DR 0104, Colorado Individual Income Tax Return 2024-2026

What is the DR 0104, Colorado Individual Income Tax Return

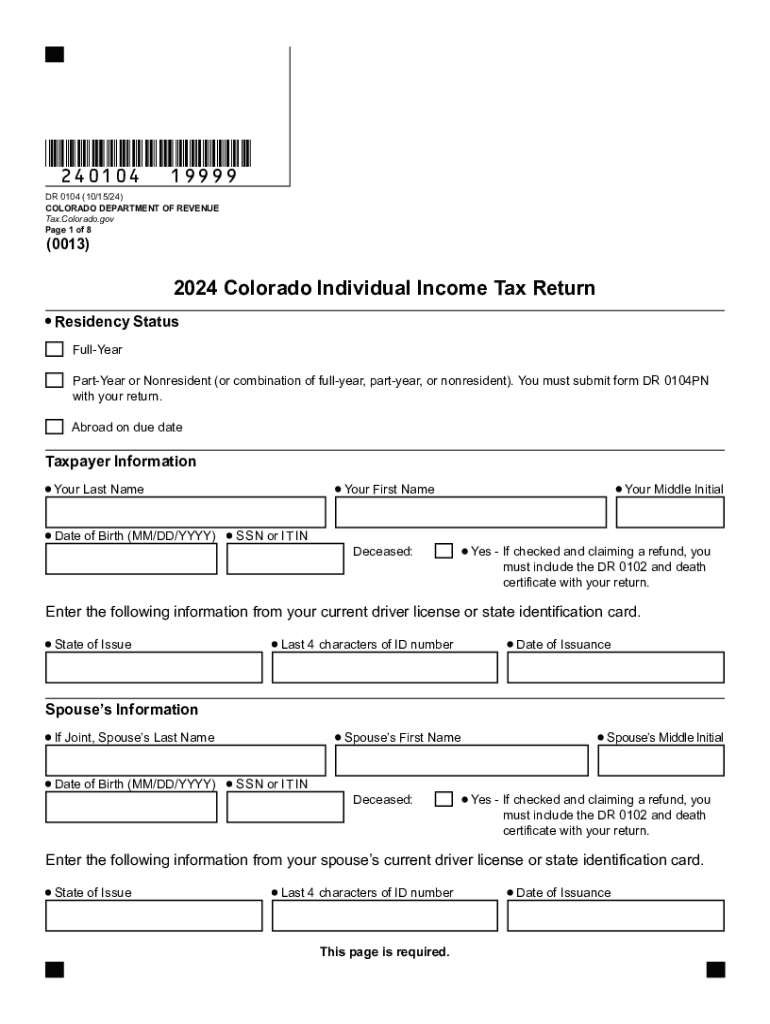

The DR 0104 is the official form used for filing individual income tax returns in the state of Colorado. This form is essential for residents and part-year residents who need to report their income, calculate their tax liability, and claim any applicable credits or deductions. The DR 0104 is designed to ensure that taxpayers comply with Colorado tax laws while providing a straightforward method for reporting their financial information to the Colorado Department of Revenue.

How to obtain the DR 0104, Colorado Individual Income Tax Return

Taxpayers can obtain the DR 0104 form through several convenient methods. The most common way is to download it directly from the Colorado Department of Revenue's official website. Additionally, physical copies of the form can often be found at local tax offices, public libraries, and community centers. For those who prefer assistance, many tax preparation services can provide the form as part of their offerings.

Steps to complete the DR 0104, Colorado Individual Income Tax Return

Completing the DR 0104 involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Calculate your deductions and credits, which can reduce your taxable income.

- Determine your tax liability using the Colorado tax tables provided with the form.

- Sign and date the form before submitting it.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines for the DR 0104. Typically, the deadline for submitting individual income tax returns in Colorado is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who need additional time to file can apply for an extension, but they must still pay any estimated taxes owed by the original deadline to avoid penalties.

Required Documents

To accurately complete the DR 0104, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or investments

- Documentation for deductions, such as mortgage interest statements and property tax receipts

- Any relevant tax credit information

Form Submission Methods (Online / Mail / In-Person)

The DR 0104 can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Colorado Department of Revenue's e-filing system, which offers a secure and efficient way to submit returns. Alternatively, forms can be mailed directly to the Colorado Department of Revenue or submitted in person at designated tax offices. Each method has its own advantages, so taxpayers should choose the one that best fits their needs.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104 colorado individual income tax return 771908872

Create this form in 5 minutes!

How to create an eSignature for the dr 0104 colorado individual income tax return 771908872

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are state of Colorado tax forms?

State of Colorado tax forms are official documents required for filing taxes in Colorado. These forms include various types such as income tax returns, sales tax forms, and property tax forms. Understanding these forms is essential for compliance with state tax regulations.

-

How can airSlate SignNow help with state of Colorado tax forms?

airSlate SignNow provides a seamless platform for businesses to send and eSign state of Colorado tax forms. With our user-friendly interface, you can easily manage and store your tax documents securely. This streamlines the filing process and ensures that your forms are completed accurately and on time.

-

Are there any costs associated with using airSlate SignNow for state of Colorado tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to choose the best option for managing your state of Colorado tax forms. You can start with a free trial to explore our features before committing.

-

What features does airSlate SignNow offer for managing state of Colorado tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage for your state of Colorado tax forms. Additionally, our platform allows for real-time collaboration, making it easy for teams to work together on tax documents. These features enhance efficiency and accuracy in tax filing.

-

Can I integrate airSlate SignNow with other software for state of Colorado tax forms?

Absolutely! airSlate SignNow offers integrations with various software applications, including accounting and tax preparation tools. This allows you to streamline your workflow and manage your state of Colorado tax forms more effectively. Integrating with your existing systems can save time and reduce errors.

-

Is airSlate SignNow secure for handling state of Colorado tax forms?

Yes, airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption and security protocols to protect your state of Colorado tax forms and sensitive information. You can trust that your documents are safe while using our eSigning services.

-

How does airSlate SignNow ensure compliance with state of Colorado tax forms?

airSlate SignNow is designed to help users comply with state regulations regarding tax forms. We provide up-to-date templates and guidance for completing state of Colorado tax forms accurately. Our platform also keeps track of changes in tax laws to ensure your documents remain compliant.

Get more for DR 0104, Colorado Individual Income Tax Return

- Membershipsociety for industrial microbiology and call for papers confexmembershipsociety for industrial microbiology and form

- Fillable online agenda request form1pdf fax email print

- Eazy save classic and premiumpub form

- Zenith bank savings account limit form

- Take advantage of pfeiffer vacuum service form

- Aapm corporate relations council application form

- Application camp staff northeast georgia council form

- Bsa campership application form

Find out other DR 0104, Colorado Individual Income Tax Return

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document