Mark an X in the Box If You Are a QEZE First Certified between August 1, , and March 31, , that Conducts Its Tax Ny Form

Understanding the QEZE First Certification

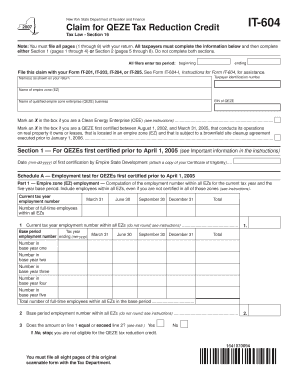

The "Mark An X In The Box If You Are A QEZE First Certified Between August 1, , And March 31, , That Conducts Its Tax Ny" form is essential for businesses seeking to identify their eligibility for specific tax benefits under the Qualified Empire Zone Enterprise (QEZE) program. This certification is designed to encourage economic development in designated areas by offering tax incentives to eligible businesses. To qualify, a business must be certified within the specified dates and meet certain operational criteria.

Steps to Complete the Form

Completing the form requires careful attention to detail. First, ensure that your business is indeed QEZE First certified within the specified timeframe. Gather necessary documentation that proves your certification status. Next, locate the section on the form where you need to mark an 'X' to indicate your eligibility. Double-check all entries for accuracy before submission to avoid any processing delays.

Eligibility Criteria for QEZE Certification

To be eligible for the QEZE First certification, a business must meet specific criteria set forth by the state. This includes operating within a designated QEZE area and fulfilling job creation or retention requirements. Additionally, businesses must demonstrate that they are actively engaged in economic activities that contribute to the local economy. It's important to review these criteria thoroughly to ensure compliance before applying.

Required Documentation

When filling out the form, certain documents may be required to substantiate your claim. This typically includes proof of your QEZE First certification, tax identification numbers, and any supporting financial statements that demonstrate your business operations. Having these documents readily available can streamline the process and ensure that your application is complete.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for compliance. The form must be submitted by the established deadlines to ensure that your business can take advantage of the tax benefits associated with the QEZE program. Missing these deadlines may result in the loss of potential tax incentives. Always check the latest updates from the state tax authority to stay informed about important dates.

Legal Use of the Form

The "Mark An X In The Box If You Are A QEZE First Certified Between August 1, , And March 31, , That Conducts Its Tax Ny" form serves a legal purpose in tax reporting and compliance. Proper use of this form ensures that businesses are accurately representing their eligibility for tax benefits. Misrepresentation or failure to submit the form correctly can lead to penalties or loss of certification.

Quick guide on how to complete mark an x in the box if you are a qeze first certified between august 1 and march 31 that conducts its tax ny

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mark an x in the box if you are a qeze first certified between august 1 and march 31 that conducts its tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Mark An X In The Box If You Are A QEZE First Certified Between August 1, , And March 31, , That Conducts Its Tax Ny?'

Marking an X in the box signifies your eligibility for special tax benefits under the Qualified Emerging Technology Company (QEZE) certification. This certification is crucial for businesses conducting tax-related activities in New York, especially those certified during the specified period.

-

How can airSlate SignNow help with QEZE tax documentation?

airSlate SignNow provides an efficient platform for creating, signing, and managing tax documents associated with the QEZE certification. By using our eSignature solution, you can ensure that your compliance paperwork is handled swiftly and securely, making it easier to mark an X in the box for your tax submissions.

-

What are the pricing options for using airSlate SignNow?

Our pricing is designed to be cost-effective and flexible, accommodating businesses of all sizes. By choosing airSlate SignNow, you can access powerful features to streamline your operations, helping you mark an X in the box if you are QEZE certified and ensure fair tax practices under New York regulations.

-

What features does airSlate SignNow offer that are beneficial for QEZE certified businesses?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and cloud storage, all of which facilitate efficient document management. By using these features, QEZE certified businesses can easily manage their documentation needs and simplify the process of marking an X in the box for tax compliance.

-

Can airSlate SignNow integrate with other software to support my business?

Yes, airSlate SignNow offers integrations with various software platforms like CRM systems and accounting tools. These integrations help streamline your workflow, allowing you to efficiently manage the documents required when you mark an X in the box if you are QEZE certified and conducting business in New York.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! Whether you are a small startup or a large corporation, airSlate SignNow offers scalable solutions that can adapt to your needs. By providing an easy-to-use platform, we help you manage the documentation effectively when marking an X in the box for QEZE certification and tax compliance.

-

What are the benefits of using eSignatures for QEZE certifications?

Using eSignatures with airSlate SignNow ensures that your QEZE certification documents are signed quickly and securely, reducing delays and potential errors. This enhances your efficiency in marking an X in the box on your tax submissions and provides an added layer of compliance protection throughout the process.

Get more for Mark An X In The Box If You Are A QEZE First Certified Between August 1, , And March 31, , That Conducts Its Tax Ny

- Transaid eligibility application fill and sign printable template form

- Metropolitan life insurance company gul beneficiary form

- Download proxy access form unitypoint health

- Chubb marine insurance application doc form

- Agreements promotions form

- Loan submission form fha sponsor number 247510000

- Limited residential appraisal and summary 1095 form

- Credit application form feb

Find out other Mark An X In The Box If You Are A QEZE First Certified Between August 1, , And March 31, , That Conducts Its Tax Ny

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract