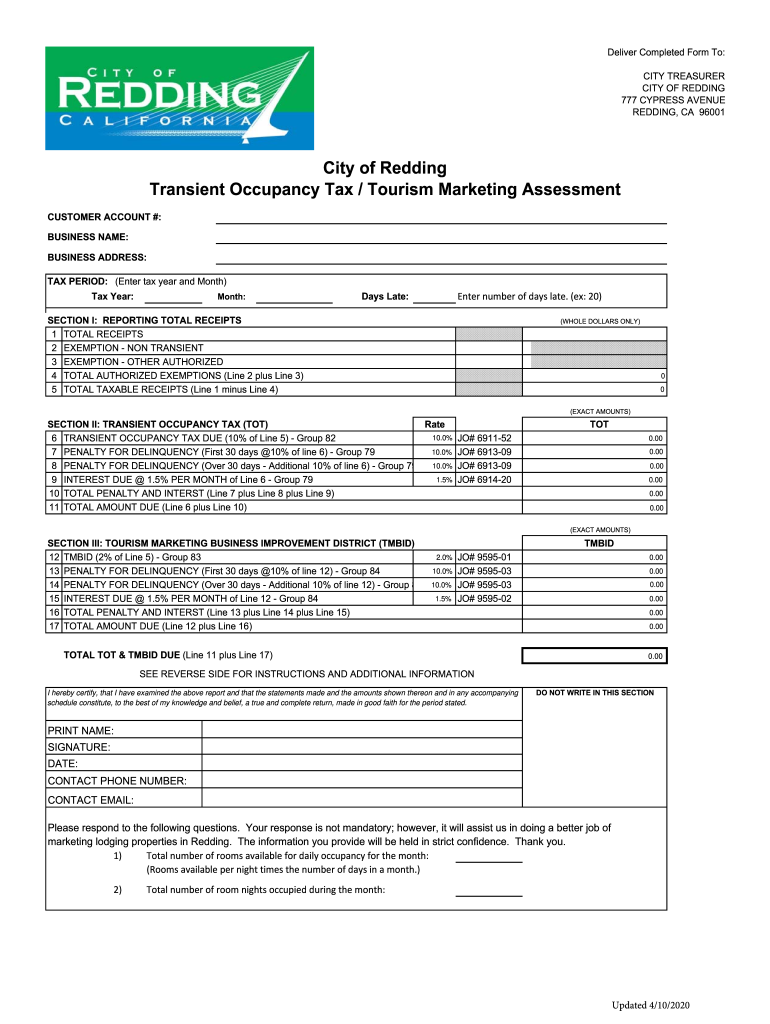

TOT TMBID Tax Form Xlsx City of Redding

What is the city transient occupancy tax?

The city transient occupancy tax (TOT) is a tax levied on individuals staying in a hotel, motel, or other lodging facilities within a city for a short period. This tax is typically applied to the rental fee and is collected by the lodging provider on behalf of the city. The revenue generated from the TOT is often used to fund local services, tourism promotion, and community projects. Each city may have different rates and regulations governing this tax, making it essential for both property owners and guests to understand their obligations.

Steps to complete the city transient occupancy tax form

Completing the city transient occupancy tax form involves several key steps. First, gather all necessary information, including the rental period, total charges, and guest details. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. After filling out the form, review it for accuracy and completeness. Finally, submit the form according to the city's submission guidelines, which may include online submission, mailing, or in-person delivery.

Filing deadlines and important dates

Each city sets specific filing deadlines for the transient occupancy tax. It is crucial to be aware of these dates to avoid penalties. Typically, the tax is due on a monthly basis, with forms needing to be submitted by the end of the following month. For example, taxes collected in January would be due by the end of February. Some cities may also have annual reporting requirements, so checking local regulations is advisable.

Penalties for non-compliance

Failure to comply with the city transient occupancy tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Additionally, lodging providers may face revocation of their business licenses if they consistently fail to remit the tax. It is essential for property owners to stay informed about their tax obligations and to submit forms accurately and on time to avoid these consequences.

Eligibility criteria for the city transient occupancy tax

Eligibility for the city transient occupancy tax typically applies to all short-term rentals, including hotels, motels, and vacation rentals. However, specific exemptions may exist for certain types of accommodations or for stays that exceed a designated duration. It is important for property owners to familiarize themselves with local laws to determine if their rental activities fall under the tax's jurisdiction.

Who issues the city transient occupancy tax form?

The city transient occupancy tax form is usually issued by the local government or city finance department. This form may be available online through the city’s official website or can be obtained directly from the finance department's office. Property owners should ensure they are using the most current version of the form to comply with local regulations.

Required documents for filing the city transient occupancy tax

When filing the city transient occupancy tax, certain documents may be required. These typically include proof of rental agreements, receipts for charges collected, and any prior tax filings. Some cities may also request additional documentation to verify compliance with local regulations. Keeping thorough records will facilitate the filing process and ensure accurate reporting.

Quick guide on how to complete tot tmbid tax form xlsx city of redding

Complete TOT TMBID Tax Form xlsx City Of Redding effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage TOT TMBID Tax Form xlsx City Of Redding on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign TOT TMBID Tax Form xlsx City Of Redding with ease

- Obtain TOT TMBID Tax Form xlsx City Of Redding and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign TOT TMBID Tax Form xlsx City Of Redding and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tot tmbid tax form xlsx city of redding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for TOT TMBID Tax Form xlsx City Of Redding

Find out other TOT TMBID Tax Form xlsx City Of Redding

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template