MSCU Account Card MemberSource Credit Union Form

Understanding the MSCU Account Card from MemberSource Credit Union

The MSCU Account Card from MemberSource Credit Union is a financial tool designed for members to access their accounts easily. This card functions as a debit card, allowing users to make purchases directly from their checking or savings accounts. It also provides access to ATMs, enabling cash withdrawals and balance inquiries. The card is linked to the member's account, ensuring that transactions are secure and convenient.

How to Use the MSCU Account Card Effectively

Using the MSCU Account Card is straightforward. Members can swipe or insert the card at point-of-sale terminals to make purchases. For online transactions, the card number, expiration date, and security code are required. Additionally, members can use the card at ATMs to withdraw cash, check balances, or transfer funds between accounts. It is essential to keep the card secure and report any lost or stolen cards immediately to prevent unauthorized transactions.

Obtaining Your MSCU Account Card

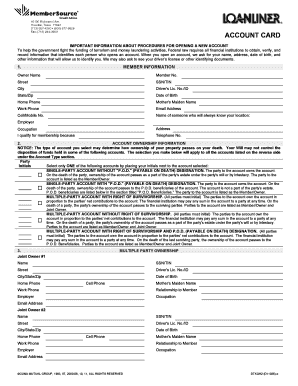

To obtain an MSCU Account Card, members must first open an account with MemberSource Credit Union. This process typically involves providing personal identification, proof of address, and completing an application form. Once the account is established, the credit union will issue the MSCU Account Card, which can be activated upon receipt. Members should follow the instructions provided by the credit union to activate their card and set up any necessary PINs.

Steps to Complete the MSCU Account Card Application

Completing the application for the MSCU Account Card involves several key steps:

- Visit the MemberSource Credit Union website or a local branch.

- Fill out the account application form, providing necessary personal information.

- Submit identification documents as required by the credit union.

- Review and accept the terms and conditions associated with the account.

- Wait for the credit union to process the application and issue the card.

Legal Considerations for Using the MSCU Account Card

When using the MSCU Account Card, members must comply with federal and state regulations governing financial transactions. This includes understanding the terms of use, fees associated with the card, and the rights and responsibilities of both the member and the credit union. It is advisable to review the credit union's policies and any legal documentation provided during the application process to ensure compliance.

Key Features of the MSCU Account Card

The MSCU Account Card offers several key features that enhance its usability:

- Direct access to funds in checking and savings accounts.

- Compatibility with a wide range of ATMs across the United States.

- Enhanced security features, including chip technology.

- Online account management tools for tracking expenditures.

Eligibility Criteria for the MSCU Account Card

Eligibility for the MSCU Account Card typically requires membership in MemberSource Credit Union. Prospective members must meet specific criteria, which may include:

- Residency in the United States.

- Age requirement, usually eighteen years or older.

- Provision of valid identification and proof of address.

Quick guide on how to complete mscu account card membersource credit union

Complete [SKS] easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely manage it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant sections of the documents or redact sensitive details using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the information and then click on the Done button to finalize your changes.

- Decide how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Edit and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MSCU Account Card MemberSource Credit Union

Create this form in 5 minutes!

How to create an eSignature for the mscu account card membersource credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I activate my members credit union debit card?

Activate your Card Activate Your New VISA Credit or Debit Card. 800-290-7893 (US) 206-624-7998 (Outside US) Report Your Card Lost or Stolen. 888-297-3416 (US) 206-389-5200 (Outside US) Select Your Pin. 800-290-7893 (US) 206-624-7998 (Outside US)

-

What is a membership account at a credit union?

As a member, you're a part owner, you have a say in how your credit union is run and you get to share in its success in tangible ways. The main difference between banks and credit unions is their ownership: banks are owned by investors and credit unions are member-owned (this makes them financial co-operatives).

-

Is your money guaranteed in a credit union?

It is the NCUSIF that guarantees money in credit union accounts is backed with the full faith and credit of the U.S. government. For all federal credit unions and most state-chartered credit unions, the NCUSIF provides up to $250,000 in coverage for each single ownership account.

-

What happens to credit unions if banks collapse?

Both the NCUA and FDIC are responsible for insuring funds in the event that a financial institution fails. The NCUA insures credit union accounts, while the FDIC provides federal insurance for bank accounts. They both come with the same limits on insurance coverage.

-

How much money is guaranteed in a credit union account?

WHAT BASIC COVERAGE IS PROVIDED BY THE NCUSIF? The NCUSIF provides all members of federally insured credit unions with $250,000 in coverage for their single ownership accounts.

-

Are joint accounts NCUA insured to $500,000?

The NCUSIF provides each joint account holder with $250,000 coverage for their aggregate interests at each federally insured credit union. For example, a two person joint account with no beneficiaries has $500,000 in coverage.

-

Do credit unions issue cards?

Yes, you can get a credit card through a credit union. In fact, many credit unions offer credit cards with more competitive rates and terms than a traditional bank. And like any other type of credit card, one issued from a credit union can also be used to make purchases or cash advances.

-

How much money is protected in a credit union account?

The National Credit Union Administration (NCUA) is an independent agency created by the U.S. government to regulate and protect credit unions and their owners. Just like the FDIC, the NCUA insures up to $250,000 to all credit union members and provides protection in the event of a credit union failure.

Get more for MSCU Account Card MemberSource Credit Union

- Ph sc 108 university of south carolina sc form

- The cal gab calgb calgb form

- Badgercare plus program form

- Transmittal form pa dutch council bsa padutchbsa

- Approval of this work plan is for the purposes of obtaining data for doi form

- Graduate degree plan form university of minnesota policy library

- Important remember to include your e mail address when sos ga form

- Application for interconnecting a ul1741 certified heco com form

Find out other MSCU Account Card MemberSource Credit Union

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document