DR 0104, Colorado Individual Income Tax Return 2022

What is the DR 0104, Colorado Individual Income Tax Return

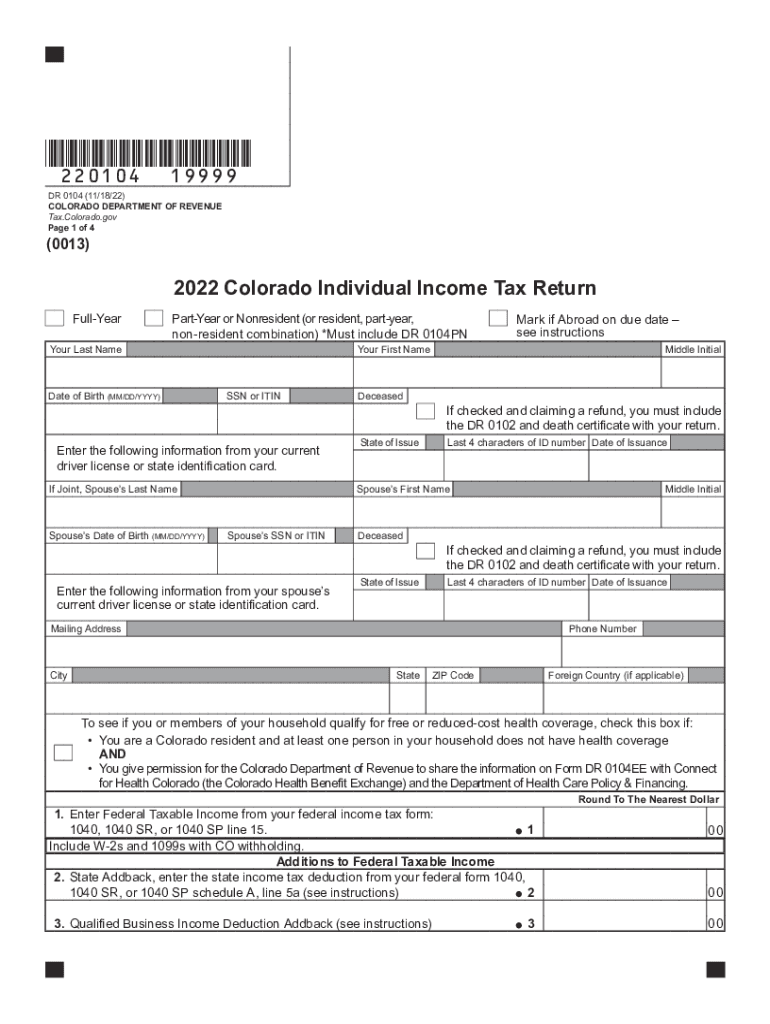

The DR 0104 is the official form used for filing individual income tax returns in Colorado. This form is essential for residents and non-residents who earn income in the state. It allows taxpayers to report their income, claim deductions, and calculate their tax liability. Understanding the purpose and structure of the DR 0104 is crucial for accurate tax filing and compliance with Colorado tax laws.

Steps to complete the DR 0104, Colorado Individual Income Tax Return

Completing the DR 0104 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering personal information, income details, and applicable deductions. After completing the form, review it for any errors or omissions. Finally, submit the form either electronically or by mail, ensuring that it is sent to the correct address based on your filing method.

How to use the DR 0104, Colorado Individual Income Tax Return

Using the DR 0104 requires careful attention to detail. Start by downloading the form from the Colorado Department of Revenue website or obtaining a physical copy. Follow the instructions provided on the form to fill it out accurately. It is important to include all relevant income and deductions to avoid penalties. Once completed, ensure that you sign and date the form before submitting it. If filing electronically, follow the prompts provided by the e-filing system.

Legal use of the DR 0104, Colorado Individual Income Tax Return

The DR 0104 is legally recognized as a valid document for reporting income and calculating tax liability in Colorado. To ensure its legal standing, it must be completed in accordance with state tax laws and regulations. This includes providing truthful information and adhering to deadlines. Misrepresentation or failure to file can result in penalties or legal repercussions, making it essential to understand the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0104 are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines, as well as to consider extensions if necessary. Late filings can incur penalties and interest on any owed taxes.

Required Documents

To complete the DR 0104 accurately, several documents are required. Taxpayers should have their W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as receipts for medical expenses or charitable contributions, should be gathered. Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The DR 0104 can be submitted through various methods, providing flexibility for taxpayers. Electronic filing is available through approved e-filing platforms, which can expedite processing times. Alternatively, taxpayers can mail their completed forms to the appropriate address based on their residence. In-person submission may also be possible at designated tax offices. Each method has its own guidelines and processing times, so it is important to choose the one that best suits your needs.

Quick guide on how to complete dr 0104 2022 colorado individual income tax return

Manage DR 0104, Colorado Individual Income Tax Return effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers a sustainable alternative to conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without interruptions. Handle DR 0104, Colorado Individual Income Tax Return on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to adjust and electronically sign DR 0104, Colorado Individual Income Tax Return with ease

- Find DR 0104, Colorado Individual Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with the tools provided by airSlate SignNow designed for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or a shareable link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign DR 0104, Colorado Individual Income Tax Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104 2022 colorado individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the dr 0104 2022 colorado individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2013 104 Colorado tax form?

The 2013 104 Colorado tax form is used by residents of Colorado to file their state income taxes. It allows individuals to report income, claim deductions, and calculate their tax liability. Using this form is essential for ensuring compliance with Colorado state tax regulations.

-

How can I access the 2013 104 Colorado form online?

You can easily access the 2013 104 Colorado form online through the Colorado Department of Revenue's website. The form is available in PDF format, allowing for easy download and printing. Additionally, airSlate SignNow can help you eSign the completed document electronically.

-

Are there any fees associated with submitting the 2013 104 Colorado form?

Submitting the 2013 104 Colorado form itself does not have any associated fees, but you should be aware of any taxes owed. If you choose to use a professional tax service to assist with the filing, there may be fees for their services. Utilizing airSlate SignNow can streamline your submission process at a competitive price.

-

What are the benefits of using airSlate SignNow for the 2013 104 Colorado form?

Using airSlate SignNow for the 2013 104 Colorado form provides a seamless eSigning experience with robust security. The platform allows you to easily collect signatures and track the status of your document. This not only saves time but also enhances the overall efficiency of tax filing.

-

Can I integrate airSlate SignNow with my current tax software for the 2013 104 Colorado?

Yes, airSlate SignNow offers integrations with various tax software solutions to facilitate the signing process for the 2013 104 Colorado form. This compatibility helps streamline your workflow, ensuring you can collect signatures without leaving your preferred application. Check our website for a full list of integrations.

-

What features does airSlate SignNow offer for document management related to the 2013 104 Colorado form?

airSlate SignNow provides various features for managing documents, including template creation, real-time collaboration, and automated reminders. These features simplify the process of completing the 2013 104 Colorado form. You can ensure that all necessary signatories receive their documents promptly.

-

What should I do if I made a mistake on my 2013 104 Colorado form?

If you made a mistake on your 2013 104 Colorado form, it is crucial to file an amended return as soon as possible. You can make corrections by filling out the 104 Colorado form again and indicating that it is an amended return. Using airSlate SignNow allows you to make and send these changes quickly and securely.

Get more for DR 0104, Colorado Individual Income Tax Return

- Motion guardianship 497327319 form

- Affidavit payment form

- Sellers affidavit of payment of contractors subcontractors materialmen individual texas form

- Tx quitclaim deed form

- Texas special warranty deed 497327323 form

- Texas affidavit completion form

- Texas 1 individual form

- General warranty deed 497327326 form

Find out other DR 0104, Colorado Individual Income Tax Return

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple