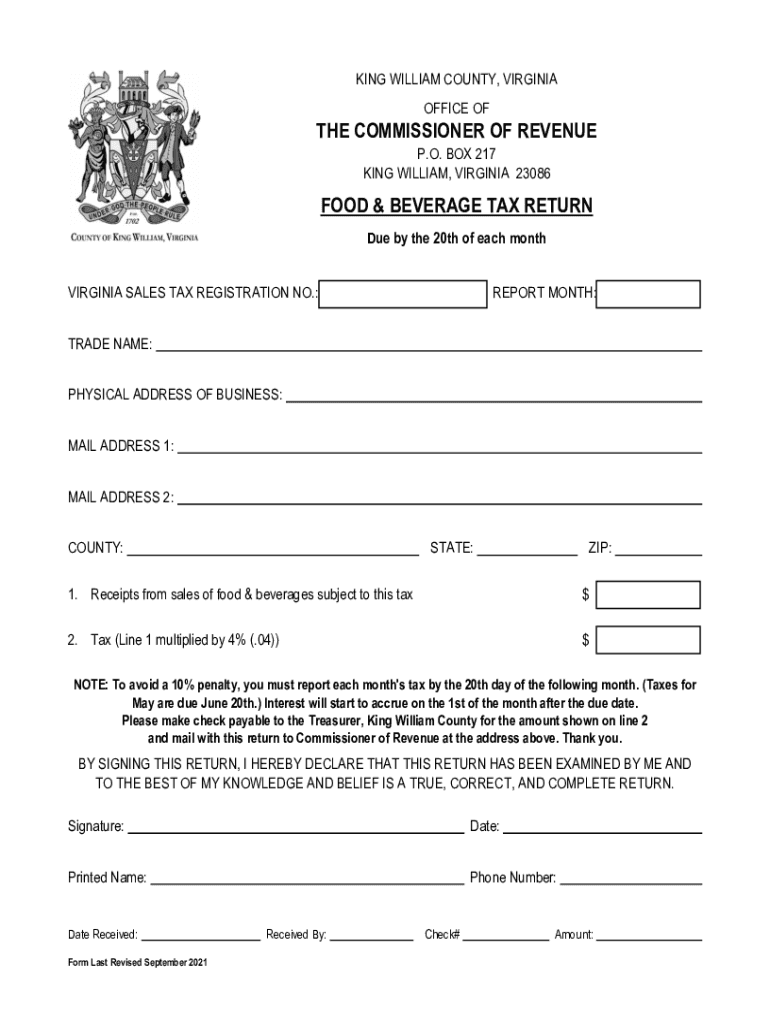

The COMMISSIONER of REVENUE Form

What is the Commissioner of Revenue

The Commissioner of Revenue is a key official responsible for overseeing tax collection and enforcement within a specific jurisdiction, typically at the state level in the United States. This role involves managing the administration of tax laws, ensuring compliance, and providing guidance to taxpayers. The Commissioner may also be involved in policy development related to taxation and revenue generation, aiming to create a fair and efficient tax system.

How to Obtain the Commissioner of Revenue

To obtain the services or information from the Commissioner of Revenue, taxpayers can typically visit the official state revenue department website. This site often provides resources such as forms, guidelines, and contact information. In some states, taxpayers may also be able to request information or assistance via phone or in-person visits to local offices.

Steps to Complete the Commissioner of Revenue Form

Completing forms associated with the Commissioner of Revenue generally involves several key steps:

- Gather necessary documentation, such as income statements, previous tax returns, and identification.

- Access the correct form from the state revenue department’s website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Commissioner of Revenue

The legal use of the Commissioner of Revenue encompasses the enforcement of tax laws and regulations. This includes the authority to audit taxpayers, collect unpaid taxes, and impose penalties for non-compliance. Taxpayers are expected to adhere to the guidelines set forth by the Commissioner to avoid legal repercussions.

Required Documents

When dealing with the Commissioner of Revenue, certain documents are typically required. These may include:

- Proof of identity, such as a driver’s license or Social Security card.

- Income documentation, including W-2s or 1099 forms.

- Previous tax returns for reference.

- Any relevant financial statements or records that support deductions or credits claimed.

Filing Deadlines / Important Dates

Filing deadlines for forms related to the Commissioner of Revenue can vary by state and type of tax. Generally, most income tax returns are due by April 15 each year. It is essential for taxpayers to be aware of specific deadlines to avoid late fees or penalties. Checking the state revenue department’s website can provide the most accurate and updated information regarding important dates.

Quick guide on how to complete the commissioner of revenue

Prepare THE COMMISSIONER OF REVENUE effortlessly on any device

Online document management has become increasingly popular with companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage THE COMMISSIONER OF REVENUE on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign THE COMMISSIONER OF REVENUE with ease

- Find THE COMMISSIONER OF REVENUE and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and eSign THE COMMISSIONER OF REVENUE to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the commissioner of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who is in charge of the Minnesota Department of Revenue?

Our leadership team consists of our commissioner, deputy commissioner, assistant commissioners, communications director, and chief business technology officer. Paul Marquart is the commissioner at the Minnesota Department of Revenue where he oversees the day-to-day operations for an agency with more than 1,400…

-

Who is in charge of Fairfax County?

Jeffrey C. Chairman McKay is a lifelong Fairfax County resident, born and raised on the historic Route One Corridor. As Chairman, he represents Fairfax County's 1.2 million residents.

-

What does the Virginia Commissioner of Revenue do?

The Commissioner of Revenue's duties include: Administering business taxes including: Business License Tax Business Tangible Tax Custodial taxes, including Meals Tax, Short-Term Rental Tax (like Air BnB), Transient Occupancy (Hotel) Tax, and Cigarette Tax. Providing protection of confidential taxpayer information.

-

What does the Commissioner of Revenue do in Virginia?

The Office of the Commissioner of the Revenue Assists Virginia taxpayers with filing state and local tax returns. Discovers and enrolls all persons and property for state and local taxation. Assesses all local taxes EXCEPT the real estate tax. Advocates amendment of unjust state and local tax laws.

-

Who is the US representative for Fairfax County VA?

Congressman Gerald E. “Gerry” Connolly is serving his eighth term in the U.S. House of Representatives from Virginia's 11th District, which includes Fairfax County and the City of Fairfax in Northern Virginia.

-

Who is the Commissioner of the Revenue in Fairfax County Virginia?

The Commissioner of the Revenue Office is headed by Page Johnson. The Commissioner of the Revenue is one of five Commonwealth of Virginia Constitutional Officers.

-

What does the Commissioner of the IRS do?

The IRS Commissioner is responsible for overall planning, directing, controlling and evaluating IRS policies, programs, and performance. The Office of the Commissioner consists of the Commissioner, Deputy Commissioner for Services and Enforcement, Deputy Commissioner for Operations Support, and their immediate staff.

-

Who is the county manager of Fairfax County Virginia?

Bryan Hill. County Executive, Fairfax County, Va.

Get more for THE COMMISSIONER OF REVENUE

- Ca2 form

- Lane county medical hardship dwelling form

- Crf 005 online application form

- State board of workers compensation notice of representation ga 2011 2019 form

- Mv 46a form

- Georgia department of corrections criminaldriver history consent form

- Offer in compromise short form form oic 1s etax dor ga

- Sample admit application packet to morehouse form

Find out other THE COMMISSIONER OF REVENUE

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement