H EZ Wisconsin Department of Revenue Revenue Wi Form

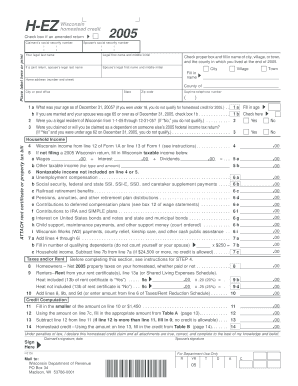

What is the H EZ Wisconsin Department Of Revenue Revenue Wi

The H EZ Wisconsin Department Of Revenue Revenue Wi is a specific form used by taxpayers in Wisconsin to report their income and calculate their tax obligations. This form is particularly designed for individuals who qualify for certain tax benefits or exemptions under state law. It simplifies the reporting process for eligible taxpayers, ensuring they can easily comply with state tax regulations.

How to use the H EZ Wisconsin Department Of Revenue Revenue Wi

Using the H EZ Wisconsin Department Of Revenue Revenue Wi requires understanding the specific sections of the form. Taxpayers should gather all necessary financial documents, including income statements and any relevant deduction information. The form guides users through the process of reporting their income, claiming deductions, and calculating their tax liability. It is important to follow the instructions carefully to ensure accurate completion.

Steps to complete the H EZ Wisconsin Department Of Revenue Revenue Wi

Completing the H EZ Wisconsin Department Of Revenue Revenue Wi involves several key steps:

- Gather all necessary documentation, including W-2s and 1099 forms.

- Fill out personal information accurately at the top of the form.

- Report income in the designated sections, ensuring all figures are correct.

- Claim any eligible deductions, following the guidelines provided.

- Calculate the total tax owed or refund due based on the information provided.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for using the H EZ Wisconsin Department Of Revenue Revenue Wi, taxpayers must meet specific eligibility criteria. Generally, this form is intended for individuals with straightforward tax situations, such as those with a single source of income or limited deductions. It is essential to review the eligibility requirements outlined by the Wisconsin Department of Revenue to determine if this form is appropriate for your tax situation.

Required Documents

When preparing to fill out the H EZ Wisconsin Department Of Revenue Revenue Wi, certain documents are essential. Taxpayers should have the following on hand:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any deductions or credits claimed.

- Identification information, such as Social Security numbers.

Form Submission Methods

The H EZ Wisconsin Department Of Revenue Revenue Wi can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the Wisconsin Department of Revenue's website, which often provides a streamlined process. Alternatively, the form can be printed and mailed to the appropriate department, or submitted in person at designated locations. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your needs.

Quick guide on how to complete h ez wisconsin department of revenue revenue wi

Effortlessly Prepare [SKS] on Any Device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to H EZ Wisconsin Department Of Revenue Revenue Wi

Create this form in 5 minutes!

How to create an eSignature for the h ez wisconsin department of revenue revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is H EZ Wisconsin Department Of Revenue Revenue Wi?

H EZ Wisconsin Department Of Revenue Revenue Wi is a streamlined solution designed to simplify the process of managing tax documents and eSignatures. With airSlate SignNow, businesses can efficiently handle their documentation needs while ensuring compliance with state regulations.

-

How does airSlate SignNow integrate with H EZ Wisconsin Department Of Revenue Revenue Wi?

airSlate SignNow offers seamless integration with H EZ Wisconsin Department Of Revenue Revenue Wi, allowing users to easily send and eSign tax documents. This integration enhances workflow efficiency and ensures that all necessary documents are processed quickly and securely.

-

What are the pricing options for using airSlate SignNow with H EZ Wisconsin Department Of Revenue Revenue Wi?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses using H EZ Wisconsin Department Of Revenue Revenue Wi. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while offering comprehensive features.

-

What features does airSlate SignNow offer for H EZ Wisconsin Department Of Revenue Revenue Wi users?

Users of H EZ Wisconsin Department Of Revenue Revenue Wi can benefit from features such as customizable templates, automated workflows, and secure eSigning capabilities. These features help streamline the document management process and enhance overall productivity.

-

How can airSlate SignNow improve my business's efficiency with H EZ Wisconsin Department Of Revenue Revenue Wi?

By utilizing airSlate SignNow with H EZ Wisconsin Department Of Revenue Revenue Wi, businesses can signNowly reduce the time spent on document handling. The platform's user-friendly interface and automation tools allow for faster processing and improved accuracy in tax-related documentation.

-

Is airSlate SignNow secure for handling H EZ Wisconsin Department Of Revenue Revenue Wi documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents related to H EZ Wisconsin Department Of Revenue Revenue Wi are protected. The platform employs advanced encryption and compliance measures to safeguard sensitive information throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for H EZ Wisconsin Department Of Revenue Revenue Wi?

Absolutely! airSlate SignNow is fully accessible on mobile devices, allowing users to manage H EZ Wisconsin Department Of Revenue Revenue Wi documents on the go. This flexibility ensures that you can send and eSign documents anytime, anywhere.

Get more for H EZ Wisconsin Department Of Revenue Revenue Wi

- Registration form cecil college cecil

- Field trip chaperone agreement form somerset academy

- Hold harmless form east central college

- Met annual kareem family science fair form

- Iupui foreign vendor packet form

- Self evaluation form pdf warren wilson college warren wilson

- Fillable online sierracollege reinstatement petition financial form

- Intern information sheet suny new paltz

Find out other H EZ Wisconsin Department Of Revenue Revenue Wi

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself