Schedule Se 2018

What is the Schedule SE?

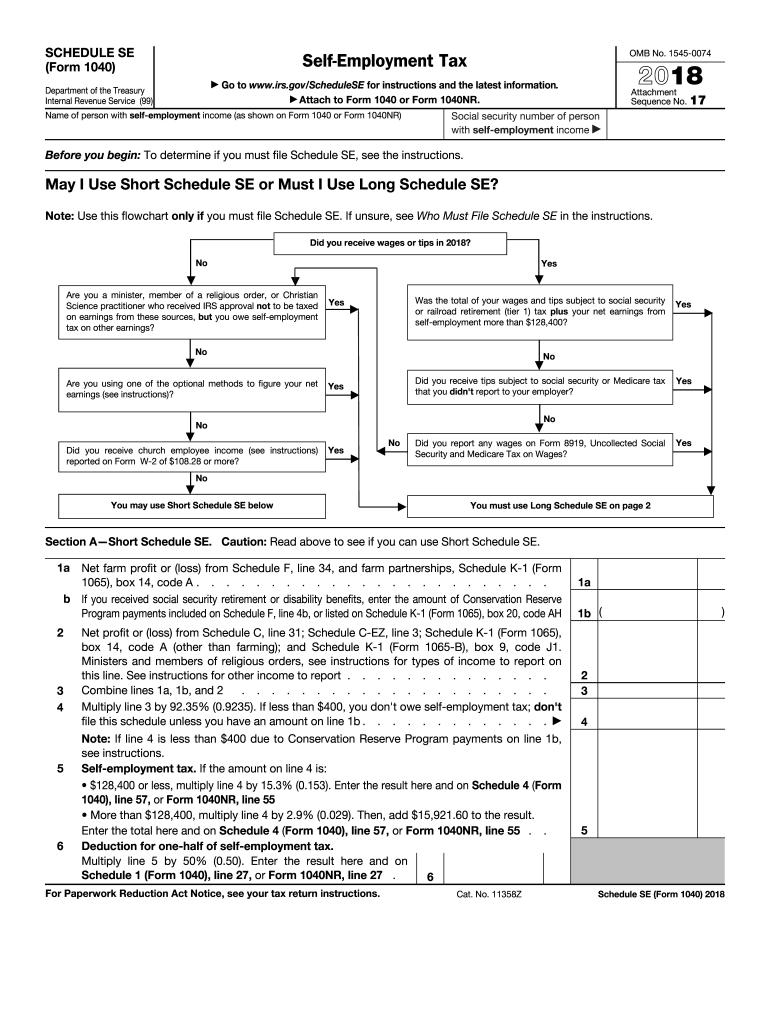

The Schedule SE is a form used by self-employed individuals to calculate their self-employment tax. This tax is essential for funding Social Security and Medicare, similar to the payroll taxes withheld from employees' wages. The Schedule SE is typically filed alongside Form 1040, the individual income tax return. Understanding this form is crucial for anyone earning income through self-employment, as it determines the amount owed for self-employment tax based on net earnings.

How to use the Schedule SE

To use the Schedule SE, begin by gathering all relevant financial information, including your total income from self-employment and any business expenses. Complete the form by entering your net earnings, which can be calculated from your income minus allowable deductions. The form will guide you through the calculation of the self-employment tax based on your net earnings, which is then reported on your Form 1040. It is important to ensure accuracy in your calculations to avoid potential penalties.

Steps to complete the Schedule SE

Completing the Schedule SE involves several key steps:

- Gather your financial records, including income and expenses related to your self-employment.

- Calculate your net earnings by subtracting your business expenses from your total income.

- Fill out Part I of the Schedule SE to determine your self-employment tax based on your net earnings.

- Transfer the calculated self-employment tax amount to your Form 1040.

- Review your completed Schedule SE for accuracy before submission.

Legal use of the Schedule SE

The Schedule SE must be used in compliance with IRS regulations. It is legally required for self-employed individuals to report their earnings accurately to ensure proper contributions to Social Security and Medicare. Failure to file the Schedule SE or inaccuracies in reporting can result in penalties or interest on unpaid taxes. It is advisable to keep thorough records of income and expenses to support your calculations and ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE align with the general tax filing deadlines for individuals. Typically, the deadline for submitting your Form 1040, along with the Schedule SE, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these deadlines to avoid late fees and penalties.

Who Issues the Form

The Schedule SE is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides the form and guidelines for its completion and submission. It is essential to use the most current version of the Schedule SE to ensure compliance with the latest tax regulations.

Quick guide on how to complete form self employment tax 2018

Discover the most efficient method to complete and endorse your Schedule Se

Are you still spending time on preparing your official papers in physical form instead of doing it online? airSlate SignNow provides a superior way to finalize and endorse your Schedule Se and related forms for public services. Our advanced electronic signature platform equips you with all the tools necessary to handle documents swiftly while adhering to official standards - robust PDF editing, managing, safeguarding, signing, and sharing features are all available within an intuitive interface.

Only a few steps are required to complete and endorse your Schedule Se:

- Incorporate the fillable template into the editor using the Get Form button.

- Review the information you need to include in your Schedule Se.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what’s truly important or Mask sections that are no longer relevant.

- Hit Sign to create a legally valid electronic signature using your chosen method.

- Add the Date next to your signature and conclude your process with the Done button.

Store your finished Schedule Se in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our solution also allows for flexible file sharing. There’s no need to print your templates when you can send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form self employment tax 2018

FAQs

-

How do I declare taxes on self-employment? I didn't get any form mailed out.

Hopefully you have kept detailed records of both your income AND your expenses or you will likely end up paying far more tax than you should. Hopefully you have also kept track of this and paid in estimated taxes quarterly or you may end up owing penalties on top of the taxes. There may also be other taxes owed throughout the year depending on your type of business.Self employment taxes can be a unpleasant surprise to someone who thinks they owe no taxes because they made less than the amount you would normally owe income tax on. Self employment taxes start at only $600 of self employment income and you really don’t get any deductions or credits to lower it.But given you are just now asking (after the end of the year) how to file your self-employment taxes, I would guess your records and quarterly tax filings are lacking.The short version is you file Schedule C and SE. But given the apparent lack of knowledge and preparation, it may be wise to consult with a tax professional and/or accountant and make sure you have everything covered and that you get set up to keep track of income and expenses as you go next year. It will make things so much easier.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the form self employment tax 2018

How to generate an electronic signature for the Form Self Employment Tax 2018 online

How to make an eSignature for the Form Self Employment Tax 2018 in Google Chrome

How to generate an eSignature for putting it on the Form Self Employment Tax 2018 in Gmail

How to create an electronic signature for the Form Self Employment Tax 2018 right from your mobile device

How to create an eSignature for the Form Self Employment Tax 2018 on iOS

How to generate an electronic signature for the Form Self Employment Tax 2018 on Android OS

People also ask

-

What is scedule se 2014, and how does it relate to airSlate SignNow?

Scedule se 2014 refers to specific provisions and features offered in our service that comply with various regulatory standards. airSlate SignNow incorporates these features to ensure your document signing process is secure and compliant. With scedule se 2014, businesses can confidently manage their documents while adhering to necessary guidelines.

-

How much does it cost to use airSlate SignNow under the scedule se 2014?

AirSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes. While pricing may vary based on the selected plan, all options include features compliant with scedule se 2014, ensuring you receive value and security in your document management. Visit our pricing page to learn more about our affordable plans.

-

What features are included with airSlate SignNow's scedule se 2014 compliance?

When using airSlate SignNow under scedule se 2014, customers benefit from features such as secure eSignature, document templates, and audit trails. These features ensure a seamless signing experience while maintaining compliance with industry standards. Explore our features page for a full list of capabilities related to scedule se 2014.

-

What are the benefits of using airSlate SignNow with scedule se 2014?

The primary benefits of using airSlate SignNow with scedule se 2014 include enhanced security, regulatory compliance, and efficient document processing. This combination allows businesses to focus on their core operations while ensuring their digital documentation meets necessary guidelines. Experience the convenience of quick, secure eSigning with airSlate SignNow.

-

Does airSlate SignNow integrate with other software while maintaining scedule se 2014 compliance?

Yes, airSlate SignNow seamlessly integrates with a variety of software solutions while adhering to scedule se 2014 compliance standards. This ensures that regardless of your existing tech ecosystem, you can incorporate our secure eSigning capabilities without compromising compliance. Check our integrations page to discover compatible applications.

-

How can I ensure my documents meet scedule se 2014 requirements with airSlate SignNow?

To ensure your documents meet scedule se 2014 requirements, use airSlate SignNow's built-in features like customizable templates and detailed audit trails. These tools provide a structured approach to document management that aligns with regulatory standards. Utilizing these features guarantees your processes remain compliant.

-

Is there a free trial available for airSlate SignNow under scedule se 2014?

Yes, airSlate SignNow offers a free trial that allows you to explore its features while ensuring compliance with scedule se 2014. This trial period is an excellent opportunity to understand how our solution can meet your business's eSigning needs. Sign up today to experience the benefits firsthand.

Get more for Schedule Se

Find out other Schedule Se

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document