Traditional, SEP, or Simple Annuity IRA Ameriprise Financial Form

Understanding the Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial

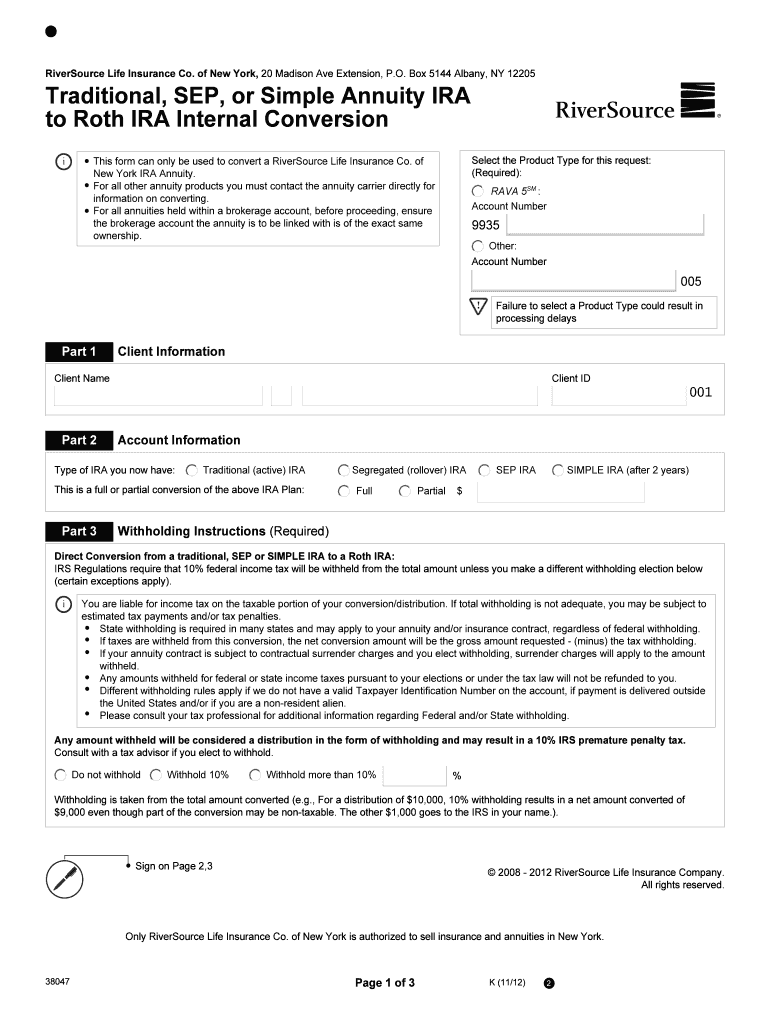

The Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial offers individuals a way to save for retirement while enjoying potential tax advantages. A Traditional IRA allows for tax-deductible contributions, while a SEP IRA is designed for self-employed individuals and small business owners, providing higher contribution limits. The Simple IRA is tailored for small businesses, allowing employees to contribute alongside employer contributions. Each type has unique features that cater to different financial situations and retirement goals.

Steps to Complete the Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial

To successfully complete the Traditional, SEP, or Simple Annuity IRA, follow these essential steps:

- Determine eligibility based on your employment status and income level.

- Gather necessary documentation, including identification and financial information.

- Choose the type of IRA that best fits your retirement needs.

- Complete the application form, ensuring all sections are filled out accurately.

- Submit the form through your preferred method, such as online or by mail.

Eligibility Criteria for the Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial

Eligibility for the Traditional, SEP, or Simple Annuity IRA varies based on the type of account:

- For a Traditional IRA, individuals must have earned income and be under the age of seventy and a half to contribute.

- Self-employed individuals and small business owners can establish a SEP IRA, allowing for higher contribution limits based on income.

- The Simple IRA is available to small businesses with fewer than one hundred employees, allowing both employer and employee contributions.

Required Documents for the Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial

When applying for a Traditional, SEP, or Simple Annuity IRA, you will need to provide specific documents:

- Proof of identity, such as a driver's license or passport.

- Social Security number for tax reporting purposes.

- Income documentation, including W-2 forms or self-employment income statements.

- Any previous retirement account statements if transferring funds.

IRS Guidelines for the Traditional, SEP, or Simple Annuity IRA

Understanding IRS guidelines is crucial for maintaining compliance and maximizing benefits:

- Contribution limits vary by account type and are subject to annual adjustments.

- Withdrawals from a Traditional IRA may be taxed as ordinary income, while early withdrawals may incur penalties.

- SEP and Simple IRAs have specific rules regarding employer contributions and employee eligibility.

Form Submission Methods for the Traditional, SEP, or Simple Annuity IRA from Ameriprise Financial

There are multiple methods for submitting your application for the Traditional, SEP, or Simple Annuity IRA:

- Online submission through the Ameriprise Financial website for a quick and efficient process.

- Mail-in submission, where you can send your completed form to the designated address.

- In-person submission at a local Ameriprise Financial office for personalized assistance.

Quick guide on how to complete traditional sep or simple annuity ira ameriprise financial

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without any delays. Handle [SKS] on any platform through airSlate SignNow’s Android or iOS applications and simplify your document-centric tasks today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with features offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Traditional, SEP, Or Simple Annuity IRA Ameriprise Financial

Create this form in 5 minutes!

How to create an eSignature for the traditional sep or simple annuity ira ameriprise financial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a traditional IRA account?

A traditional IRA is an account to which you can contribute pre-tax or after-tax dollars. Your contributions may be tax deductible depending on your situation, helping to give you immediate tax benefits.

-

What is the downside of SEP IRA?

If you set up a SEP, all employees must be included if they meet certain IRS-defined eligibility requirements. Equal contributions. Each employee must receive the same contribution as a percentage of salary. If you have more than a few employees, this may limit your ability to make large contributions for yourself.

-

Should I choose a SEP or SIMPLE IRA?

Generally, a SEP-IRA is good for businesses with less than 100 employees because it allows employers to adjust contributions based on cash flow. SIMPLE IRAs can be used by businesses of any size.

-

Which is better a traditional IRA or SEP-IRA?

If you're self-employed, a SEP IRA can allow you to save more than a traditional IRA, but be mindful that you have to contribute to an account for each employee as well. A traditional IRA may be a good option if you want to save more but aren't self-employed and can't open your own SEP IRA.

-

What is the difference between an annuity IRA and a traditional IRA?

Unlike an IRA, which typically can have only one owner, an annuity can be jointly owned. Annuities also do not have the annual contribution limits and income restrictions that IRAs have. There are a variety of annuities. You can fund an annuity all at once (known as a single premium) or you can pay into it over time.

-

How much will a SEP IRA reduce my taxes?

Will a SEP IRA Reduce Taxes? For an employer, a SEP IRA will reduce taxes, but that's not so for an individual. SEP IRAs are funded by tax-deductible dollars and are limited to up to 25% of an employee's compensation or $69,000, whichever is less in 2024.

-

What are the tax advantages of a SEP IRA?

Advantages of a SEP Contributions to a SEP are tax deductible, and your business pays no taxes on the investment earnings. You are not locked into making contributions every year. In fact, each year you decide whether, and how much, to contribute to your employees' SEP-IRAs.

-

Should I choose a SEP or SIMPLE IRA?

Generally, a SEP-IRA is good for businesses with less than 100 employees because it allows employers to adjust contributions based on cash flow. SIMPLE IRAs can be used by businesses of any size.

Get more for Traditional, SEP, Or Simple Annuity IRA Ameriprise Financial

- Fiscal year fy port security grant program fema fema form

- Fiscal year transit security grant program fema form

- Fiscal year fy tribal homeland security grant fema fema form

- Are you ready an in depth guide to citizen preparedness fema gov form

- Fiscal year 07 homeland nt program omeland fema fema form

- Fiscal year fy homeland security grant program hsgp frequently asked questions faqs fema form

- Fiscal year i nteroperable e mergency c fema fema form

- Petition to modify spousal maintenance or form

Find out other Traditional, SEP, Or Simple Annuity IRA Ameriprise Financial

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple