Co Form 104 2015

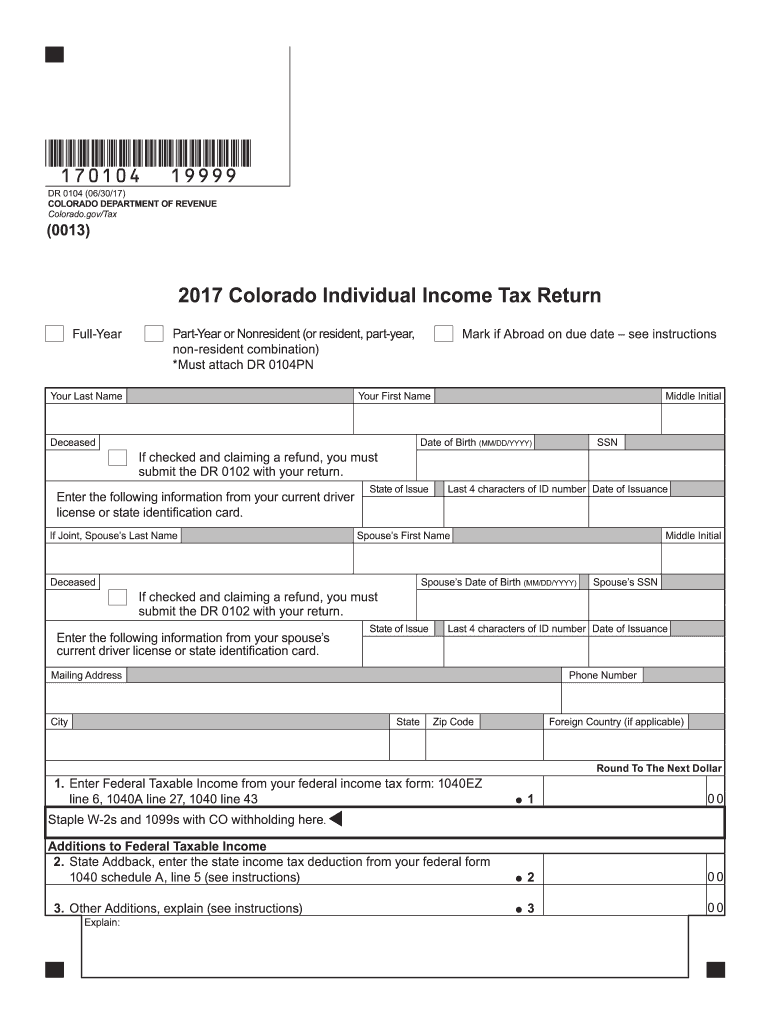

What is the Co Form 104

The Co Form 104 is a tax document used primarily for reporting income and calculating tax liabilities for businesses in the United States. This form is essential for various business entities, including corporations and partnerships, to comply with federal tax regulations. It provides a structured format for reporting earnings, deductions, and credits, ensuring that businesses meet their tax obligations accurately and efficiently.

How to use the Co Form 104

To use the Co Form 104 effectively, businesses must first gather all necessary financial information, including income statements and expense records. The form requires specific details about revenue, deductions, and any applicable credits. Once the information is compiled, businesses can fill out the form either digitally or on paper, ensuring all sections are completed accurately. After filling out the form, it should be reviewed for errors before submission to the IRS.

Steps to complete the Co Form 104

Completing the Co Form 104 involves several key steps:

- Gather financial documentation, including income and expense reports.

- Fill out the form, starting with basic business information such as name and address.

- Report total income, including sales and other earnings.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the total tax liability based on the provided information.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated filing deadline.

Legal use of the Co Form 104

The Co Form 104 must be used in accordance with IRS regulations to ensure its legal validity. Businesses are required to file this form annually, and it must reflect accurate financial information. Misrepresentation or errors can lead to penalties or audits. It is essential for businesses to maintain proper records and seek professional advice if needed to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Co Form 104 are crucial for compliance. Typically, the form must be submitted by March 15 for partnerships and corporations, although extensions may be available. It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates ensures timely submission and compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The Co Form 104 can be submitted through various methods, including online filing, mailing, or in-person submission. Online filing is often the most convenient option, allowing businesses to complete and submit the form quickly. Alternatively, businesses may choose to print and mail the form or deliver it in person to their local IRS office. Each method has its own advantages, and businesses should select the one that best suits their needs.

Quick guide on how to complete 2015 co form 104

Your assistance manual on preparing your Co Form 104

If you’re wondering how to create and submit your Co Form 104, here are a few brief pointers to make tax submission easier.

To start, you simply need to set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editing tool, you can alternate between text, checkboxes, and eSignatures and return to modify information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Co Form 104 in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our collection to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Co Form 104 in our editor.

- Complete the required fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to submit your taxes electronically with airSlate SignNow. Remember that submitting on paper can increase return errors and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 co form 104

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the 2015 co form 104

How to make an electronic signature for the 2015 Co Form 104 online

How to generate an eSignature for your 2015 Co Form 104 in Google Chrome

How to generate an eSignature for signing the 2015 Co Form 104 in Gmail

How to make an electronic signature for the 2015 Co Form 104 from your smart phone

How to make an eSignature for the 2015 Co Form 104 on iOS

How to create an electronic signature for the 2015 Co Form 104 on Android OS

People also ask

-

What is the Co Form 104 and how can airSlate SignNow help with it?

The Co Form 104 is a crucial document for various business transactions, and airSlate SignNow simplifies the process of preparing and eSigning this form. With our intuitive platform, users can easily upload, edit, and send the Co Form 104 for electronic signatures. This streamlines the workflow and ensures that all necessary parties can sign the document quickly and securely.

-

How much does it cost to use airSlate SignNow for Co Form 104 eSigning?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses of all sizes. For those looking to manage the Co Form 104, our plans start at an affordable monthly rate, providing unlimited document signing and advanced features. You can also take advantage of a free trial to explore our features before making a commitment.

-

What features does airSlate SignNow offer for managing Co Form 104 documents?

airSlate SignNow provides a range of features specifically designed for handling Co Form 104 documents, including customizable templates, automated workflows, and secure cloud storage. Users can also track the status of their Co Form 104 in real-time and receive notifications once the document has been signed. These features enhance efficiency and ensure compliance with legal standards.

-

Is airSlate SignNow secure for signing sensitive documents like Co Form 104?

Yes, airSlate SignNow prioritizes security, using industry-standard encryption to protect your documents, including the Co Form 104. Our platform complies with various regulations, ensuring that all electronic signatures are legally binding and secure. You can trust airSlate SignNow to keep your sensitive information safe during the signing process.

-

Can I integrate airSlate SignNow with other software for Co Form 104 management?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and more, making it easy to manage the Co Form 104 alongside your existing tools. This capability enhances your workflow and helps maintain a cohesive business process, minimizing the need for manual entry and reducing errors.

-

How do I create and send a Co Form 104 using airSlate SignNow?

Creating and sending a Co Form 104 with airSlate SignNow is simple. Just upload your document, customize it using our user-friendly interface, and add the necessary fields for signatures. Once ready, you can send the Co Form 104 directly to recipients via email or a shareable link for quick eSigning.

-

What are the benefits of using airSlate SignNow for Co Form 104 eSignatures?

Using airSlate SignNow for Co Form 104 eSignatures offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced organization. The platform’s digital signature capabilities eliminate the hassle of printing and scanning, allowing for a quicker and more streamlined process. Additionally, you can easily track and manage your documents in one place.

Get more for Co Form 104

Find out other Co Form 104

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application