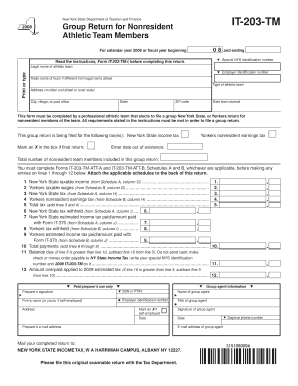

This Form Must Be Completed by a Professional Athletic Team that Elects to File a Group New Tax Ny

What is the Form for Professional Athletic Teams Filing a Group New Tax in New York?

This form is specifically designed for professional athletic teams that choose to file a group tax return in New York. It allows these teams to report their income and expenses collectively rather than individually. By completing this form, teams can streamline their tax obligations, ensuring compliance with state regulations while potentially benefiting from tax efficiencies. This form is crucial for maintaining accurate financial records and fulfilling legal requirements for tax reporting in New York.

Key Elements of the Group New Tax Form for Professional Athletic Teams

The Group New Tax form contains several essential components that teams must accurately complete. Key elements include:

- Team Identification: This section requires the name, address, and identification numbers of the teams involved.

- Income Reporting: Teams must report total income earned during the tax year, including ticket sales, merchandise, and broadcasting rights.

- Expense Deductions: Teams can list allowable deductions, such as player salaries, operational costs, and facility expenses.

- Signature Section: An authorized representative must sign the form, affirming that the information provided is accurate and complete.

Steps to Complete the Group New Tax Form

Completing the Group New Tax form involves several steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the team identification section with accurate details for each participating team.

- Report total income and list all applicable deductions in the designated sections.

- Review the completed form for any errors or omissions.

- Obtain the required signatures from authorized representatives of each team.

- Submit the form by the specified filing deadline to avoid penalties.

Filing Deadlines and Important Dates

It is crucial for professional athletic teams to be aware of the filing deadlines associated with the Group New Tax form. Typically, the form must be submitted by a specific date each year, often aligned with the end of the fiscal year for tax purposes. Teams should also stay informed about any changes in deadlines due to state regulations or special circumstances. Missing the deadline may result in penalties or interest charges, making timely submission essential.

Legal Use of the Group New Tax Form

The Group New Tax form is legally mandated for professional athletic teams that opt to file collectively in New York. It ensures compliance with state tax laws and regulations, allowing teams to fulfill their tax obligations appropriately. Proper use of this form not only helps avoid legal complications but also supports the integrity of financial reporting within the sports industry. Teams should consult legal or tax professionals if they have questions about the form's requirements or implications.

How to Obtain the Group New Tax Form

Professional athletic teams can obtain the Group New Tax form through several avenues. The form is typically available on the official New York State Department of Taxation and Finance website. Teams may also request physical copies by contacting the department directly. Additionally, tax professionals and accountants familiar with New York tax regulations can provide the necessary forms and guidance on completing them accurately.

Quick guide on how to complete this form must be completed by a professional athletic team that elects to file a group new tax ny

Complete [SKS] effortlessly on any device

The management of documents online has become increasingly favored by both companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and store it securely online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents rapidly and without complications. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Mark important sections of your documents or redact sensitive data with tools specifically available from airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of misplaced or lost files, tedious form searching, or the need to reprint new document versions due to errors. airSlate SignNow satisfies your document management needs in just a few clicks from your selected device. Adjust and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this form must be completed by a professional athletic team that elects to file a group new tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do athletes pay taxes where they play?

Taxes are based on where the money is earned, on a game by game basis. So if the game is played in Toronto, players for the home and road team are both taxed at the Ontario rate. Signing bonuses are taxed in the players' state/province/nation of residence.

-

Does NY have a composite return?

Such composite return shall consist of a form or forms prescribed by the commissioner and an attachment or attachments of magnetic tape or other approved media. Notwithstanding any provision in this Subchapter to the contrary, a single form and attachment may comprise the returns of more than one such person.

-

How do American taxpayers support sports teams and athletes?

Governments often contribute by splitting the cost of construction with the teams. The argument for doing so is that building a facility generates downstream tax revenue from ticket sales, taxes on hotels from visitors and even taxes on visiting player salaries in states where there is a personal income tax.

-

Do sports team owners pay taxes?

But the team owners still get to deduct the value of those assets over time, sometimes billions of dollars' worth, from their taxable income. It helps billionaire sports team owners pay far lower income tax rates than the athletes they employ or even the low-wage workers who sell food or clean their stadiums.

-

What does the owner of a sports team do?

Their primary role is to be the financial backer of the team. That said some owners can be very involved in running the business of the team, working with the managers on team decisions.

Get more for This Form Must Be Completed By A Professional Athletic Team That Elects To File A Group New Tax Ny

- Hospital request for position replacement form

- Policy loan withdrawal request kskj life form

- Please circle one n p p a m d d o form

- Medical staff bylaws trinity health form

- Clinical site visit rt form

- Motor vehicle liability insurance card north star mutual insurance form

- Download doctors note templates pdf rtf word wikidownload form

- Physical therapy prescription form

Find out other This Form Must Be Completed By A Professional Athletic Team That Elects To File A Group New Tax Ny

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple