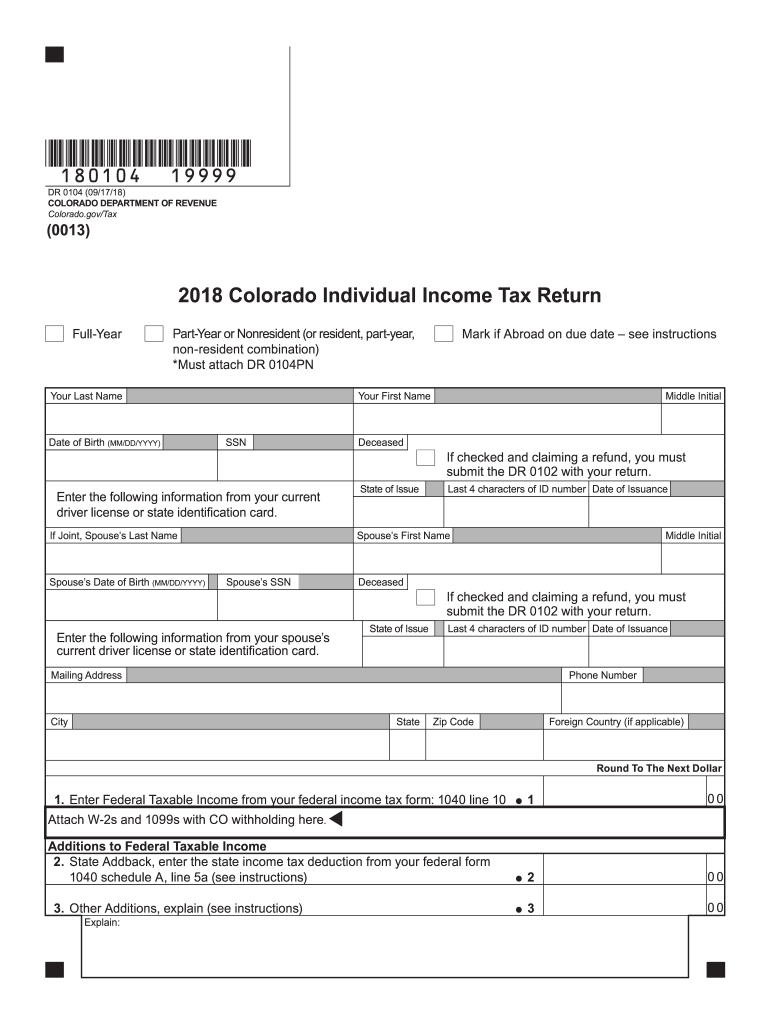

Colorado Income Tax Forms 2018

What is the Colorado Income Tax Form?

The Colorado Income Tax Form, commonly referred to as the 104 form, is a state-specific document used by residents to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating within Colorado, as it ensures compliance with state tax regulations. The 104 form includes sections for reporting various types of income, deductions, and credits, allowing taxpayers to accurately assess their financial obligations to the state.

Steps to Complete the Colorado Income Tax Form

Completing the Colorado Income Tax Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, follow these steps:

- Fill out personal information: Include your name, address, and Social Security number.

- Report income: Enter all sources of income, including wages, interest, and dividends.

- Claim deductions: Identify and document any eligible deductions, such as medical expenses or mortgage interest.

- Calculate tax liability: Use the provided tax tables to determine the amount owed or refund due.

- Sign and date the form: Ensure that the form is signed to validate the information provided.

How to Obtain the Colorado Income Tax Form

Obtaining the Colorado Income Tax Form is straightforward. Taxpayers can access the form through the Colorado Department of Revenue's website, where it is available for download in a printable format. Additionally, physical copies can often be found at local libraries, post offices, and tax preparation offices. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Form Submission Methods

Taxpayers have multiple options for submitting the Colorado Income Tax Form. These methods include:

- Online submission: Many taxpayers opt to file electronically through authorized e-filing services, which can expedite processing times.

- Mail: The completed form can be mailed to the appropriate address provided by the Colorado Department of Revenue.

- In-person: Taxpayers may also submit their forms in person at designated state offices, which can be useful for those needing assistance.

Key Elements of the Colorado Income Tax Form

The Colorado Income Tax Form includes several key elements that are crucial for accurate tax reporting. These elements consist of:

- Personal information section: Captures taxpayer details.

- Income reporting section: Details various income sources.

- Deductions and credits section: Lists eligible deductions and tax credits.

- Signature line: Confirms the accuracy of the submitted information.

Legal Use of the Colorado Income Tax Form

The Colorado Income Tax Form must be used in accordance with state laws and regulations. It is legally binding and serves as an official record of income and tax liability. Taxpayers are responsible for ensuring that the information reported is accurate and complete to avoid penalties. Understanding the legal implications of submitting this form is essential for compliance with Colorado tax laws.

Quick guide on how to complete form 104 2018 2019

Your assistance manual on how to prepare your Colorado Income Tax Forms

If you wish to learn how to generate and send your Colorado Income Tax Forms, here are some brief instructions on how to simplify tax filing.

Initially, you just need to create your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, as well as return to update information as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Colorado Income Tax Forms in a matter of minutes:

- Create your account and start working on PDFs in moments.

- Utilize our directory to obtain any IRS tax document; explore various versions and schedules.

- Click Obtain form to access your Colorado Income Tax Forms in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase return mistakes and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 104 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 104 2018 2019

How to create an electronic signature for your Form 104 2018 2019 online

How to create an eSignature for your Form 104 2018 2019 in Chrome

How to generate an eSignature for putting it on the Form 104 2018 2019 in Gmail

How to create an electronic signature for the Form 104 2018 2019 right from your smart phone

How to create an electronic signature for the Form 104 2018 2019 on iOS

How to create an electronic signature for the Form 104 2018 2019 on Android OS

People also ask

-

What is a 104 form and how can airSlate SignNow help with it?

The 104 form is typically related to individual income tax returns in the U.S. airSlate SignNow simplifies the process of filling out, signing, and sending your 104 form electronically, ensuring that your documents are secure and compliant with regulations.

-

Can I use airSlate SignNow to send my 104 form for signatures?

Yes, airSlate SignNow allows you to easily send your 104 form for digital signatures. Our platform offers a straightforward interface for sending documents and tracking their status, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the 104 form?

airSlate SignNow offers various pricing plans to fit different business needs, including options for those who primarily need to manage documents like the 104 form. Our competitive pricing ensures you get a cost-effective solution for your eSignature needs.

-

What features does airSlate SignNow offer for managing the 104 form?

With airSlate SignNow, you can easily edit, sign, and share your 104 form. Features such as in-app templates, reminders, and document tracking enhance your workflow and ensure timely processing of your tax forms.

-

Can I integrate airSlate SignNow with other software tools for my 104 form?

Absolutely! airSlate SignNow integrates seamlessly with various other software tools, allowing you to streamline your workflow when preparing the 104 form. This integration enhances data management and helps maintain an organized approach to your document processing.

-

How secure is my 104 form data when using airSlate SignNow?

Your data's security is our priority. When you use airSlate SignNow for your 104 form, you benefit from industry-standard encryption and compliance with regulations, ensuring that your sensitive information remains safe and confidential.

-

Is it easy to track the status of my 104 form using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of your 104 form. You can easily see when the document has been viewed, signed, or completed, giving you complete visibility and control over your document management process.

Get more for Colorado Income Tax Forms

- Michigan dch 0838 2015 2019 form

- Tax ohio form

- 2016 form 3536

- Pl706 j controlled substances and alcohol testing certification cpuc ca form

- Md medical form 2015 2019

- Cdc daily time and attendance form cdc provider child care timeattendance record michigan

- Pgampe cpuc ca form

- Employment permit application djei form

Find out other Colorado Income Tax Forms

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document