DOR Property Tax Exemption Forms Wisconsin Department 2020-2026

Understanding the Wisconsin Tax Exempt Form 2024

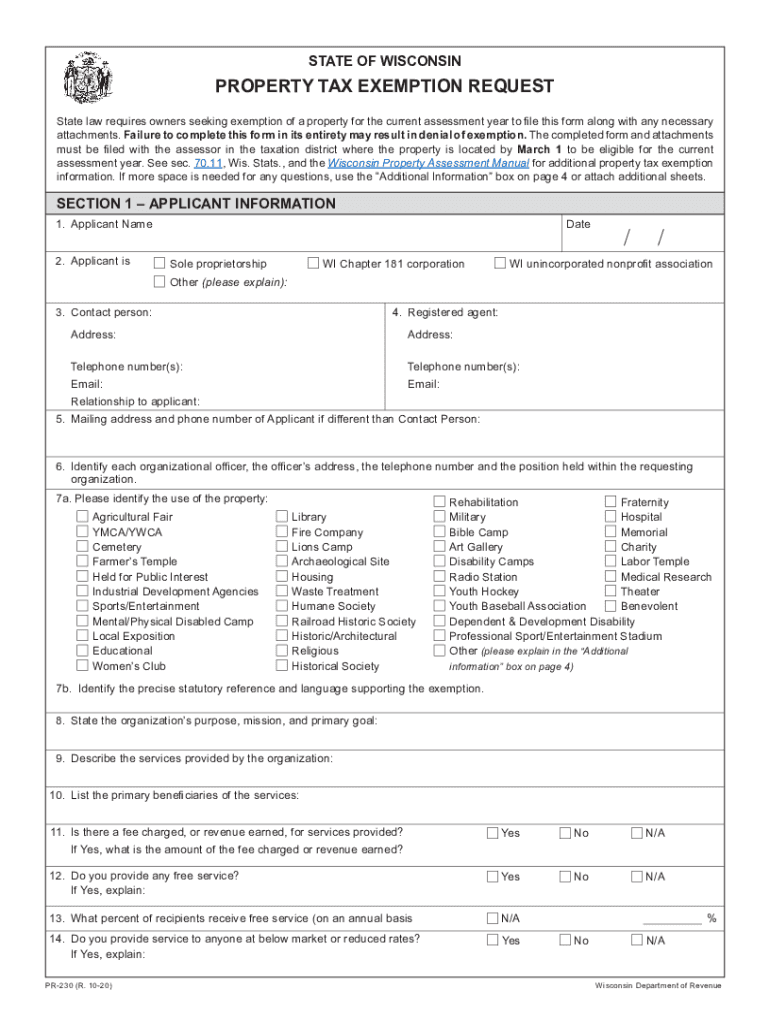

The Wisconsin tax exempt form 2024 is a crucial document for individuals and organizations seeking property tax exemptions in the state. This form, often referred to as the PR-230, is utilized to apply for various types of exemptions, including the homestead exemption and senior property tax exemption. Understanding the purpose and requirements of this form is essential for eligible applicants to ensure they receive the appropriate tax relief.

Steps to Complete the Wisconsin Tax Exempt Form 2024

Completing the Wisconsin tax exempt form 2024 involves several key steps to ensure accuracy and compliance. Start by gathering necessary documentation, which may include proof of income, residency, and age if applying for senior exemptions. Next, fill out the form carefully, providing all requested information, including your name, address, and details about the property in question. It is important to review the form for completeness before submission, as any errors may delay processing.

Eligibility Criteria for Wisconsin Property Tax Exemptions

Eligibility for property tax exemptions in Wisconsin varies based on the type of exemption being sought. For the homestead exemption, applicants must meet specific income limits and residency requirements. Senior property tax exemptions typically require applicants to be at least sixty-five years old and meet certain income thresholds. Understanding these criteria is vital to determine if you qualify for the Wisconsin tax exempt form 2024.

Required Documents for Submission

When submitting the Wisconsin tax exempt form 2024, several documents may be required to support your application. Commonly needed documents include proof of income, such as tax returns or pay stubs, and identification verification, such as a driver's license or state ID. Additionally, if applying for specific exemptions like the senior property tax exemption, applicants may need to provide documentation that verifies their age. Ensuring that all required documents are included can expedite the review process.

Form Submission Methods for the Wisconsin Tax Exempt Form 2024

The Wisconsin tax exempt form 2024 can be submitted through multiple methods, providing flexibility for applicants. You may choose to submit the form online via the Wisconsin Department of Revenue's website, which offers a user-friendly interface for electronic submissions. Alternatively, you can print the completed form and mail it to your local assessor's office. In-person submissions are also an option, allowing for direct interaction with local officials if needed.

Important Filing Deadlines for Wisconsin Tax Exemptions

Filing deadlines for the Wisconsin tax exempt form 2024 are critical to ensure that your application is considered for the current tax year. Generally, applications for property tax exemptions must be submitted by a specific date, often in early March. It is advisable to check the Wisconsin Department of Revenue's official guidelines for the exact deadlines, as timely submission can significantly impact your eligibility for tax relief.

Legal Use of the Wisconsin Tax Exempt Form 2024

The legal use of the Wisconsin tax exempt form 2024 is governed by state laws and regulations. It is essential for applicants to understand that providing false information on this form can lead to penalties, including fines or denial of the exemption. Therefore, ensuring that all information is accurate and truthful is not only a legal requirement but also a best practice for maintaining compliance with Wisconsin tax laws.

Quick guide on how to complete dor property tax exemption forms wisconsin department

Complete DOR Property Tax Exemption Forms Wisconsin Department easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage DOR Property Tax Exemption Forms Wisconsin Department on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign DOR Property Tax Exemption Forms Wisconsin Department effortlessly

- Find DOR Property Tax Exemption Forms Wisconsin Department and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides for that very purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign DOR Property Tax Exemption Forms Wisconsin Department and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor property tax exemption forms wisconsin department

Create this form in 5 minutes!

How to create an eSignature for the dor property tax exemption forms wisconsin department

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Wisconsin tax exempt form 2024?

The Wisconsin tax exempt form 2024 is a document that allows eligible entities to claim exemption from state sales tax on purchases. This form is vital for organizations such as non-profits, schools, and government agencies to ensure they do not pay unnecessary taxes on qualified purchases. Understanding how to properly fill out and submit this form can save your organization signNow funds.

-

How do I obtain the Wisconsin tax exempt form 2024?

You can obtain the Wisconsin tax exempt form 2024 directly from the Wisconsin Department of Revenue website or through authorized state agencies. It's important to ensure that you are using the most current version of the form to avoid any filing mistakes. Once downloaded, the form can be filled out digitally and submitted easily.

-

What are the benefits of using airSlate SignNow for the Wisconsin tax exempt form 2024?

Using airSlate SignNow for the Wisconsin tax exempt form 2024 allows for secure and streamlined document management. Our platform makes it easy to eSign and send forms digitally, reducing paperwork and saving time. Plus, you can track the status of your documents in real-time, ensuring you stay organized.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin tax exempt form 2024?

While airSlate SignNow offers various pricing tiers, signing documents like the Wisconsin tax exempt form 2024 can be part of a cost-effective package. Users can choose a plan that best fits their needs and budget. Additionally, the efficiency gained through our platform can lead to long-term savings.

-

Can I integrate airSlate SignNow with other tools for the Wisconsin tax exempt form 2024?

Yes, airSlate SignNow easily integrates with a variety of tools and applications, enhancing your workflow with the Wisconsin tax exempt form 2024. Whether you are using CRM systems, cloud storage services, or accounting software, you can streamline your tasks and document management efficiently. These integrations help maintain a seamless process from start to finish.

-

How can I ensure my Wisconsin tax exempt form 2024 is filled out correctly?

To ensure your Wisconsin tax exempt form 2024 is filled out correctly, carefully follow the guidelines provided by the Wisconsin Department of Revenue. Double-check all required fields are completed, and utilize airSlate SignNow's templates and eSignature features to avoid common mistakes. Additionally, consider having a colleague review your submission for accuracy.

-

What types of organizations can use the Wisconsin tax exempt form 2024?

Various organizations can use the Wisconsin tax exempt form 2024, including non-profit organizations, government entities, and educational institutions. Each entity must meet specific eligibility criteria to qualify for tax exemption. It’s essential to familiarize yourself with these criteria to ensure your organization benefits effectively.

Get more for DOR Property Tax Exemption Forms Wisconsin Department

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract washington form

- Notice of intent to enforce forfeiture provisions of contact for deed washington form

- Final notice of forfeiture and request to vacate property under contract for deed washington form

- Buyers request for accounting from seller under contract for deed washington form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed washington form

- General notice of default for contract for deed washington form

- Washington seller disclosure form

- Seller disclosure agreement 497429217 form

Find out other DOR Property Tax Exemption Forms Wisconsin Department

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile