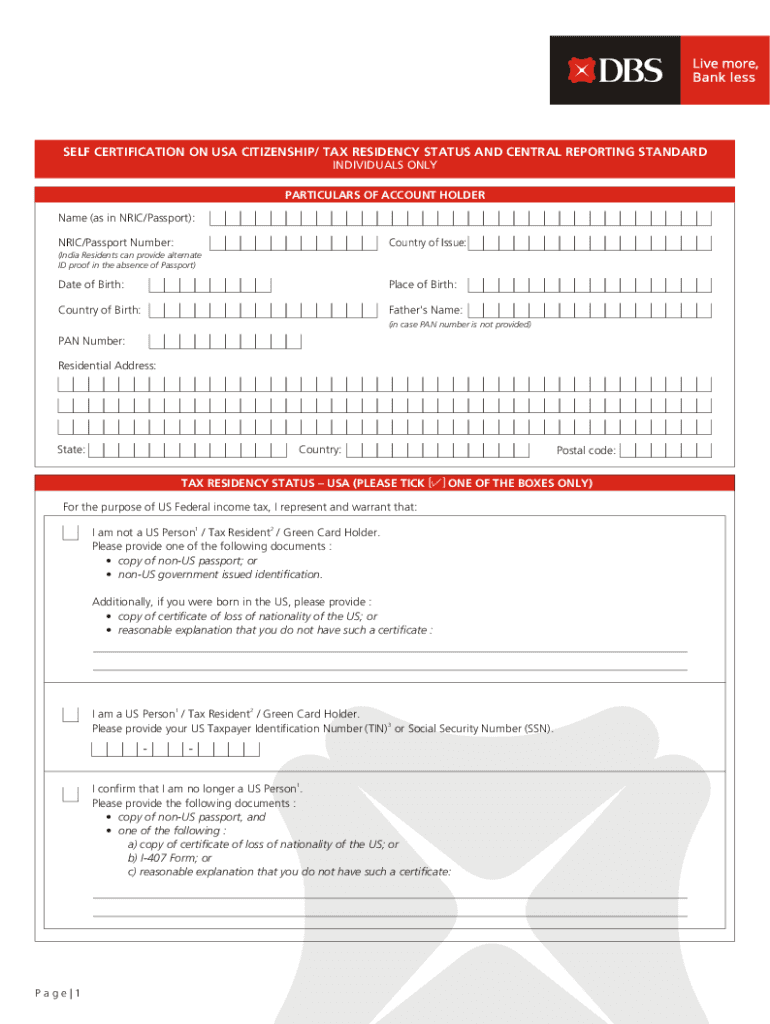

SELF CERTIFICATION on USA CITIZENSHIP TAX RESIDENCY STATUS and CENTRAL REPORTING STANDARD Form

Understanding the DBS Self Certification on Tax Residency Status

The DBS self certification on tax residency status is a crucial document for individuals and entities to declare their tax residency. This form is designed to comply with the Common Reporting Standard (CRS), which is an international standard for the automatic exchange of financial account information between governments. In the United States, this certification helps financial institutions determine the tax obligations of their clients, ensuring adherence to U.S. tax laws and regulations.

Steps to Complete the DBS Self Certification on Tax Residency Status

Completing the DBS self certification form involves several key steps:

- Gather Required Information: Collect personal identification details, including your name, address, and taxpayer identification number.

- Determine Your Tax Residency: Assess your residency status based on the IRS guidelines, which may include factors such as physical presence and citizenship.

- Fill Out the Form: Accurately complete the DBS self certification form, ensuring all information is correct and up to date.

- Review and Sign: Carefully review the completed form for any errors before signing it. Your signature certifies the accuracy of the information provided.

- Submit the Form: Follow the submission guidelines, whether online, by mail, or in person, as specified by your financial institution.

Legal Use of the DBS Self Certification on Tax Residency Status

The DBS self certification serves as a legal declaration of your tax residency status. It is essential for compliance with U.S. tax laws and international reporting standards. By submitting this form, individuals and entities affirm their tax obligations, which helps prevent tax evasion and ensures transparency in financial dealings. Failure to provide accurate information can lead to penalties and legal repercussions.

Required Documents for the DBS Self Certification

When completing the DBS self certification, certain documents may be necessary to support your claims. These typically include:

- Government-issued identification (e.g., passport or driver's license)

- Proof of address (e.g., utility bill or bank statement)

- Taxpayer identification number (TIN) or Social Security number (SSN)

Having these documents ready can streamline the completion process and ensure that your submission is accurate.

IRS Guidelines for Tax Residency Certification

The IRS provides specific guidelines regarding tax residency that individuals must follow when filling out the DBS self certification. These guidelines include criteria for determining residency status, such as the substantial presence test and citizenship considerations. Understanding these guidelines is vital for ensuring that your certification aligns with federal tax requirements and avoids potential issues with the IRS.

Penalties for Non-Compliance with Tax Residency Certification

Failure to comply with the requirements of the DBS self certification can result in significant penalties. Non-compliance may lead to:

- Fines imposed by the IRS for inaccurate or incomplete information

- Increased scrutiny of your financial accounts

- Potential legal action if tax obligations are not met

It is important to take the certification process seriously to avoid these consequences.

Quick guide on how to complete self certification on usa citizenship tax residency status and central reporting standard

Effortlessly Create SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD on Any Device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditionally printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly without any hold-ups. Manage SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD with Ease

- Obtain SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD to ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self certification on usa citizenship tax residency status and central reporting standard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the common reporting standard CRS self certification?

A "self-certification" is a certification by the Account Holder that provides the Account Holder's status and any other information that may be reasonably requested by the MYFIs to fulfil its reporting and due diligence obligations, such as whether the Account Holder is resident for tax purposes in a Reportable ...

-

How do I get a US tax residency certificate?

Taxpayers must use IRS Form 8802 to request the Form 6166 to show certification of U.S. tax residency. Only authorized representatives of a business entity can sign Form 8802 — i.e., officers, executives or partners of the business entity. The IRS also requires specific documentation for particular types of entities.

-

How do you prove residency to the IRS?

Use of the Form 8802 is mandatory. Form 6166 is a letter printed on U.S. Department of Treasury stationery signNowing that the individuals or entities listed are residents of the United States for purposes of the income tax laws of the United States.

-

How long does it take to get tax residency certificate from IRS?

Typically, it takes 4-6 weeks to receive your U.S. Tax Residency Certificate. It's important to note that you cannot file Form 6166 if you haven't filed a required U.S. tax return or if you have filed a U.S tax return as a nonresident.

-

What is a certificate of tax residence?

U.S. Tax Residency Certification – Form 6166 Form 6166 is a letter printed on U.S. Department of Treasury stationery that certifies that the entity listed is a resident of the United States for purposes of U.S. taxation for the year indicated on the form. An original letter must be provided.

-

What is the IRS form for proof of residency?

Form 6166 Certification of U.S. Tax Residency | Internal Revenue Service.

-

What is a fatca crs self certification form?

Foreign Account Tax Compliance Act (“FATCA”) and Common Reporting Standard (“CRS”) regulations require financial institutions like us to collect and report information about where our customers are tax resident. Under these regulations, we have to ask you to provide the information requested in this form.

-

How to get certification of U.S. tax residency?

Taxpayers must use IRS Form 8802 to request the Form 6166 to show certification of U.S. tax residency. Only authorized representatives of a business entity can sign Form 8802 — i.e., officers, executives or partners of the business entity. The IRS also requires specific documentation for particular types of entities.

Get more for SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD

- Www woodlakeonline com wp content uploadswca pavilion rental agreement woodlake life on the lake form

- Sample intake referral forms

- Waiver of warranty and exhibition rights addendum form

- St therese villa form

- Pdf download rental application cook inlet housing authority form

- Kodiak island housing authority 3137 mill bay rd kodiak form

- Office of state treasurer david mcrae facebook com form

- Branson mo form

Find out other SELF CERTIFICATION ON USA CITIZENSHIP TAX RESIDENCY STATUS AND CENTRAL REPORTING STANDARD

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online