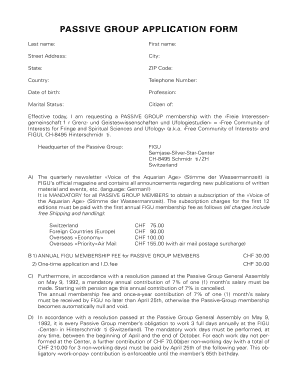

PASSIVE GROUP APPLICATION FORM

What is the PASSIVE GROUP APPLICATION FORM

The PASSIVE GROUP APPLICATION FORM is a specific document used by groups to apply for passive income tax treatment. This form is essential for organizations that wish to report income generated from passive activities, such as rental properties or investments, under U.S. tax law. By utilizing this form, groups can streamline their tax reporting process and ensure compliance with IRS regulations.

How to use the PASSIVE GROUP APPLICATION FORM

Using the PASSIVE GROUP APPLICATION FORM involves several steps to ensure accurate completion. First, gather all necessary information regarding the group’s passive income sources. Next, fill out the form with details about each member of the group, including their share of income. Once completed, review the form for accuracy before submission. This careful approach helps avoid potential errors that could lead to delays or penalties.

Steps to complete the PASSIVE GROUP APPLICATION FORM

Completing the PASSIVE GROUP APPLICATION FORM requires a systematic approach:

- Collect all relevant financial documents related to passive income.

- Identify all group members and their respective shares of income.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check the entries for any discrepancies.

- Submit the form by the designated deadline to avoid penalties.

Required Documents

To successfully complete the PASSIVE GROUP APPLICATION FORM, certain documents are necessary. These may include:

- Financial statements detailing income from passive activities.

- Identification information for all group members.

- Any prior tax returns related to passive income.

Having these documents ready will facilitate a smoother application process.

Eligibility Criteria

Eligibility for submitting the PASSIVE GROUP APPLICATION FORM is typically based on the nature of the income generated. Groups must ensure that their income qualifies as passive under IRS guidelines. This generally includes income from rental activities, royalties, or limited partnerships. Understanding these criteria is crucial for proper form submission.

Form Submission Methods

The PASSIVE GROUP APPLICATION FORM can be submitted through various methods, providing flexibility for users. Options include:

- Online submission through the IRS e-file system.

- Mailing a physical copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can impact processing times and overall convenience.

Quick guide on how to complete passive group application form

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and seamlessly. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related operations today.

The easiest way to edit and eSign [SKS] without difficulty

- Obtain [SKS] and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure clear communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PASSIVE GROUP APPLICATION FORM

Create this form in 5 minutes!

How to create an eSignature for the passive group application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PASSIVE GROUP APPLICATION FORM?

The PASSIVE GROUP APPLICATION FORM is a digital document designed to streamline the application process for groups seeking to participate in various programs. It allows users to fill out and submit their information electronically, ensuring a more efficient and organized approach.

-

How can I access the PASSIVE GROUP APPLICATION FORM?

You can easily access the PASSIVE GROUP APPLICATION FORM through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and select the PASSIVE GROUP APPLICATION FORM to begin the application process.

-

What are the benefits of using the PASSIVE GROUP APPLICATION FORM?

Using the PASSIVE GROUP APPLICATION FORM offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. It allows groups to submit their applications quickly and securely, improving overall efficiency in the application process.

-

Is the PASSIVE GROUP APPLICATION FORM customizable?

Yes, the PASSIVE GROUP APPLICATION FORM can be customized to meet the specific needs of your organization. You can add or modify fields, adjust the layout, and incorporate branding elements to ensure the form aligns with your group’s identity.

-

What integrations are available with the PASSIVE GROUP APPLICATION FORM?

The PASSIVE GROUP APPLICATION FORM integrates seamlessly with various applications, including CRM systems and cloud storage solutions. This allows for easy data transfer and management, enhancing your workflow and ensuring that all information is centralized.

-

How much does it cost to use the PASSIVE GROUP APPLICATION FORM?

The cost of using the PASSIVE GROUP APPLICATION FORM varies based on the subscription plan you choose with airSlate SignNow. We offer flexible pricing options to accommodate different business sizes and needs, ensuring you get the best value for your investment.

-

Can I track submissions of the PASSIVE GROUP APPLICATION FORM?

Absolutely! airSlate SignNow provides tracking features for the PASSIVE GROUP APPLICATION FORM, allowing you to monitor submissions in real-time. This ensures you stay updated on the status of applications and can follow up as needed.

Get more for PASSIVE GROUP APPLICATION FORM

Find out other PASSIVE GROUP APPLICATION FORM

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter