Reset Form Schedule NR Michigan Department of Treasury Rev

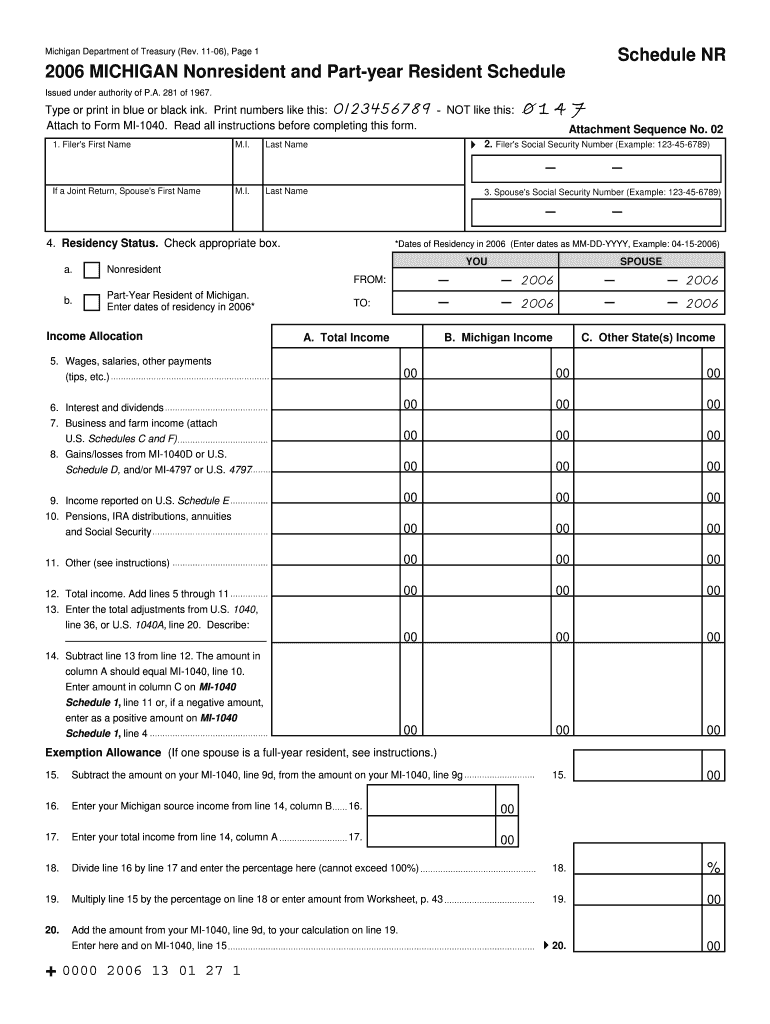

What is the Reset Form Schedule NR Michigan Department Of Treasury Rev

The Reset Form Schedule NR is a specific form issued by the Michigan Department of Treasury. It is designed for non-resident taxpayers who need to reset their tax information for the state of Michigan. This form is essential for those who have previously filed taxes in Michigan but are now seeking to amend or update their tax records. It allows individuals to correct errors or make necessary adjustments to their tax filings, ensuring compliance with state regulations.

How to use the Reset Form Schedule NR Michigan Department Of Treasury Rev

To effectively use the Reset Form Schedule NR, taxpayers must first download the form from the Michigan Department of Treasury's official website. Once obtained, individuals should carefully read the instructions provided. Completing the form involves entering accurate personal information, including name, address, and Social Security number. Additionally, taxpayers must specify the changes they wish to make to their previous filings. After filling out the form, it should be reviewed for accuracy before submission.

Steps to complete the Reset Form Schedule NR Michigan Department Of Treasury Rev

Completing the Reset Form Schedule NR involves several key steps:

- Download the form from the Michigan Department of Treasury's website.

- Gather necessary documents, such as previous tax returns and supporting materials.

- Fill out the form with accurate personal and tax information.

- Clearly indicate the changes or corrections needed.

- Review the completed form for any errors or omissions.

- Submit the form according to the provided instructions.

Legal use of the Reset Form Schedule NR Michigan Department Of Treasury Rev

The Reset Form Schedule NR is legally recognized by the Michigan Department of Treasury. It serves as an official document for non-resident taxpayers to amend their tax filings. Proper use of this form ensures that individuals remain compliant with state tax laws. It is crucial to submit the form within the designated time frames to avoid potential penalties or legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Reset Form Schedule NR are critical for taxpayers to adhere to. Typically, the form should be submitted by the tax filing deadline for the relevant tax year. It is advisable to check the Michigan Department of Treasury's website for specific dates, as these can vary annually. Timely submission helps avoid penalties and ensures that taxpayers can correct their filings without complications.

Required Documents

When completing the Reset Form Schedule NR, certain documents are required to support the changes being made. These may include:

- Previous tax returns filed in Michigan.

- Documentation supporting the changes, such as W-2 forms or 1099s.

- Any correspondence received from the Michigan Department of Treasury.

Having these documents ready will facilitate a smoother completion and submission process.

Quick guide on how to complete reset form schedule nr michigan department of treasury rev

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Reset Form Schedule NR Michigan Department Of Treasury Rev

Create this form in 5 minutes!

How to create an eSignature for the reset form schedule nr michigan department of treasury rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I speak to someone at Michigan Treasury?

Treasury & Income Tax Office Staff Address. Lansing, MI 48933. Directions. For general information please call - 311. Phone: 517-483-4121. Office Hours. Monday through Friday. 8 am to 4:00 pm. Phone Hours. Monday through Friday. 8 am to 5 pm.

-

Do I need to file a nonresident Michigan tax return?

Nonresidents and part-year residents must pay income tax to Michigan on all income earned in Michigan or attributable to Michigan.

-

What is the phone number for the Michigan Treasury collection?

To pay your debt or other questions about your delinquent account, call Treasury Collection Services Bureau at 517-636-5265. If you are making a payment by electronic withdrawal (EFT), please have your bank account number and the 9 digit bank routing number of your financial institution available.

-

What is form AR1000F?

The Arkansas Form AR1000F (2023) is the official tax return used by full-year residents of Arkansas to report their income and calculate their state income tax liability for the tax year 2023.

-

How do I talk to a person at the Michigan Department of Treasury?

Treasury & Income Tax Office Address. Lansing, MI 48933. Directions. For general information please call - 311. Phone: 517-483-4121. Office Hours. Monday through Friday. 8 am to 4:00 pm. Phone Hours. Monday through Friday. 8 am to 5 pm.

-

Who to contact about Michigan tax refund?

You can view income tax refunds appeals here or call a Customer Service Representative about your refund adjustment or denial. Customer Service Representatives can be signNowed at (517) 636-4486.

-

How do I speak to someone at the Department of Treasury?

Toll-free: 844-284-2676 Note: Beware of scammers, and carefully dial the correct numbers.

-

How to amend a Michigan tax return?

Option 1: Sign into your eFile.com account, modify your Return and download/print the MI Form MI-1040 under My Account. Check the "Amended Return" box, sign the form, and mail it to one of the addresses listed below. Complete Schedule AMD and attach it to your Form MI-1040.

Get more for Reset Form Schedule NR Michigan Department Of Treasury Rev

- Womens services hh for women ampamp children form

- Parent applicant worksheet form

- Poms si chi01401 001 in indiana state form

- Magic home care form

- Asthma medication administration formoffice of school

- Reportable incidents and notable occurrences bissnybborgb form

- Fhcda consent form 2

- Staff action plan opwdd form

Find out other Reset Form Schedule NR Michigan Department Of Treasury Rev

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document