Henderson County Occupancy Tax Report Henderson Co Form

Understanding the Henderson County Occupancy Tax Report

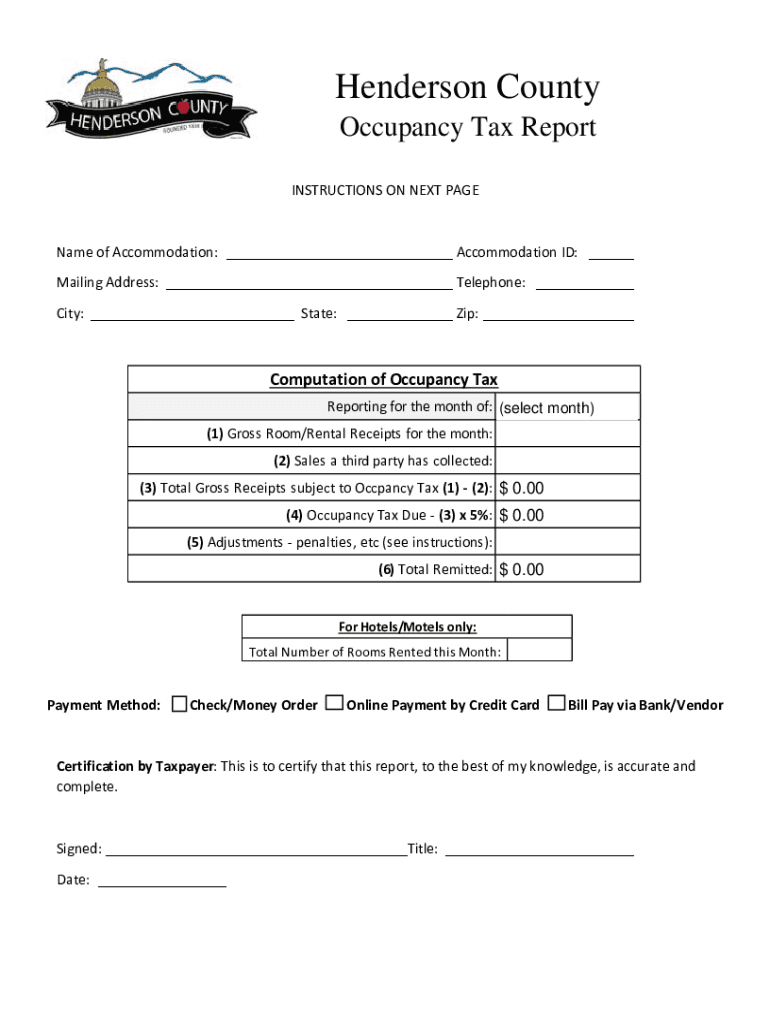

The Henderson County Occupancy Tax Report is a crucial document for businesses operating in the hospitality sector within Henderson County. This report is designed to collect taxes from lodging providers, such as hotels and vacation rentals, who offer accommodations to visitors. The funds generated from this tax are typically used to promote tourism and enhance local infrastructure. Understanding the specifics of this report is essential for compliance and to ensure that businesses contribute their fair share to the community.

How to Complete the Henderson County Occupancy Tax Report

Completing the Henderson County Occupancy Tax Report involves several key steps. First, businesses must gather all relevant sales data, including the total number of rooms rented and the gross rental income for the reporting period. Next, the applicable tax rate should be applied to the gross rental income to calculate the total tax owed. Finally, businesses must fill out the report accurately, ensuring all figures are correct before submission. It is advisable to keep a copy of the completed report for your records.

Obtaining the Henderson County Occupancy Tax Report

The Henderson County Occupancy Tax Report can be obtained through the Henderson County government website or directly from the local tax office located at 113 North Main Street, Hendersonville, NC 28792. Businesses may also request a physical copy if needed. It is important to ensure that you are using the most current version of the report, as forms may be updated periodically to reflect changes in tax rates or regulations.

Legal Considerations for the Henderson County Occupancy Tax Report

Filing the Henderson County Occupancy Tax Report is not just a matter of compliance; it is also a legal obligation for businesses in the hospitality industry. Failure to submit the report on time can result in penalties or fines, which can significantly impact a business's finances. It is essential to understand the legal implications of the occupancy tax and to ensure that all submissions are made accurately and punctually to avoid any legal repercussions.

Important Dates for Filing the Henderson County Occupancy Tax Report

Businesses must be aware of the filing deadlines associated with the Henderson County Occupancy Tax Report. Typically, reports are due on a monthly or quarterly basis, depending on the volume of business. It is critical to mark these dates on your calendar to ensure timely submissions. Late filings may incur penalties, so staying informed about these important dates can help businesses maintain compliance and avoid unnecessary costs.

Key Elements of the Henderson County Occupancy Tax Report

The Henderson County Occupancy Tax Report includes several key elements that must be accurately filled out. These elements typically consist of the business name, address, period of reporting, total gross rental income, and the calculated tax owed. Additionally, businesses may need to provide information regarding any exemptions or deductions that apply. Ensuring that all required fields are completed will facilitate a smoother review process by the tax authorities.

Quick guide on how to complete henderson county occupancy tax report henderson co

Effortlessly Prepare Henderson County Occupancy Tax Report Henderson Co on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Henderson County Occupancy Tax Report Henderson Co across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Henderson County Occupancy Tax Report Henderson Co Seamlessly

- Obtain Henderson County Occupancy Tax Report Henderson Co and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Henderson County Occupancy Tax Report Henderson Co to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the henderson county occupancy tax report henderson co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax in Henderson Colorado?

Henderson sales tax details The minimum combined 2024 sales tax rate for Henderson, Colorado is 4.75%. This is the total of state, county, and city sales tax rates. The Colorado sales tax rate is currently 2.9%.

-

What is the occupational license fee in Kentucky?

An Occupational License Fee is imposed on the wages of those employees working within the city limits at the rate of 1.95% of all salaries, wages, commissions and other compensation including deferred compensation, earned for work and or services performed in the city.

-

What is an occupation tax in Kentucky?

Occupational license taxes may be imposed as a percentage of gross earnings (payroll) on all persons working within the city or on gross receipts or net profits on all businesses within a city. A flat annual rate may also be used by cities, which is often referred to as a business license fee.

-

What is local occupational tax?

An occupational tax is a type of tax that is imposed on individuals or businesses based on their occupation or profession. This tax is usually paid to the local government and is used to fund public services and infrastructure.

-

What does occupancy mean on taxes?

Occupancy taxes typically apply to short-term lodging rentals, and go by many names, such as hotel tax, hotel/motel tax, lodging tax and transient room tax. The laws that impose these taxes typically define the length of stay subject to the tax.

-

What is the occupational tax in Henderson County KY?

Calendar year filers with a year end of December 31, 2022 pay a tax of 1.49% on net profits.

-

What is the occupancy tax rate in Hendersonville NC?

A report must be filed every month by all accommodations even if no tax is due. There are no seasonal exemptions or exclusions. collected by the third party. - Occupancy Tax is 5% of gross room/rental receipts.

-

What is the occupancy tax in Kentucky?

Airbnb and VRBO are collecting and remitting the 1% state-wide transient room tax for all participating Kentucky hosts. Effective January 1, 2023, these online platforms are also required to report and pay the local transient room tax based upon total charges for rentals, including service fees.

Get more for Henderson County Occupancy Tax Report Henderson Co

Find out other Henderson County Occupancy Tax Report Henderson Co

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy