Instructions for Form 1099 CAP Internal Revenue Service 2016

What is the Instructions For Form 1099 CAP Internal Revenue Service

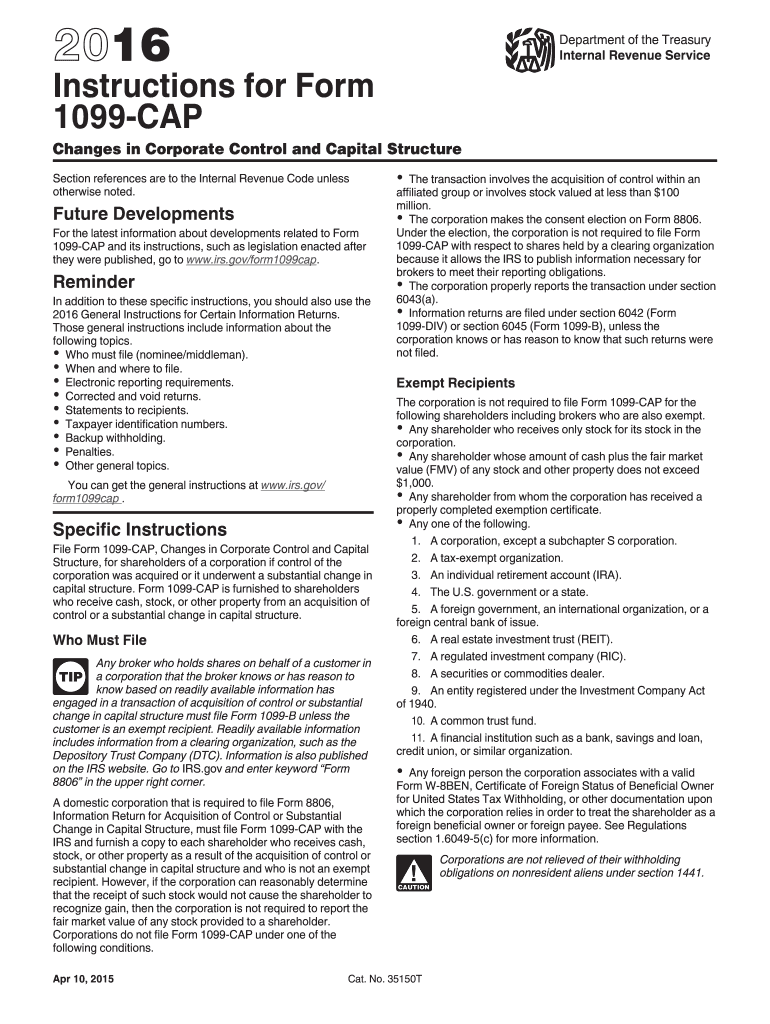

The Instructions for Form 1099 CAP are guidelines provided by the Internal Revenue Service (IRS) to assist individuals and businesses in properly completing and filing this specific tax form. Form 1099 CAP is used to report certain types of income, including capital gains distributions and other financial transactions. Understanding these instructions is crucial for ensuring compliance with federal tax regulations and avoiding potential penalties.

Steps to complete the Instructions For Form 1099 CAP Internal Revenue Service

Completing the Instructions for Form 1099 CAP involves several key steps:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Review the specific income types that need to be reported on the form.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for correctness to avoid errors that could lead to delays or penalties.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for Form 1099 CAP are crucial for compliance. Typically, the form must be filed by January thirty-first of the year following the tax year in which the income was paid. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is essential to stay informed about any changes to these deadlines to avoid late filing penalties.

Legal use of the Instructions For Form 1099 CAP Internal Revenue Service

The legal use of the Instructions for Form 1099 CAP involves adhering to IRS guidelines for reporting income accurately. This includes ensuring that the information provided is truthful and complete. Misreporting or failing to file can result in penalties, including fines and interest on unpaid taxes. It is important for filers to understand their legal obligations under U.S. tax law.

Key elements of the Instructions For Form 1099 CAP Internal Revenue Service

Key elements of the Instructions for Form 1099 CAP include:

- Detailed descriptions of the types of income that must be reported.

- Guidelines for filling out each section of the form.

- Information on where and how to submit the form.

- Explanations of potential penalties for non-compliance.

Form Submission Methods (Online / Mail / In-Person)

Form 1099 CAP can be submitted through various methods, including:

- Online filing through the IRS e-file system, which is often the fastest method.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete 2016 instructions for form 1099 cap internal revenue service

Discover the simplest method to complete and sign your Instructions For Form 1099 CAP Internal Revenue Service

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior approach to finalize and sign your Instructions For Form 1099 CAP Internal Revenue Service and associated forms for public services. Our intelligent electronic signature platform equips you with everything necessary to manage documents swiftly and in compliance with legal standards - comprehensive PDF editing, organizing, safeguarding, signing, and sharing options all accessible through an easy-to-use interface.

Only a few steps are needed to fill out and sign your Instructions For Form 1099 CAP Internal Revenue Service:

- Insert the editable template into the editor by clicking the Get Form button.

- Verify the information you need to include in your Instructions For Form 1099 CAP Internal Revenue Service.

- Move between the fields using the Next option to avoid missing any sections.

- Utilize Text, Check, and Cross tools to fill in the blanks with your data.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure areas that are no longer relevant.

- Select Sign to create a legally recognized electronic signature using your preferred method.

- Insert the Date beside your signature and finalize your work by clicking the Done button.

Store your completed Instructions For Form 1099 CAP Internal Revenue Service in the Documents folder within your account, download it, or send it to your chosen cloud storage. Our platform also allows for adaptable form sharing. There’s no need to print your templates when filing them at the designated public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 instructions for form 1099 cap internal revenue service

FAQs

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the 2016 instructions for form 1099 cap internal revenue service

How to make an eSignature for the 2016 Instructions For Form 1099 Cap Internal Revenue Service online

How to make an eSignature for your 2016 Instructions For Form 1099 Cap Internal Revenue Service in Google Chrome

How to create an electronic signature for putting it on the 2016 Instructions For Form 1099 Cap Internal Revenue Service in Gmail

How to make an eSignature for the 2016 Instructions For Form 1099 Cap Internal Revenue Service right from your smart phone

How to generate an electronic signature for the 2016 Instructions For Form 1099 Cap Internal Revenue Service on iOS

How to make an eSignature for the 2016 Instructions For Form 1099 Cap Internal Revenue Service on Android

People also ask

-

What are the Instructions For Form 1099 CAP Internal Revenue Service?

The Instructions For Form 1099 CAP Internal Revenue Service provide essential guidance on how to report contributions to and distributions from a Coverdell Education Savings Account. Understanding these instructions ensures compliance and accurate reporting on your taxes.

-

How can airSlate SignNow assist with submitting Instructions For Form 1099 CAP Internal Revenue Service?

AirSlate SignNow offers a streamlined process for eSigning and sending tax documents, including those related to the Instructions For Form 1099 CAP Internal Revenue Service. With our user-friendly platform, you can ensure timely submissions to the IRS while keeping your documents secure.

-

What features does airSlate SignNow offer for handling tax documents like Form 1099 CAP?

AirSlate SignNow provides features such as customizable templates, advanced security protocols, and seamless integrations with accounting software. These enhance your ability to manage and send documents related to the Instructions For Form 1099 CAP Internal Revenue Service effectively.

-

Is airSlate SignNow cost-effective for handling Forms like 1099 CAP?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By simplifying the process of sending and signing documents, it reduces administrative costs associated with managing instructions for Form 1099 CAP Internal Revenue Service compliance.

-

Can airSlate SignNow integrate with accounting software to manage tax forms?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software solutions, allowing you to efficiently manage Instructions For Form 1099 CAP Internal Revenue Service. This integration streamlines your document handling and ensures accurate record-keeping.

-

What benefits do I get from using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including Instructions For Form 1099 CAP Internal Revenue Service, offers numerous benefits such as improved efficiency, reduced paperwork, and enhanced security. With eSigning, you can expedite your workflows and ensure compliance effortlessly.

-

How secure is airSlate SignNow when handling sensitive tax documents?

AirSlate SignNow prioritizes security with features like encryption, secure cloud storage, and user authentication. This is particularly important when dealing with sensitive tax documents like those related to Instructions For Form 1099 CAP Internal Revenue Service.

Get more for Instructions For Form 1099 CAP Internal Revenue Service

Find out other Instructions For Form 1099 CAP Internal Revenue Service

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA