submit your Pr 230 Form, here are some brief guidelines to simplify the tax submission process.

To get started, you just need to sign up for your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a very user-friendly and effective document solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to adjust answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Pr 230 Form in a matter of minutes:

- Create your account and begin working on PDFs in a few minutes.

- Utilize our directory to search for any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Pr 230 Form in our editor.

- Complete the needed fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your addressee, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to return errors and postpone reimbursements. Naturally, before electronically filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin property tax exemption 2017 2019 form

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the wisconsin property tax exemption 2017 2019 form

How to generate an eSignature for the Wisconsin Property Tax Exemption 2017 2019 Form online

How to create an electronic signature for the Wisconsin Property Tax Exemption 2017 2019 Form in Chrome

How to generate an eSignature for putting it on the Wisconsin Property Tax Exemption 2017 2019 Form in Gmail

How to create an electronic signature for the Wisconsin Property Tax Exemption 2017 2019 Form straight from your smart phone

How to generate an electronic signature for the Wisconsin Property Tax Exemption 2017 2019 Form on iOS devices

How to make an eSignature for the Wisconsin Property Tax Exemption 2017 2019 Form on Android OS

People also ask

-

What is the process for submitting an on line property tax exemption request WI?

The process for submitting an on line property tax exemption request WI involves completing the required forms on our platform and eSigning them digitally. You can easily upload supporting documents and submit your application directly through airSlate SignNow, ensuring a streamlined experience.

-

How much does it cost to use airSlate SignNow for on line property tax exemption request WI?

airSlate SignNow offers competitive pricing plans that suit different business needs. When making an on line property tax exemption request WI, you'll find that our solution provides signNow value by saving time and reducing paperwork, often at a fraction of the cost of traditional methods.

-

What features does airSlate SignNow offer for on line property tax exemption requests?

airSlate SignNow includes features such as templates for on line property tax exemption requests WI, secure eSignatures, and document tracking. These features simplify the application process, allowing you to ensure that your documents are always organized and accessible.

-

What are the benefits of using airSlate SignNow for on line property tax exemption requests?

Using airSlate SignNow for your on line property tax exemption request WI provides numerous benefits, including increased efficiency and reduced processing time. Our platform eliminates the hassle of physical paperwork, allowing for faster approvals and better management of your tax exemptions.

-

Can airSlate SignNow integrate with other software for handling on line property tax exemption requests?

Yes, airSlate SignNow can seamlessly integrate with a variety of software solutions to enhance your workflow for on line property tax exemption requests WI. This integration capability ensures that you can connect with your existing tools and systems for optimal document management.

-

Is it secure to send my on line property tax exemption request WI using airSlate SignNow?

Absolutely! airSlate SignNow employs top-level encryption and security protocols to protect your sensitive information when submitting an on line property tax exemption request WI. We prioritize data security and compliance to give you peace of mind while using our platform.

-

What types of documents are required for an on line property tax exemption request WI?

When making an on line property tax exemption request WI using airSlate SignNow, you typically need to provide proof of eligibility along with the completed exemption application form. Be sure to check local regulations for any specific documentation required to expedite your request.

Get more for Pr 230 Form

- Xpo bol template form

- Barclays share transfer form

- Dmc form

- Physicians certificate of medical examination texas form

- Drano dual force foamer guarantee form

- Va form 22 1919 conflicting interests certification for proprietary schools

- Service for service agreement template form

- Serviced office agreement template form

Find out other Pr 230 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors