Canada Security Clearance Health Form

Understanding Canada Security Clearance Health

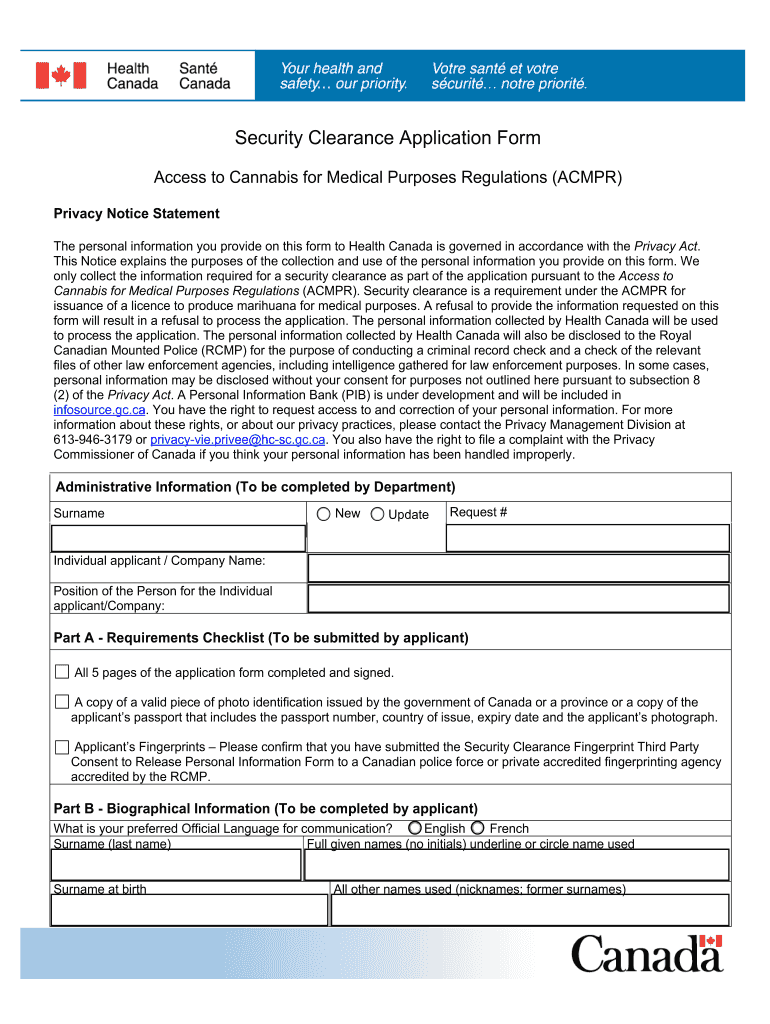

The Canada Security Clearance Health is a critical component in the security clearance application process, particularly for individuals seeking positions that require access to sensitive information. This health assessment evaluates an applicant's physical and mental well-being to ensure they can handle the responsibilities associated with security-sensitive roles. The evaluation typically includes a review of medical history, mental health assessments, and may require a physical examination. Understanding this aspect is essential for applicants to prepare adequately and meet the necessary requirements.

Steps to Complete the Canada Security Clearance Health

Completing the Canada Security Clearance Health involves several important steps. First, applicants should gather all necessary medical documentation, including records from healthcare providers. Next, they need to fill out the required health forms accurately, providing detailed information about their medical history. Once the forms are completed, applicants may need to schedule an appointment with a designated healthcare professional for a physical examination. After the assessment, the healthcare provider will submit the findings to the relevant authorities as part of the security clearance application.

Required Documents for Canada Security Clearance Health

When applying for the Canada Security Clearance Health, specific documents are required to facilitate the assessment process. These typically include:

- Completed health assessment forms

- Medical history records

- Results from any recent physical examinations

- Documentation of any ongoing treatments or medications

Having these documents ready will streamline the application process and help ensure that all necessary information is provided to the reviewing authorities.

Eligibility Criteria for Canada Security Clearance Health

Eligibility for the Canada Security Clearance Health is determined by several factors, including the nature of the position being applied for and the level of security clearance required. Generally, applicants must demonstrate a clean bill of health, free from conditions that could impair their ability to perform their job duties. Additionally, individuals with a history of substance abuse or severe mental health issues may face challenges in obtaining clearance. Understanding these criteria can help applicants assess their readiness for the application process.

Application Process and Approval Time for Canada Security Clearance Health

The application process for the Canada Security Clearance Health typically involves submitting the required health documentation along with the security clearance application form. Once submitted, the review process can take several weeks, depending on the complexity of the case and the volume of applications being processed. Applicants should be prepared for potential follow-up requests from the authorities, which may extend the approval time. Staying informed about the process can help manage expectations and reduce anxiety during the waiting period.

Legal Use of Canada Security Clearance Health

The legal use of the Canada Security Clearance Health is governed by privacy laws and regulations that protect personal health information. It is essential for applicants to understand their rights regarding the confidentiality of their health data. The information gathered during the health assessment is used solely for the purpose of determining eligibility for security clearance and must be handled in compliance with relevant legal standards. Familiarizing oneself with these legal aspects can empower applicants to navigate the process confidently.

Quick guide on how to complete canada security clearance health

Complete Canada Security Clearance Health effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to access the correct format and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Canada Security Clearance Health on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to alter and eSign Canada Security Clearance Health with ease

- Find Canada Security Clearance Health and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Canada Security Clearance Health and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada security clearance health

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What disqualifies you from security clearance?

What can disqualify you? You are not a U.S. citizen. You were dishonorably discharged from the military. You are currently involved in illegal drug use. You have been judged as mentally incompetent or mentally incapacitated by a mental health professional. You have had a clearance revoked for security reasons.

-

What is a security clearance check in Canada?

A security clearance is like a background check. It is required for individuals who are hired for Canadian government jobs or any organization that handles information pertaining to national security. The security clearance process ensures your ability to securely access, manage, and protect classified information.

-

What can make you fail a security clearance in Canada?

You could also be denied if you are deemed unreliable because there are reasonable grounds for believing you may disclose information by, for example, carelessly talking or failing to safeguard records or by being induced as a result of blackmail or other means to disclose information.

-

What is checked during security clearance?

Credit and criminal history checks will be conducted on all applicants. For a Top Secret security clearance, the background investigation includes additional record checks which can verify citizenship for the applicant and family members, verification of birth, education, employment history, and military history.

-

What disqualifies you from security clearance?

What can disqualify you? You are not a U.S. citizen. You were dishonorably discharged from the military. You are currently involved in illegal drug use. You have been judged as mentally incompetent or mentally incapacitated by a mental health professional. You have had a clearance revoked for security reasons.

-

What do they check in security clearance Canada?

Investigation. Depending on the level of clearance you are looking to obtain, you will undergo a series of checks on your identification, background, employment, credit history, and more. The RCMP will conduct an inquiry, and so will CSIS for most clearance levels.

-

What are the 5 levels of security clearance in Canada?

Protected A. Injury to an. individual, organization or. Protected B. Serious injury to. an individual, organization or. Protected C. Extremely grave. injury to an individual, organization or. Confidential. Injury to the. national interest. Secret. Top Secret. Exceptionally grave. injury to the national. interest.

-

What can make you fail a security clearance in Canada?

You could also be denied if you are deemed unreliable because there are reasonable grounds for believing you may disclose information by, for example, carelessly talking or failing to safeguard records or by being induced as a result of blackmail or other means to disclose information.

Get more for Canada Security Clearance Health

- Account information sheet

- Managed forest law form 9300 029a

- Travelers casualty and surety company of america hartford form

- The income tax act 1962 form no 10ba legal pundits

- Wheel of life 12 09 bold steps inc form

- Isaca journal subscription request isaca form

- If your application for a residence permit is rejected and form

- Room sublease agreement template form

Find out other Canada Security Clearance Health

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple