New York State Department of Taxation and Finance CT 32 S New York Bank S Corporation Franchise Tax Return Calendar Year Filers Form

Understanding the New York State Department Of Taxation And Finance CT-32-S

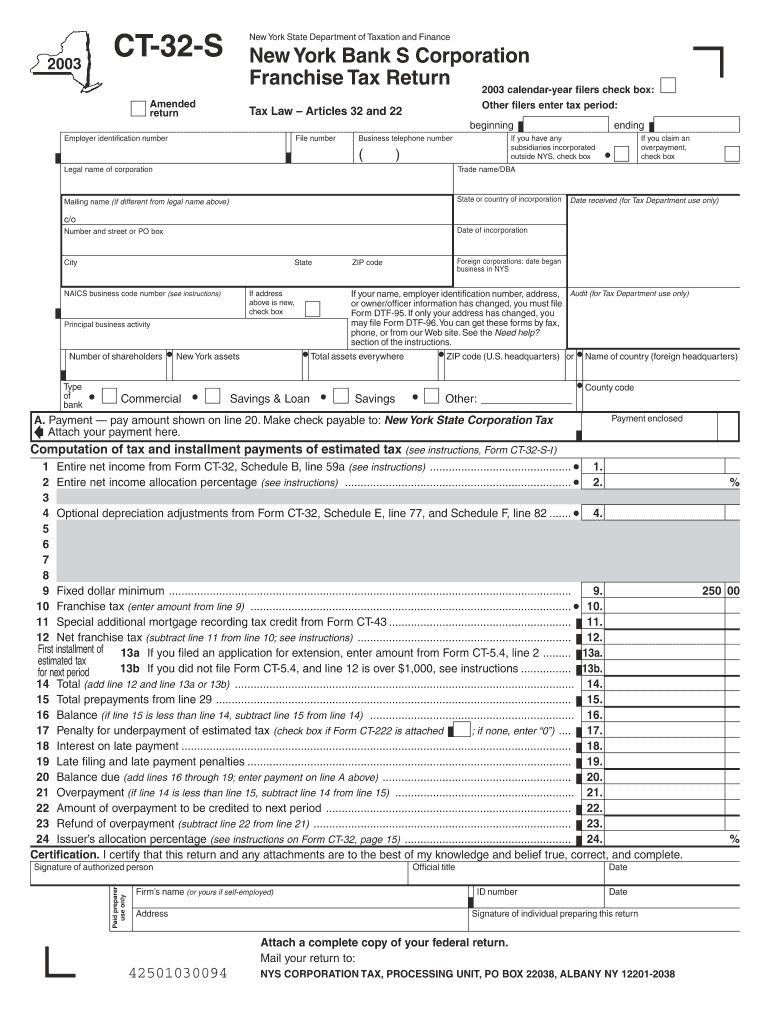

The New York State Department Of Taxation And Finance CT-32-S is a crucial tax form for banks operating as S corporations within New York. This form is specifically designed for calendar year filers and is used to report franchise taxes. It includes various sections that require detailed financial information about the corporation, ensuring compliance with state tax laws under Articles 32 and 22. Understanding this form is essential for accurate tax reporting and to avoid potential penalties.

Steps to Complete the CT-32-S Form

Completing the CT-32-S form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, ensuring all corporate details are accurate.

- Report the corporation's income and expenses in the designated sections.

- Check the appropriate box if filing an amended return.

- Review the completed form for accuracy before submission.

Each step is vital for ensuring that the form is filled out correctly and submitted on time.

Legal Use of the CT-32-S Form

The CT-32-S form serves a legal purpose by documenting the tax obligations of S corporations in New York. Proper use of this form is necessary to comply with state tax regulations. Failure to file or inaccuracies can lead to penalties, interest, and potential audits. Therefore, it is important for corporations to understand their legal responsibilities when using this form.

Filing Deadlines and Important Dates

Timely filing of the CT-32-S form is critical. The due date for calendar year filers typically aligns with the corporation's annual tax return deadlines. It is essential to keep track of these dates to avoid late fees and penalties. Corporations should also be aware of any changes in tax laws that may affect filing requirements.

Required Documents for Filing

To complete the CT-32-S form, corporations must gather several documents, including:

- Financial statements, including profit and loss statements.

- Balance sheets detailing assets and liabilities.

- Any prior year tax returns for reference.

Having these documents ready can streamline the filing process and ensure accuracy.

Form Submission Methods

The CT-32-S form can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on the corporation's preferences and the urgency of the filing.

Quick guide on how to complete new york state department of taxation and finance ct 32 s new york bank s corporation franchise tax return calendar year filers

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to retrieve the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] with minimal effort

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then press the Done button to retain your adjustments.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance CT 32 S New York Bank S Corporation Franchise Tax Return Calendar year Filers

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance ct 32 s new york bank s corporation franchise tax return calendar year filers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance CT 32 S New York Bank S Corporation Franchise Tax Return?

The New York State Department Of Taxation And Finance CT 32 S New York Bank S Corporation Franchise Tax Return is a tax form specifically designed for banks operating in New York. It allows calendar year filers to report their franchise tax obligations. Understanding this form is crucial for compliance and to avoid penalties.

-

How do I file an amended return for the CT 32 S New York Bank S Corporation Franchise Tax?

To file an amended return for the CT 32 S New York Bank S Corporation Franchise Tax, you need to check the amended return box on the form. Ensure that you enter the correct tax period and any adjustments needed. This process helps in rectifying any errors from your original filing.

-

What are the benefits of using airSlate SignNow for tax document management?

airSlate SignNow offers a user-friendly platform for managing tax documents, including the CT 32 S New York Bank S Corporation Franchise Tax Return. It streamlines the eSigning process, ensuring that your documents are signed quickly and securely. This efficiency can save you time and reduce the stress associated with tax season.

-

Is airSlate SignNow compliant with New York tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those set by the New York State Department Of Taxation And Finance. This ensures that your use of the platform for filing the CT 32 S New York Bank S Corporation Franchise Tax Return meets legal requirements, providing peace of mind.

-

What features does airSlate SignNow offer for tax professionals?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for tax professionals. These tools help in efficiently managing the CT 32 S New York Bank S Corporation Franchise Tax Return and other tax-related documents. This can enhance your productivity and client satisfaction.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers integrations with various accounting software, making it easier to manage your tax documents. This is particularly useful for handling the CT 32 S New York Bank S Corporation Franchise Tax Return alongside your other financial tasks. Integration helps streamline your workflow and reduces the chances of errors.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for individual users and teams. The pricing is competitive and reflects the value of features that assist with tax document management, such as the CT 32 S New York Bank S Corporation Franchise Tax Return. You can choose a plan that best fits your budget and requirements.

Get more for New York State Department Of Taxation And Finance CT 32 S New York Bank S Corporation Franchise Tax Return Calendar year Filers

- West vancouver police departmentwest vancouver police form

- Www pdffiller com426988966 calgary ethiopiancalgary ethiopian community association fill online form

- Bcaoa orgwp contentuploadsliability insurance program application form 20162017

- Www uslegalforms comform library339944declaration of project completion fill and sign printable

- Heidelhouse comwp contentuploadsvendor application december 3 ampamp 4 entry form

- Members manual icna sisters icnasisters form

- Course waiver form guelph

- Fin 312 direct deposit application provincial treasury form

Find out other New York State Department Of Taxation And Finance CT 32 S New York Bank S Corporation Franchise Tax Return Calendar year Filers

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple