Md Homeowner Tax 2018-2026

What is the Md Homeowner Tax Credit?

The Maryland Homeowner Tax Credit Program is designed to provide financial relief to eligible homeowners by reducing their property tax burden. This program aims to assist those who may be struggling to pay their property taxes due to financial hardship, ensuring that homeownership remains accessible. The credit is based on the homeowner's income and the assessed value of their property, allowing for a reduction in taxes owed. Homeowners must meet specific eligibility criteria to qualify for this program, which can significantly alleviate financial stress.

Eligibility Criteria for the Md Homeowner Tax Credit

To qualify for the Maryland Homeowner Tax Credit, applicants must meet several requirements:

- The applicant must be a Maryland resident and occupy the property as their principal residence.

- The property must be owned by the applicant, either outright or with a mortgage.

- Income limits apply, which vary based on the number of individuals living in the home.

- The assessed value of the property must not exceed a certain threshold set by the state.

Homeowners should review these criteria carefully to determine their eligibility before applying for the credit.

Steps to Complete the Md Homeowner Tax Credit Application

Filing for the Maryland Homeowner Tax Credit involves several steps to ensure a smooth application process:

- Gather necessary documentation, including proof of income, property assessment details, and identification.

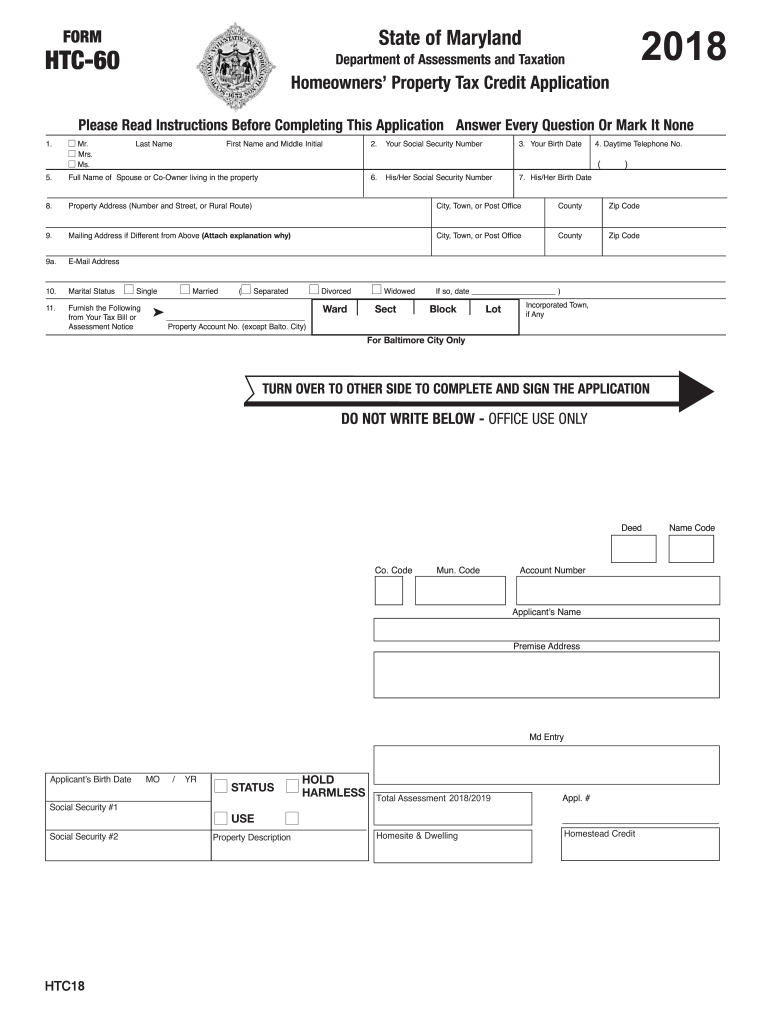

- Complete the Maryland Homeowner Tax Credit application form, often referred to as the HTC 60 form.

- Review the completed form for accuracy and ensure all required documents are attached.

- Submit the application either online, by mail, or in person at the local tax office.

Following these steps carefully can help streamline the process and increase the likelihood of approval.

Required Documents for the Md Homeowner Tax Credit

When applying for the Maryland Homeowner Tax Credit, homeowners must provide specific documentation to support their application. The essential documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Property assessment information, which can usually be obtained from the local tax office.

- Identification documents, such as a driver's license or state ID.

- Any additional forms required by the local jurisdiction, which may vary.

Having these documents ready can facilitate a smoother application process and help ensure that all necessary information is provided.

Form Submission Methods for the Md Homeowner Tax Credit

Homeowners have several options for submitting their Maryland Homeowner Tax Credit application. The available methods include:

- Online: Many jurisdictions allow homeowners to submit their application electronically through the state’s tax website.

- Mail: Applicants can print the completed form and send it to their local tax office via postal service.

- In-Person: Homeowners may also choose to deliver their application directly to their local tax office.

Each submission method has its own advantages, and homeowners should choose the one that best fits their needs and preferences.

Application Process & Approval Time for the Md Homeowner Tax Credit

The application process for the Maryland Homeowner Tax Credit typically involves the following stages:

- Submission of the application and supporting documents.

- Review by the local tax authority, which may take several weeks.

- Notification of approval or denial, usually sent by mail.

The approval time can vary based on the volume of applications received and the specific local jurisdiction's processing capabilities. Homeowners are encouraged to apply as early as possible to ensure they receive any potential tax credits in a timely manner.

Quick guide on how to complete form htc 60 2018 2019

Your assistance manual on how to prepare your Md Homeowner Tax

If you're interested in learning how to create and submit your Md Homeowner Tax, here are a few concise instructions to simplify your tax submission process.

To begin, you only need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify responses when necessary. Streamline your tax management with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Md Homeowner Tax in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Md Homeowner Tax in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Use this manual to electronically file your taxes with airSlate SignNow. Please remember that filing on paper may lead to more mistakes and slower reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your location.

Create this form in 5 minutes or less

Find and fill out the correct form htc 60 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form htc 60 2018 2019

How to generate an electronic signature for your Form Htc 60 2018 2019 in the online mode

How to make an eSignature for your Form Htc 60 2018 2019 in Chrome

How to make an eSignature for putting it on the Form Htc 60 2018 2019 in Gmail

How to make an electronic signature for the Form Htc 60 2018 2019 straight from your smart phone

How to make an eSignature for the Form Htc 60 2018 2019 on iOS

How to create an eSignature for the Form Htc 60 2018 2019 on Android OS

People also ask

-

What is the MD homeowners tax credit program?

The MD homeowners tax credit program is designed to provide financial relief to eligible homeowners by reducing property taxes. This program can signNowly lower tax burdens, making homeownership more affordable for Maryland residents. Understanding the qualifications and benefits of this program is essential for savvy homeowners.

-

How can I apply for the MD homeowners tax credit program?

To apply for the MD homeowners tax credit program, homeowners must complete an application form available on the Maryland state website. You will need to provide proof of residency and other necessary documentation to support your eligibility. Ensure you review the requirements thoroughly to streamline your application process.

-

Who qualifies for the MD homeowners tax credit program?

Eligibility for the MD homeowners tax credit program typically includes homeowners who occupy their property and meet certain income thresholds. Factors like age, disability status, and whether you are a veteran may also influence eligibility. It’s essential to check the specific criteria to see if you qualify for this valuable program.

-

What are the benefits of the MD homeowners tax credit program?

The MD homeowners tax credit program offers various benefits, chiefly a potential reduction in property taxes, which can lead to signNow savings. Enhanced affordability allows homeowners to allocate funds to other important expenses. By reducing financial strains, this program promotes homeownership stability in Maryland.

-

How does the MD homeowners tax credit program affect property taxes?

The MD homeowners tax credit program directly reduces the amount of property tax that qualifying homeowners must pay. This reduction is calculated based on assessed property value and applicable income levels. Lower property taxes can signNowly impact monthly budgets, benefiting many Maryland homeowners.

-

Can I use the MD homeowners tax credit program if I am renting?

Unfortunately, the MD homeowners tax credit program is specifically for homeowners who occupy their properties. Renters do not qualify for this tax credit since it is designed to alleviate the financial burden of property taxes for homeowners. However, it’s beneficial for owners to understand how this credit can enhance their investment.

-

Are there any costs associated with the MD homeowners tax credit program application?

There are no specific costs associated with applying for the MD homeowners tax credit program itself; the application process is free. However, potential applicants should ensure they have the necessary documentation that may involve some administrative costs. It's advisable to check with local authorities for any updates regarding application fees or changes.

Get more for Md Homeowner Tax

- Ins5210 form 100874660

- Ia affidavit financial form

- Exalted 3rd ed 2 page interactive sheet mrgoneamp39s character sheets form

- 2015 2016 minnesota board of dentistry self assessment mn form

- 716 106 d avam v21doc form

- Inz 1225 form

- Ondemandassessment aptitude question nd answer form

- Official form 410a fillable

Find out other Md Homeowner Tax

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document