Order Determining Succession to Real Property Forms

What is the Order Determining Succession To Real Property Forms

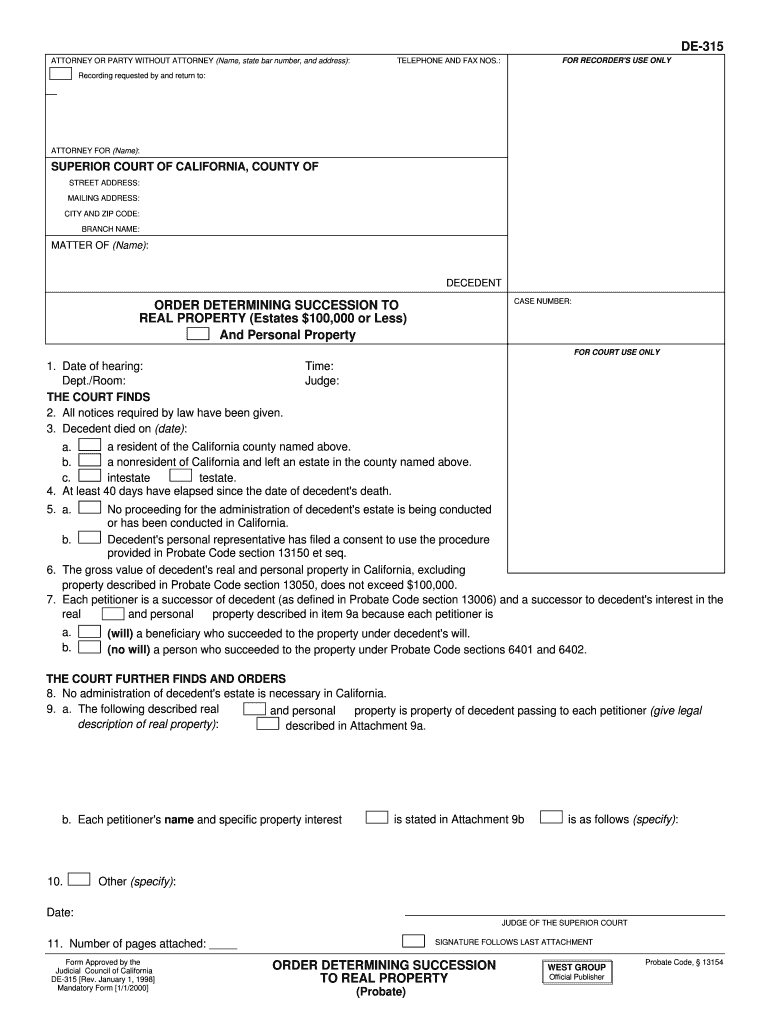

The Order Determining Succession To Real Property Forms are legal documents used to establish the rightful heirs of a deceased person's real estate assets. This form is particularly important in cases where a person passes away without a will, as it helps clarify the distribution of property according to state laws. The form typically requires information about the deceased, the heirs, and the specific properties involved. Understanding this form is crucial for ensuring that the transfer of property ownership is conducted legally and efficiently.

How to Use the Order Determining Succession To Real Property Forms

Using the Order Determining Succession To Real Property Forms involves several steps. First, gather all necessary information about the deceased and the heirs, including names, addresses, and relationships to the deceased. Next, fill out the form with accurate details, ensuring that all required fields are completed. After completing the form, it must be filed with the appropriate court, along with any supporting documents, such as a death certificate. It is advisable to consult with a legal professional to ensure compliance with local laws and regulations during this process.

Steps to Complete the Order Determining Succession To Real Property Forms

Completing the Order Determining Succession To Real Property Forms requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including the death certificate and any existing property deeds.

- Identify all potential heirs and their respective relationships to the deceased.

- Fill out the form, ensuring all sections are accurately completed.

- Review the form for any errors or omissions before submission.

- File the completed form with the appropriate court, along with any required fees.

Legal Use of the Order Determining Succession To Real Property Forms

The legal use of the Order Determining Succession To Real Property Forms is essential for validating the transfer of property ownership after a person's death. This form serves as a legal declaration that identifies the rightful heirs and outlines their claims to the deceased's real estate. Courts typically require this form to ensure that property is distributed according to state laws, which may vary significantly. Proper completion and submission of this form help prevent disputes among heirs and facilitate a smoother transition of property ownership.

Key Elements of the Order Determining Succession To Real Property Forms

Several key elements must be included in the Order Determining Succession To Real Property Forms to ensure their validity:

- Decedent Information: Full name, date of birth, and date of death.

- Heir Information: Names, addresses, and relationships of all heirs.

- Property Details: Description of the real property, including addresses and legal descriptions.

- Affidavit of Heirs: A statement confirming the heirs' identities and their claims to the property.

- Signature: Signatures of the heirs, and in some cases, a notary public.

State-Specific Rules for the Order Determining Succession To Real Property Forms

Each state in the U.S. has its own rules and regulations regarding the Order Determining Succession To Real Property Forms. These rules can affect how the form is filled out, the required supporting documents, and the filing process. It is important for individuals to familiarize themselves with their state's specific requirements to ensure compliance. Consulting with a legal professional who understands local laws can provide valuable guidance and help avoid potential delays or complications in the property transfer process.

Quick guide on how to complete order determining succession to real property forms

Effortlessly complete [SKS] on any device

The management of online documents has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle [SKS] across any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign [SKS] seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunts, or errors that require printing additional copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Order Determining Succession To Real Property Forms

Create this form in 5 minutes!

How to create an eSignature for the order determining succession to real property forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a petition to determine succession to real property?

allows for the transfer of real estate and personal property to the heirs by filing a Petition to Determine Succession to Real Property so long as all the assets owned by the decedent are worth less than $184,500. There is one court hearing required for this procedure.

-

What is the probate code for sale of real property in California?

Probate Code §10308 provides that all sales of real property, whether by private sale or public auction, shall be with court confirmation unless the personal representative has been granted full authority under the Independent Administration of Estate Act (IAEA) as outlined in Probate Code §10500 to 10538.

-

What is an Affidavit of succession to real property in Arizona?

The Affidavit is used only to transfer title of a deceased person's real property, including a debt secured by a lien on real property.

-

What is an affidavit of successor trustee in Arizona?

Arizona Affidavit of Successor Trustee Overview The document contains sworn statements confirmed in the presence of a notary public, and provides notice that the successor has assumed the authority of the preceding trustee relevant to real property held in trust.

-

What is an order determining succession to real property?

An order determining succession to real property is an alternative petition to get a court order transferring the property. (Prob. Code § 13154.)

-

What is the prob code 13151?

Section 13151 - [Effective 1/1/2025] Petition to determine that petitioner has succeeded to personal property (a) If a decedent dies leaving real property that was their primary residence in this state and the gross value of that real property does not exceed seven hundred fifty thousand dollars ($750,000), as adjusted ...

-

How do I transfer property after my parent dies in Arizona?

In the state of Arizona, estates with less than $75,000 in personal property and less than $100,000 in real property are eligible to transfer property without going through probate court. If there is a house or other property involved, you'll need to wait at least 6 months before filing a small estate affidavit.

-

What is an affidavit of succession in Arizona?

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

Get more for Order Determining Succession To Real Property Forms

- Colorado birth certificate request mesa county public health form

- Colorado first judicial district attorneys officecreating a form

- Dmap prior authorization form 557971262

- Legacy referral forms

- Authorization for use and disclosure of individual information msc 2099

- City of johannesburg environmental health business licensing restaurant org form

- Temporary appointment requisition form department headchair 4

- Kwazulunatal department of educationec38applicati form

Find out other Order Determining Succession To Real Property Forms

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online