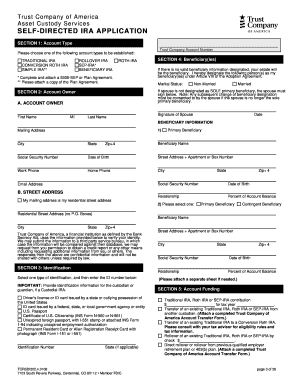

SELF DIRECTED IRA APPLICATION Trust Company of America Form

What is the Self Directed IRA Application for Trust Company of America

The Self Directed IRA Application for Trust Company of America is a specialized document that allows individuals to establish a self-directed individual retirement account (IRA). This type of account provides the account holder with the flexibility to invest in a broader range of assets compared to traditional IRAs, including real estate, private equity, and other alternative investments. By using this application, individuals can take control of their retirement savings and make investment decisions that align with their financial goals.

Steps to Complete the Self Directed IRA Application for Trust Company of America

Completing the Self Directed IRA Application involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number, date of birth, and contact details. Next, choose the type of self-directed IRA you wish to open, such as a traditional or Roth IRA. After selecting the account type, fill out the application form with the required details, ensuring that all information is accurate and complete. Finally, submit the application along with any required documentation, such as identification and proof of address, to Trust Company of America for processing.

Required Documents for the Self Directed IRA Application

To successfully complete the Self Directed IRA Application, several documents are typically required. These may include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of address, which can be a utility bill or bank statement.

- Your Social Security number or tax identification number.

- Any previous retirement account statements if you are transferring funds.

Having these documents ready can streamline the application process and help avoid delays.

Eligibility Criteria for the Self Directed IRA Application

Eligibility for opening a Self Directed IRA with Trust Company of America generally requires that the applicant is at least eighteen years old and has earned income. Additionally, individuals must not exceed the contribution limits set by the IRS for the tax year. Certain restrictions may apply based on the type of investments being considered, so it is important to review IRS guidelines to ensure compliance.

Application Process & Approval Time for the Self Directed IRA Application

The application process for the Self Directed IRA with Trust Company of America typically involves submitting the completed application form along with required documents. Once submitted, the approval time can vary, but applicants can generally expect a response within a few business days. During this time, Trust Company of America will review the application for completeness and compliance with regulatory requirements. If additional information is needed, they will reach out to the applicant directly.

Legal Use of the Self Directed IRA Application

The Self Directed IRA Application is legally binding and must comply with IRS regulations governing retirement accounts. This includes adhering to contribution limits, distribution rules, and prohibited transactions. It is essential for applicants to understand these legal stipulations to avoid penalties and ensure that their retirement savings are protected. Consulting a financial advisor or tax professional can provide additional guidance on legal considerations when using this application.

Quick guide on how to complete self directed ira application trust company of america

Easily prepare SELF DIRECTED IRA APPLICATION Trust Company Of America on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct version and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle SELF DIRECTED IRA APPLICATION Trust Company Of America on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign SELF DIRECTED IRA APPLICATION Trust Company Of America effortlessly

- Find SELF DIRECTED IRA APPLICATION Trust Company Of America and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes requiring new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign SELF DIRECTED IRA APPLICATION Trust Company Of America to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self directed ira application trust company of america

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SELF DIRECTED IRA APPLICATION Trust Company Of America?

A SELF DIRECTED IRA APPLICATION Trust Company Of America allows individuals to manage their retirement funds by investing in a wider range of assets beyond traditional stocks and bonds. This application provides the flexibility to choose investments that align with personal financial goals, making it a popular choice for savvy investors.

-

How do I start my SELF DIRECTED IRA APPLICATION Trust Company Of America?

To start your SELF DIRECTED IRA APPLICATION Trust Company Of America, you need to complete the application process online. This typically involves providing personal information, selecting your investment options, and funding your account. Once your application is approved, you can begin managing your investments.

-

What are the fees associated with the SELF DIRECTED IRA APPLICATION Trust Company Of America?

The fees for the SELF DIRECTED IRA APPLICATION Trust Company Of America can vary based on the services you choose. Generally, there may be setup fees, annual maintenance fees, and transaction fees. It's important to review the fee structure before proceeding to ensure it aligns with your investment strategy.

-

What types of investments can I make with a SELF DIRECTED IRA APPLICATION Trust Company Of America?

With a SELF DIRECTED IRA APPLICATION Trust Company Of America, you can invest in a variety of assets, including real estate, precious metals, private equity, and more. This flexibility allows you to diversify your portfolio and potentially increase your returns. Always consult with a financial advisor to ensure compliance with IRS regulations.

-

Are there any tax advantages to using a SELF DIRECTED IRA APPLICATION Trust Company Of America?

Yes, a SELF DIRECTED IRA APPLICATION Trust Company Of America offers signNow tax advantages. Contributions may be tax-deductible, and your investments can grow tax-deferred until you withdraw funds in retirement. This can lead to substantial savings over time, enhancing your overall retirement strategy.

-

Can I transfer my existing IRA to a SELF DIRECTED IRA APPLICATION Trust Company Of America?

Yes, you can transfer your existing IRA to a SELF DIRECTED IRA APPLICATION Trust Company Of America. This process typically involves filling out a transfer request form and providing necessary documentation. It's a straightforward way to gain more control over your retirement investments.

-

What features does the SELF DIRECTED IRA APPLICATION Trust Company Of America offer?

The SELF DIRECTED IRA APPLICATION Trust Company Of America offers features such as online account management, a wide range of investment options, and educational resources to help you make informed decisions. Additionally, you can access customer support for any questions or assistance you may need during your investment journey.

Get more for SELF DIRECTED IRA APPLICATION Trust Company Of America

Find out other SELF DIRECTED IRA APPLICATION Trust Company Of America

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document